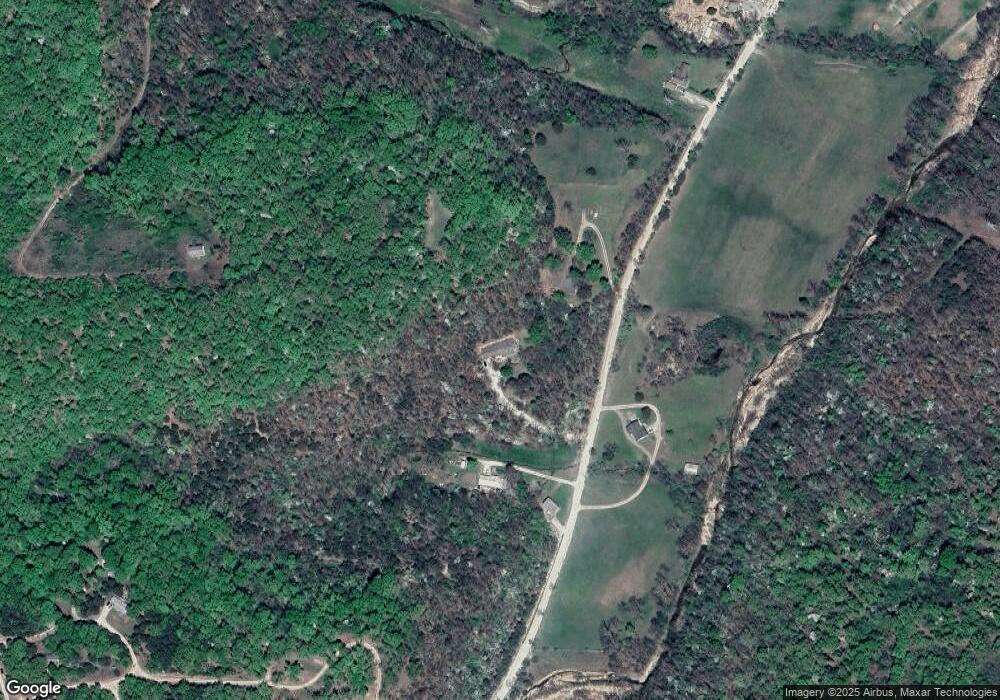

145 Oak Bend Rd Kaiser, MI 65047

Estimated Value: $285,137 - $332,000

4

Beds

2

Baths

2,112

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 145 Oak Bend Rd, Kaiser, MI 65047 and is currently estimated at $306,784, approximately $145 per square foot. 145 Oak Bend Rd is a home located in Miller County with nearby schools including Heritage Elementary School, Osage Upper Elementary School, and Osage Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2025

Sold by

Gallegos Gregory J and Gallegos Erin

Bought by

Brown & Stone Enterprise Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$299,491

Interest Rate

6.84%

Mortgage Type

Credit Line Revolving

Estimated Equity

$7,293

Purchase Details

Closed on

Mar 21, 2022

Sold by

Badolato Donna F and Badolato Michael

Bought by

Colorado Development And Investment Llc

Purchase Details

Closed on

Aug 20, 2009

Sold by

Jacob Intersts Llc

Bought by

Paull Eugene and Paull Sharon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown & Stone Enterprise Llc | -- | Great American Title | |

| Brown & Stone Enterprise Llc | -- | Great American Title | |

| Colorado Development And Investment Llc | -- | New Title Company Name | |

| Paull Eugene | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown & Stone Enterprise Llc | $300,000 | |

| Closed | Brown & Stone Enterprise Llc | $300,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $694 | $14,970 | $1,200 | $13,770 |

| 2024 | $334 | $7,160 | $1,090 | $6,070 |

| 2023 | $343 | $7,160 | $1,090 | $6,070 |

| 2022 | $344 | $7,160 | $1,090 | $6,070 |

| 2021 | $344 | $7,160 | $1,090 | $6,070 |

| 2020 | $321 | $6,570 | $1,090 | $5,480 |

| 2019 | $321 | $6,570 | $1,090 | $5,480 |

| 2018 | $324 | $6,570 | $1,090 | $5,480 |

| 2017 | $301 | $6,630 | $1,050 | $5,580 |

| 2016 | $296 | $6,630 | $0 | $0 |

| 2015 | -- | $6,630 | $0 | $0 |

| 2012 | -- | $12,310 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 765 College Blvd

- 749 Highway D

- 12 Avery Dr

- TBD Scottish Landing Rd

- F Osage Beach Pkwy

- 175 Highway D

- 21 Winston Ln

- Tract C Hwy 242

- 3 Mary Dr

- 6 Sam Dr

- 4 Kathleen Ct

- 12 Sam Dr

- Tract E Hwy 242

- TBD Hwy 54

- Lot 24 Forrest Hills Acres

- Xxx Campbell Acres

- 0 Holiday Shores Dr

- Lot 26, 27 and 29 Forrest Hills Acres

- 150 Forrest Hills Dr

- 4194 Holiday Shores Dr Unit 18

Your Personal Tour Guide

Ask me questions while you tour the home.