14430 San Miguel Rd Atascadero, CA 93422

Estimated Value: $787,973 - $1,051,000

2

Beds

2

Baths

1,176

Sq Ft

$796/Sq Ft

Est. Value

About This Home

This home is located at 14430 San Miguel Rd, Atascadero, CA 93422 and is currently estimated at $935,743, approximately $795 per square foot. 14430 San Miguel Rd is a home located in San Luis Obispo County with nearby schools including San Gabriel Elementary School, Atascadero Middle School, and Atascadero High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2010

Sold by

Langley Neil T and Sylwester Sara L

Bought by

Langley Neil T and Sylwester Sara L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,000

Outstanding Balance

$70,740

Interest Rate

4.93%

Mortgage Type

New Conventional

Estimated Equity

$865,003

Purchase Details

Closed on

Dec 31, 2001

Sold by

Langley Neil T

Bought by

Langley Neil T and Sylwester Sara L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,000

Interest Rate

7.11%

Purchase Details

Closed on

May 22, 2001

Sold by

Jordan Elias Thomas and Jordan Joan Elizabeth

Bought by

Langley Neil T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,000

Outstanding Balance

$82,064

Interest Rate

7.14%

Estimated Equity

$853,679

Purchase Details

Closed on

Mar 20, 1996

Sold by

Jordan Elias Thomas and Jordan Joan Elizabeth

Bought by

Jordan Elias Thomas and Jordan Joan Elizabeth

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Langley Neil T | -- | First American Title Company | |

| Langley Neil T | -- | First American Title Company | |

| Langley Neil T | -- | First American Title Co | |

| Langley Neil T | $340,000 | First American Title | |

| Jordan Elias Thomas | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Langley Neil T | $107,000 | |

| Closed | Langley Neil T | $131,000 | |

| Open | Langley Neil T | $218,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,597 | $520,923 | $271,220 | $249,703 |

| 2024 | $5,593 | $510,709 | $265,902 | $244,807 |

| 2023 | $5,593 | $500,696 | $260,689 | $240,007 |

| 2022 | $5,522 | $490,879 | $255,578 | $235,301 |

| 2021 | $5,413 | $481,255 | $250,567 | $230,688 |

| 2020 | $5,356 | $476,321 | $247,998 | $228,323 |

| 2019 | $5,250 | $466,983 | $243,136 | $223,847 |

| 2018 | $5,145 | $457,827 | $238,369 | $219,458 |

| 2017 | $5,043 | $448,851 | $233,696 | $215,155 |

| 2016 | $4,942 | $440,051 | $229,114 | $210,937 |

| 2015 | $4,866 | $433,442 | $225,673 | $207,769 |

| 2014 | $4,443 | $424,953 | $221,253 | $203,700 |

Source: Public Records

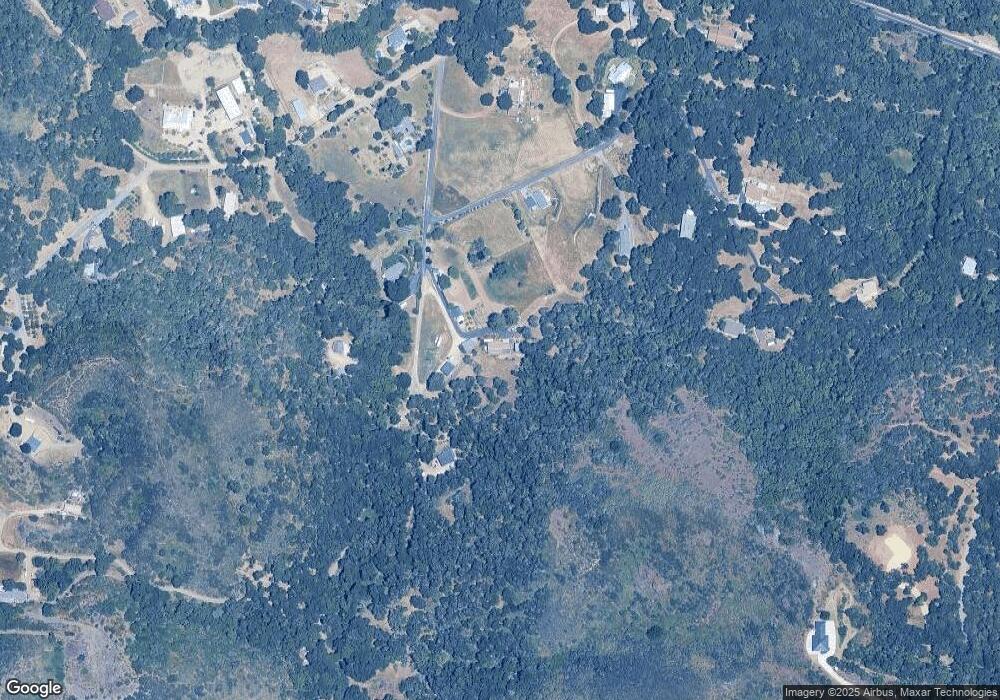

Map

Nearby Homes

- 12703 Paso Verde Ct

- 0 San Felipe Ct

- 12400 San Marcos Rd

- 14105 County Kerry Ln

- 12460 San Marcos Rd

- 6205 Toro Creek Rd

- 13750 Falcon Rd

- 11800 San Marcos Rd

- 0 San Felipe Rd

- 6650 Toro Creek Rd

- 13700 Morro Rd

- 11555 Cenegal Rd

- 11955 Santa Lucia Rd

- 9575 Laurel Rd

- 10885 San Marcos Rd

- 13205 Santa Lucia Rd

- 6452 Alta Pradera Ln

- 9900 Carmelita Ave

- 8565 Casanova Rd

- 14220 El Monte Rd

- 14805 San Miguel Rd

- 14850 San Miguel Rd

- 14445 Old Morro Rd W

- 14555 San Miguel Rd

- 14505 San Miguel Rd

- 14540 Old Morro Rd W

- 14395 Tarentaise Ct

- 14490 San Miguel Rd

- 14401 Old Morro Rd W

- 14544 Old Morro Rd W

- 14475 San Miguel Rd

- 14522 San Miguel Rd

- 14522 Old Morro Rd W

- 14584 Old Morro Rd W

- 14515 Old Morro Rd W

- 14542 Old Morro Rd W

- 14595 Morro Rd

- 14445 Morro Rd

- 14625 Morro Rd

- 14250 Old Morro Rd W