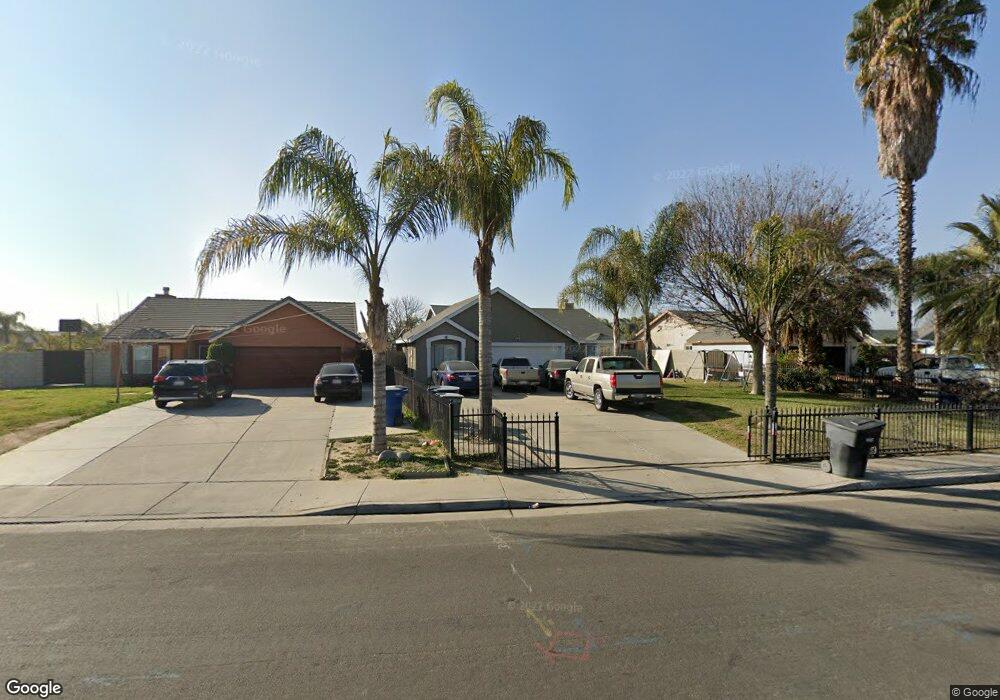

1445 Almond Tree Way Delano, CA 93215

West Delano NeighborhoodEstimated Value: $310,000 - $358,000

5

Beds

3

Baths

1,694

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 1445 Almond Tree Way, Delano, CA 93215 and is currently estimated at $335,960, approximately $198 per square foot. 1445 Almond Tree Way is a home located in Kern County with nearby schools including Fremont Elementary School, Almond Tree Middle School, and Robert F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 24, 2023

Sold by

Ceja Roberto M and Ceja Margarita A

Bought by

Ceja Family Living Trust and Mora

Current Estimated Value

Purchase Details

Closed on

Jun 18, 2003

Sold by

Ceja Heriberto Fajardo

Bought by

Ceja Roberto M and Ceja Margarita A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,500

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 26, 1997

Sold by

Syroli

Bought by

Ceja Roberto M and Ceja Margarita A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,652

Interest Rate

7.58%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ceja Family Living Trust | -- | None Listed On Document | |

| Ceja Roberto M | -- | Chicago Title | |

| Ceja Roberto M | $104,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ceja Roberto M | $93,500 | |

| Previous Owner | Ceja Roberto M | $103,652 | |

| Closed | Ceja Roberto M | $29,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,961 | $165,740 | $39,643 | $126,097 |

| 2024 | $1,905 | $162,491 | $38,866 | $123,625 |

| 2023 | $1,905 | $159,304 | $38,103 | $121,201 |

| 2022 | $1,873 | $156,181 | $37,356 | $118,825 |

| 2021 | $1,799 | $153,119 | $36,624 | $116,495 |

| 2020 | $1,797 | $151,550 | $36,249 | $115,301 |

| 2019 | $1,765 | $151,550 | $36,249 | $115,301 |

| 2018 | $1,741 | $145,666 | $34,842 | $110,824 |

| 2017 | $1,751 | $142,812 | $34,160 | $108,652 |

| 2016 | $1,722 | $140,012 | $33,490 | $106,522 |

| 2015 | $1,777 | $137,910 | $32,988 | $104,922 |

| 2014 | $1,660 | $135,210 | $32,342 | $102,868 |

Source: Public Records

Map

Nearby Homes

- 230 W 15th Place

- 229 15th Place

- 419 Catalina Place

- 1509 Borel St

- 1123 Bordelais St

- 146 W 11th Place

- 142 W 11th Place

- 1942 Clinton St

- 725 Anita Ave Unit 5

- 0 Timmons Ave

- 814 Encanto Way

- 115 9th Ave

- 441 14th Ave

- 718 Florito Way

- 816 Rosa Ct

- Floorplan 1320 at Ranho Del Sol - Rancho Del Sol

- Floorplan 1700 at Ranho Del Sol - Rancho Del Sol

- Floorplan 1523 at Ranho Del Sol - Rancho Del Sol

- Floorplan 2100 at Ranho Del Sol - Rancho Del Sol

- Floorplan 1810 at Ranho Del Sol - Rancho Del Sol

- 402 North El Dorado Cir

- 1437 Almond Tree Way

- 483 South El Dorado Cir

- 408 North El Dorado Cir

- 479 South El Dorado Cir

- 412 North El Dorado Cir

- 479 S El Dorado Cir

- 412 N El Dorado Cir

- 1446 Almond Tree Way

- 1469 Almond Tree Way

- 1421 Almond Tree Way

- 1438 Almond Tree Way

- 1454 Almond Tree Way

- 475 South El Dorado Cir

- 418 North El Dorado Cir

- 475 S El Dorado Cir

- 405 North El Dorado Cir

- 1422 Almond Tree Way

- 480 South El Dorado Cir

- 409 North El Dorado Cir