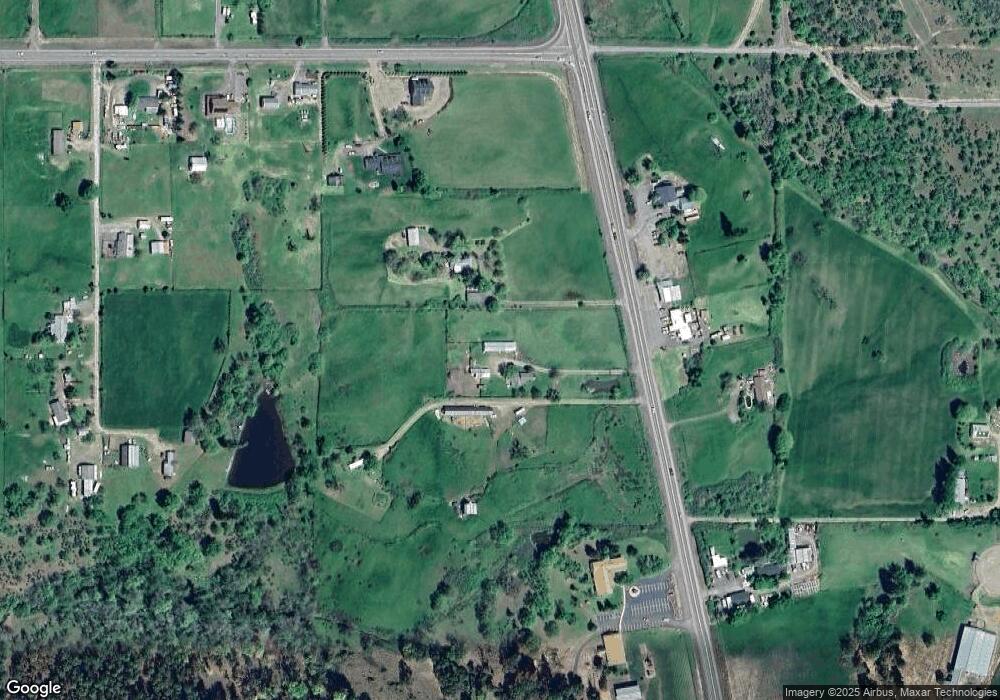

14737 Highway 62 Eagle Point, OR 97524

Estimated Value: $364,268 - $434,000

3

Beds

2

Baths

1,168

Sq Ft

$341/Sq Ft

Est. Value

About This Home

This home is located at 14737 Highway 62, Eagle Point, OR 97524 and is currently estimated at $398,756, approximately $341 per square foot. 14737 Highway 62 is a home located in Jackson County with nearby schools including Eagle Point Middle School, White Mountain Middle School, and Eagle Point High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2014

Sold by

Gallo Marcus B and Sizemore Janette M

Bought by

Gallo Marcus B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,000

Outstanding Balance

$93,315

Interest Rate

4.23%

Mortgage Type

Credit Line Revolving

Estimated Equity

$305,441

Purchase Details

Closed on

Jun 3, 2005

Sold by

Gallo Marcus B

Bought by

Gallo Marcus B and Gallo Janette M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,500

Interest Rate

5.72%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 22, 2001

Sold by

Snyder Kevin and Snyder Stephanie

Bought by

Gallo Marcus B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,750

Interest Rate

7.15%

Purchase Details

Closed on

Jul 17, 1991

Sold by

Neilson Thomas R and Neilson Constance A

Bought by

Snyder Kevin and Snyder Stephanie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gallo Marcus B | -- | None Available | |

| Gallo Marcus B | -- | Lawyers Title Ins | |

| Gallo Marcus B | $125,000 | Jackson County Title | |

| Snyder Kevin | $67,000 | Mountain Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gallo Marcus B | $124,000 | |

| Closed | Gallo Marcus B | $141,500 | |

| Closed | Gallo Marcus B | $118,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $2,270 | $195,330 | -- | -- |

| 2025 | $2,209 | $189,650 | $110,770 | $78,880 |

| 2024 | $2,209 | $184,130 | $107,550 | $76,580 |

| 2023 | $2,134 | $178,770 | $104,420 | $74,350 |

| 2022 | $2,078 | $178,770 | $104,420 | $74,350 |

| 2021 | $2,019 | $173,570 | $101,390 | $72,180 |

| 2020 | $2,178 | $168,520 | $98,440 | $70,080 |

| 2019 | $2,152 | $158,860 | $92,800 | $66,060 |

| 2018 | $2,103 | $154,240 | $90,100 | $64,140 |

| 2017 | $2,054 | $154,240 | $90,100 | $64,140 |

| 2016 | $2,002 | $145,390 | $84,930 | $60,460 |

| 2015 | $1,934 | $145,390 | $84,930 | $60,460 |

| 2014 | $1,879 | $137,050 | $80,040 | $57,010 |

Source: Public Records

Map

Nearby Homes

- 800 Hillandale Cir

- 1305 Butte Falls Hwy

- 2162 Butte Falls Hwy

- 2795 Ball Rd

- 417 E Rolling Hills Dr

- 739 W Rolling Hills Dr

- 712 Nottingham Terrace

- 700 Nottingham Terrace

- 631 Nottingham Terrace

- 510 Chateau Dr

- 1881 Brophy Rd

- 945 Win Way

- 208 Northview Dr Unit 1B

- 1017 Havenwood Dr

- 198 Flamingo Dr

- 110 Linton Way

- 445 Mount Castle Dr

- 925 Sellwood Dr

- 407 N Deanjou Ave

- 912 Stonewater Dr

- 14797 Highway 62

- 14780 Highway 62

- 14706 Highway 62

- 14600 Highway 62

- 145 Highway 234

- 235 Highway 234

- 235 Highway 234

- 245 Highway 234

- 185 Highway 234

- 14646 Oregon 62

- 260 Highway 234

- 290 Oregon 234

- 180 Highway 234

- 0 Del Isle Way

- 0 Del Isle Way

- 15050 Highway 62 Unit Freebird Ranch Apart

- 15050 Highway 62

- 14940 Highway 62

- 14411 Highway 62

- 14461 Highway 62

Your Personal Tour Guide

Ask me questions while you tour the home.