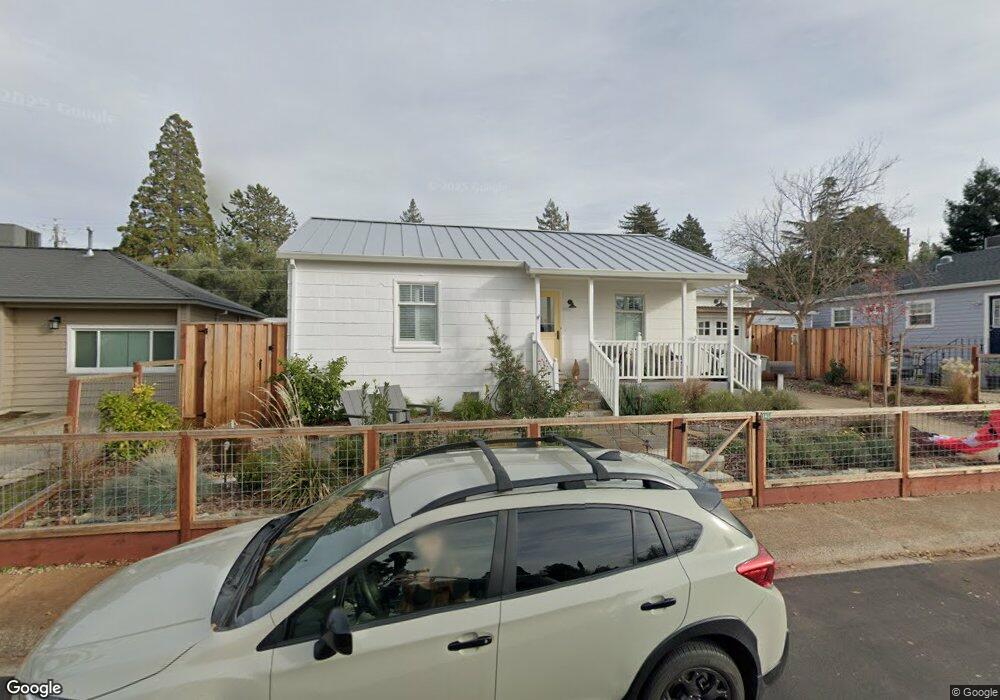

145 Del Monte Way Auburn, CA 95603

Estimated Value: $372,000 - $572,000

2

Beds

1

Bath

854

Sq Ft

$505/Sq Ft

Est. Value

About This Home

This home is located at 145 Del Monte Way, Auburn, CA 95603 and is currently estimated at $431,150, approximately $504 per square foot. 145 Del Monte Way is a home located in Placer County with nearby schools including Skyridge Elementary School, Placer High School, and Alta Vista Community Charter.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2024

Sold by

Manner Mary T

Bought by

145 Girls Trust and Manner

Current Estimated Value

Purchase Details

Closed on

Apr 17, 2012

Sold by

Castle Bret

Bought by

Manner Mary T

Purchase Details

Closed on

Oct 12, 2005

Sold by

Manner Mary T

Bought by

Castle Bret and Manner Mary T

Purchase Details

Closed on

Apr 25, 2001

Sold by

Manner Mary T and Manner Judith A

Bought by

Manner Mary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,200

Interest Rate

6.98%

Purchase Details

Closed on

May 4, 1999

Sold by

Manner Ritchie D

Bought by

Manner Judith A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,164

Interest Rate

6.96%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 28, 1997

Sold by

Rose John L and Rose Marie V

Bought by

Jicha Barbara L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 145 Girls Trust | -- | None Listed On Document | |

| Manner Mary T | -- | None Available | |

| Castle Bret | -- | -- | |

| Manner Mary | -- | Old Republic Title Company | |

| Manner Judith A | -- | Old Republic Title Company | |

| Manner Mary T | $131,500 | Old Republic Title Company | |

| Jicha Barbara L | $114,500 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Manner Mary | $143,200 | |

| Previous Owner | Manner Mary T | $130,164 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,016 | $241,119 | $94,049 | $147,070 |

| 2023 | $3,016 | $197,445 | $90,398 | $107,047 |

| 2022 | $2,980 | $193,575 | $88,626 | $104,949 |

| 2021 | $2,906 | $189,781 | $86,889 | $102,892 |

| 2020 | $2,891 | $187,836 | $85,999 | $101,837 |

| 2019 | $2,853 | $184,154 | $84,313 | $99,841 |

| 2018 | $2,749 | $180,544 | $82,660 | $97,884 |

| 2017 | $2,678 | $177,005 | $81,040 | $95,965 |

| 2016 | $2,604 | $173,535 | $79,451 | $94,084 |

| 2015 | $2,528 | $170,929 | $78,258 | $92,671 |

| 2014 | $2,467 | $167,582 | $76,726 | $90,856 |

Source: Public Records

Map

Nearby Homes

- 440 Foresthill Ave

- 681 Foresthill Ave

- 381 Foresthill Ave

- 486 Foresthill Ave

- 438 Olive Orchard Dr

- 140 Oak St

- 101 Lincoln Way

- 60 Lincoln Way

- 13005 Lincoln Way Unit F

- 173 Center St

- 13067 Lincoln Way Unit D

- 13061 Lincoln Way Unit B

- 300 Cherry Ave

- 143 Hillmont Ave

- 146 E Placer St

- 287 Swenson Ct

- 258 Swenson Ct

- 278 Swenson Ct

- 266 Swenson Ct

- 1430 Auburn Ravine Rd

- 135 Del Monte Way

- 165 Del Monte Way

- 175 Del Monte Way

- 421 Aeolia Dr

- 425 Aeolia Dr

- 125 Del Monte Way

- 185 Del Monte Way

- 120 Del Monte Way

- 140 Del Monte Way

- 160 Del Monte Way

- 475 Aeolia Dr

- 195 Del Monte Way

- 170 Del Monte Way

- 110 Blair St

- 115 Del Monte Way

- 110 Del Monte Way

- 180 Del Monte Way

- 415 Aeolia Dr

- 137 Maribel Way

- 300 Foresthill Ave