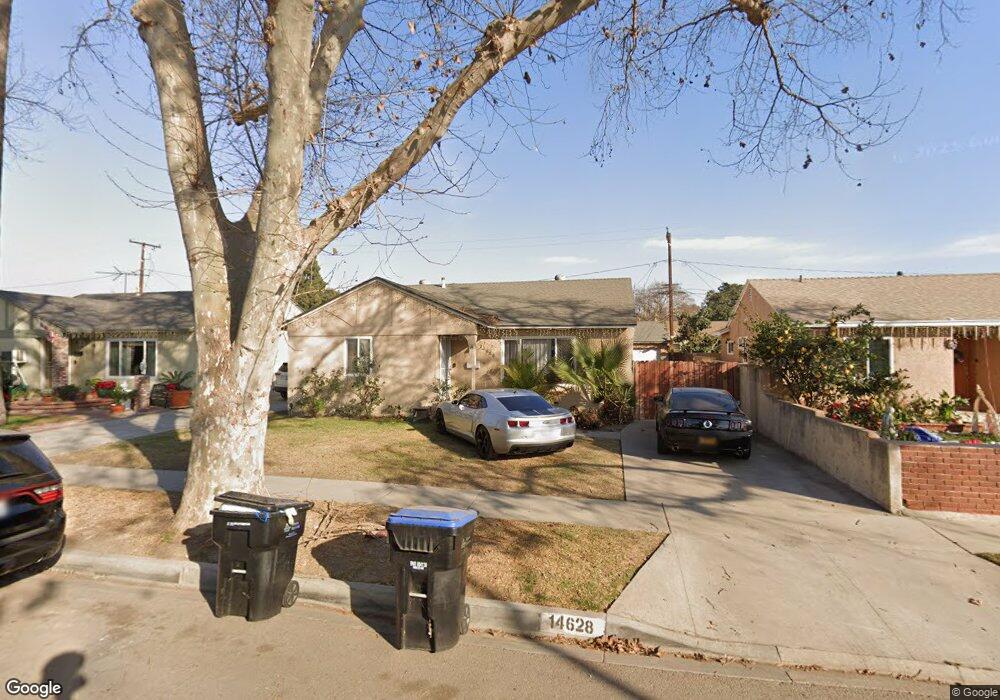

14628 Domart Ave Norwalk, CA 90650

Estimated Value: $806,000 - $876,000

3

Beds

2

Baths

1,613

Sq Ft

$515/Sq Ft

Est. Value

About This Home

This home is located at 14628 Domart Ave, Norwalk, CA 90650 and is currently estimated at $831,342, approximately $515 per square foot. 14628 Domart Ave is a home located in Los Angeles County with nearby schools including Anna M. Glazier Elementary School, Los Alisos Middle School, and Norwalk High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2009

Sold by

Trinidad Graciela

Bought by

Castillo Socrates O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$358,388

Interest Rate

5.14%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 14, 2006

Sold by

Munn Rick

Bought by

Trinidad Graciela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$432,000

Interest Rate

6.9%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 31, 2006

Sold by

Munn Stephanie

Bought by

Munn Rick

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$432,000

Interest Rate

6.9%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castillo Socrates O | $365,000 | Fidelity National Title | |

| Trinidad Graciela | $540,000 | Western Resources Title Co | |

| Trinidad Graciela | -- | Western Resources Title Co | |

| Munn Rick | -- | Wrt |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Castillo Socrates O | $358,388 | |

| Previous Owner | Trinidad Graciela | $432,000 | |

| Previous Owner | Munn Rick | $108,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,072 | $471,134 | $193,227 | $277,907 |

| 2024 | $6,072 | $461,897 | $189,439 | $272,458 |

| 2023 | $5,865 | $452,841 | $185,725 | $267,116 |

| 2022 | $5,760 | $443,963 | $182,084 | $261,879 |

| 2021 | $5,676 | $435,259 | $178,514 | $256,745 |

| 2019 | $5,512 | $422,351 | $173,220 | $249,131 |

| 2018 | $5,300 | $414,071 | $169,824 | $244,247 |

| 2016 | $5,076 | $397,994 | $163,231 | $234,763 |

| 2015 | $5,032 | $392,017 | $160,780 | $231,237 |

| 2014 | $4,527 | $371,000 | $152,000 | $219,000 |

Source: Public Records

Map

Nearby Homes

- 14831 Domart Ave

- 14426 Piuma Ave

- 14837 Piuma Ave

- 10525 Somerset Blvd Unit 45

- 10525 Somerset Blvd Unit 40

- 14508 Dumont Ave

- 15343 Carfax Ave

- 10343 Mapledale St

- 10347 Mapledale St

- 13936 Edgewater Dr Unit 122

- 15406 Dumont Ave

- 13828 Regentview Ave

- 10121 1/5 Washington St

- 11051 Molette St

- 14002 Bergen Ave

- 15412 Allingham Ave

- 10844 Tonibar St

- 10855 Leffingwell Rd

- 11113 Barnwall St

- 15531 Woodruff Ave

- 14622 Domart Ave

- 14632 Domart Ave

- 14629 Flatbush Ave

- 14618 Domart Ave

- 14638 Domart Ave

- 14623 Flatbush Ave

- 14633 Flatbush Ave

- 14619 Flatbush Ave

- 14639 Flatbush Ave

- 14644 Domart Ave

- 14612 Domart Ave

- 14645 Flatbush Ave

- 14613 Flatbush Ave

- 14648 Domart Ave

- 14606 Domart Ave

- 14631 Domart Ave

- 14643 Domart Ave

- 14625 Domart Ave

- 14637 Domart Ave

- 14619 Domart Ave