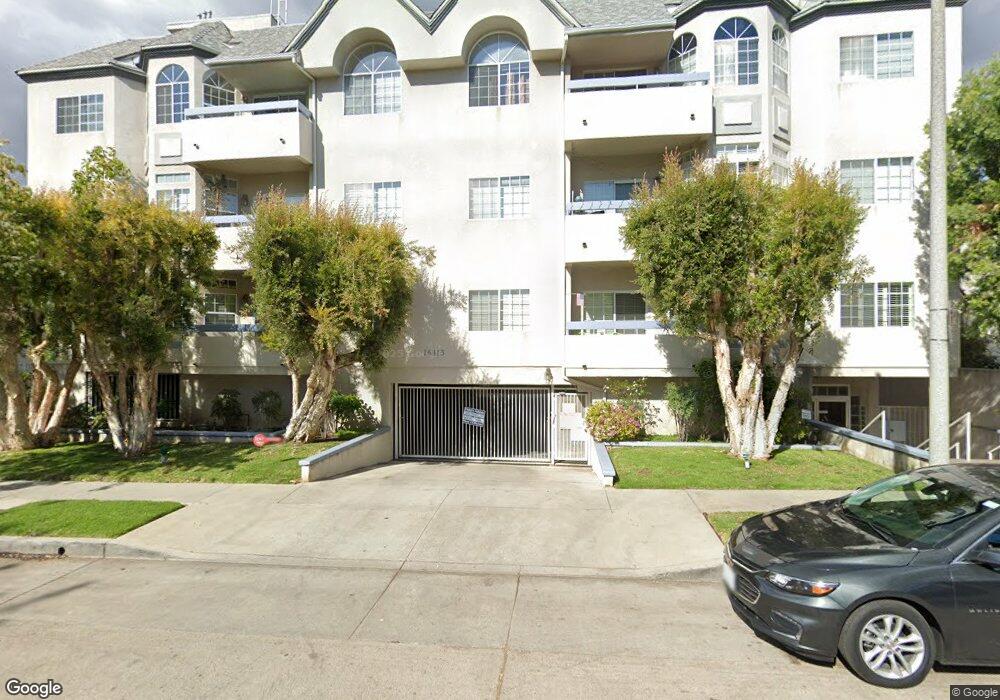

14415 Benefit St Unit 205 Sherman Oaks, CA 91423

Estimated Value: $600,037 - $738,000

2

Beds

2

Baths

1,145

Sq Ft

$602/Sq Ft

Est. Value

About This Home

This home is located at 14415 Benefit St Unit 205, Sherman Oaks, CA 91423 and is currently estimated at $689,259, approximately $601 per square foot. 14415 Benefit St Unit 205 is a home located in Los Angeles County with nearby schools including Van Nuys High School, Sherman Oaks Elementary Charter School, and Dixie Canyon Avenue Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2013

Sold by

Lindsey Steve

Bought by

Steven Lindsey and Steven Susan Dritsas

Current Estimated Value

Purchase Details

Closed on

Dec 6, 1999

Sold by

Dritsas Susan

Bought by

Lindsey Steve and Lindsey Susan Dritsas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Outstanding Balance

$45,104

Interest Rate

7.96%

Mortgage Type

Stand Alone First

Estimated Equity

$644,155

Purchase Details

Closed on

Oct 9, 1995

Sold by

The Federal Home Loan Mtg Corp

Bought by

Dritsas Susan

Purchase Details

Closed on

Feb 22, 1995

Sold by

Lindsey Steve R and Federal Home Loan Mortgage Cor

Bought by

Federal Home Loan Mortgage Corporation

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Steven Lindsey | -- | None Available | |

| Lindsey Steve | -- | United Title Company | |

| Dritsas Susan | $60,000 | Stewart Title | |

| Federal Home Loan Mortgage Corporation | $125,000 | First Southwestern Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lindsey Steve | $143,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,317 | $99,641 | $39,851 | $59,790 |

| 2024 | $1,317 | $97,688 | $39,070 | $58,618 |

| 2023 | $1,294 | $95,773 | $38,304 | $57,469 |

| 2022 | $1,234 | $93,896 | $37,553 | $56,343 |

| 2021 | $1,213 | $92,056 | $36,817 | $55,239 |

| 2019 | $1,177 | $89,327 | $35,726 | $53,601 |

| 2018 | $1,164 | $87,576 | $35,026 | $52,550 |

| 2017 | $1,137 | $85,860 | $34,340 | $51,520 |

| 2016 | $1,099 | $84,177 | $33,667 | $50,510 |

| 2015 | $1,084 | $82,914 | $33,162 | $49,752 |

| 2014 | $1,095 | $81,291 | $32,513 | $48,778 |

Source: Public Records

Map

Nearby Homes

- 14332 Dickens St Unit 10

- 14332 Dickens St Unit 20

- 4323 Van Nuys Blvd

- 14506 Benefit St Unit 103

- 14521 Benefit St Unit 102

- 14519 Greenleaf St

- 14238 Dickens St Unit 4

- 4227 Van Nuys Blvd

- 14530 Benefit St Unit 205

- 14234 Dickens St Unit 2

- 14539 Benefit St Unit 201

- 14235 Greenleaf St

- 14569 Benefit St Unit 102

- 14569 Benefit St Unit 212

- 4141 Knobhill Dr

- 14570 Benefit St Unit 202

- 14144 Dickens St Unit 216

- 14600 Dickens St Unit 202

- 14151 Moorpark St

- 4437 Calhoun Ave

- 14415 Benefit St Unit 305

- 14415 Benefit St Unit 304

- 14415 Benefit St Unit 303

- 14415 Benefit St Unit 302

- 14415 Benefit St Unit 301

- 14415 Benefit St Unit 206

- 14415 Benefit St Unit 204

- 14415 Benefit St Unit 203

- 14415 Benefit St Unit 202

- 14415 Benefit St Unit 201

- 14415 Benefit St Unit 105

- 14415 Benefit St Unit 104

- 14415 Benefit St Unit 103

- 14415 Benefit St Unit 102

- 14415 Benefit St Unit 101

- 14415 Benefit St Unit 306

- 14425 Benefit St

- 14407 Benefit St

- 4303 Beverly Glen Blvd

- 14429 Benefit St