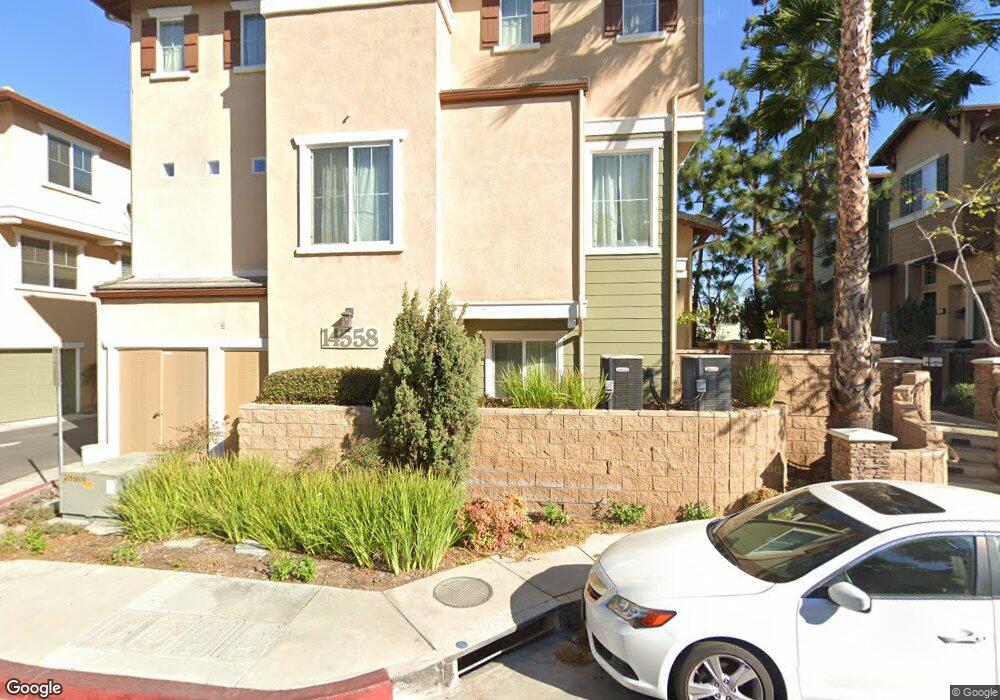

14558 Newport Ave Unit 3 Tustin, CA 92780

Estimated Value: $796,000 - $922,000

3

Beds

2

Baths

1,395

Sq Ft

$617/Sq Ft

Est. Value

About This Home

This home is located at 14558 Newport Ave Unit 3, Tustin, CA 92780 and is currently estimated at $861,114, approximately $617 per square foot. 14558 Newport Ave Unit 3 is a home located in Orange County with nearby schools including Sycamore Magnet Academy, Tustin High School, and St. Cecilia Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 16, 2016

Sold by

Apisakkul Mary

Bought by

Woo Winston

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$390,000

Outstanding Balance

$308,581

Interest Rate

3.64%

Mortgage Type

New Conventional

Estimated Equity

$552,533

Purchase Details

Closed on

Mar 15, 2016

Sold by

Woo Winston

Bought by

Aynie Armin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$390,000

Outstanding Balance

$308,581

Interest Rate

3.64%

Mortgage Type

New Conventional

Estimated Equity

$552,533

Purchase Details

Closed on

Apr 18, 2013

Sold by

Woo Winston and Wu Victoria

Bought by

Woo Winston

Purchase Details

Closed on

Jul 12, 2005

Sold by

Olson 737 Tustin 63 Llc

Bought by

Woo Winston and Woo Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,191

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woo Winston | -- | First American Title Company | |

| Aynie Armin | $500,000 | First American Title Company | |

| Woo Winston | -- | None Available | |

| Woo Winston | $516,500 | Fidelity National Title Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Aynie Armin | $390,000 | |

| Previous Owner | Woo Winston | $413,191 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,626 | $591,896 | $360,870 | $231,026 |

| 2024 | $6,626 | $580,291 | $353,794 | $226,497 |

| 2023 | $6,463 | $568,913 | $346,857 | $222,056 |

| 2022 | $6,364 | $557,758 | $340,056 | $217,702 |

| 2021 | $6,236 | $546,822 | $333,388 | $213,434 |

| 2020 | $6,203 | $541,216 | $329,970 | $211,246 |

| 2019 | $6,051 | $530,604 | $323,500 | $207,104 |

| 2018 | $5,951 | $520,200 | $317,156 | $203,044 |

| 2017 | $5,847 | $510,000 | $310,937 | $199,063 |

| 2016 | $5,205 | $450,000 | $235,935 | $214,065 |

| 2015 | $4,995 | $418,000 | $203,935 | $214,065 |

| 2014 | $4,118 | $339,936 | $125,871 | $214,065 |

Source: Public Records

Map

Nearby Homes

- 14802 Newport Ave Unit 18A

- 14802 Newport Ave Unit 18C

- 1192 Mitchell Ave Unit 70

- 1192 Mitchell Ave Unit 3

- 1192 Mitchell Ave Unit 7

- 1076 Mitchell Ave

- 1425 Sycamore Ave

- 14801 Braeburn Rd

- 1626 Birchfield Dr

- 157 Balsawood

- Plan 1643 Modeled at Stafford Glen

- Plan 1642 at Stafford Glen

- Plan 1387 Modeled at Stafford Glen

- 153 Balsawood

- 14032 Woodlawn Ave

- 1006 Overton Ct

- 1582 Mitchell Ave

- 1112 1114 Napa St

- 164 & 172 Preble Dr

- 1091 Bonita St

- 14558 Newport Ave Unit 3

- 14558 Newport Ave Unit 2

- 14558 Newport Ave Unit 4

- 14558 Newport Ave Unit 1

- 14554 Newport Ave Unit 3

- 14554 Newport Ave Unit 1

- 14554 Newport Ave Unit 4

- 14554 Newport Ave Unit 2

- 14562 Newport Ave Unit 3

- 14562 Newport Ave Unit 4

- 14562 Newport Ave Unit 2

- 14562 Newport Ave Unit 1

- 14550 Newport Ave Unit 3

- 14550 Newport Ave Unit 2

- 14550 Newport Ave Unit 1

- 14560 Newport Ave Unit 2

- 14560 Newport Ave Unit 3

- 14560 Newport Ave Unit 1

- 14556 Newport Ave Unit 3

- 14556 Newport Ave Unit 2