14740 Lakeview Dr Unit 1 Middlefield, OH 44062

Estimated Value: $167,145 - $179,000

2

Beds

1

Bath

1,240

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 14740 Lakeview Dr Unit 1, Middlefield, OH 44062 and is currently estimated at $172,536, approximately $139 per square foot. 14740 Lakeview Dr Unit 1 is a home located in Geauga County with nearby schools including Jordak Elementary School, Cardinal Middle School, and Cardinal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 1998

Sold by

Maheu Frank and Maheu Holly A

Bought by

Shibley Commercial Properties

Current Estimated Value

Purchase Details

Closed on

Feb 1, 1995

Sold by

Johnson & Son Builders

Bought by

Hunt Arthur L and Hunt Iolanda

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shibley Commercial Properties | $67,500 | -- | |

| Hunt Arthur L | $85,900 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,122 | $38,850 | $5,250 | $33,600 |

| 2023 | $1,116 | $38,850 | $5,250 | $33,600 |

| 2022 | $1,003 | $30,310 | $4,550 | $25,760 |

| 2021 | $1,005 | $30,310 | $4,550 | $25,760 |

| 2020 | $1,037 | $30,310 | $4,550 | $25,760 |

| 2019 | $1,035 | $28,630 | $4,550 | $24,080 |

| 2018 | $1,035 | $28,630 | $4,550 | $24,080 |

| 2017 | $1,035 | $28,630 | $4,550 | $24,080 |

| 2016 | $861 | $27,690 | $6,300 | $21,390 |

| 2015 | $843 | $27,690 | $6,300 | $21,390 |

| 2014 | $769 | $27,690 | $6,300 | $21,390 |

| 2013 | $760 | $27,690 | $6,300 | $21,390 |

Source: Public Records

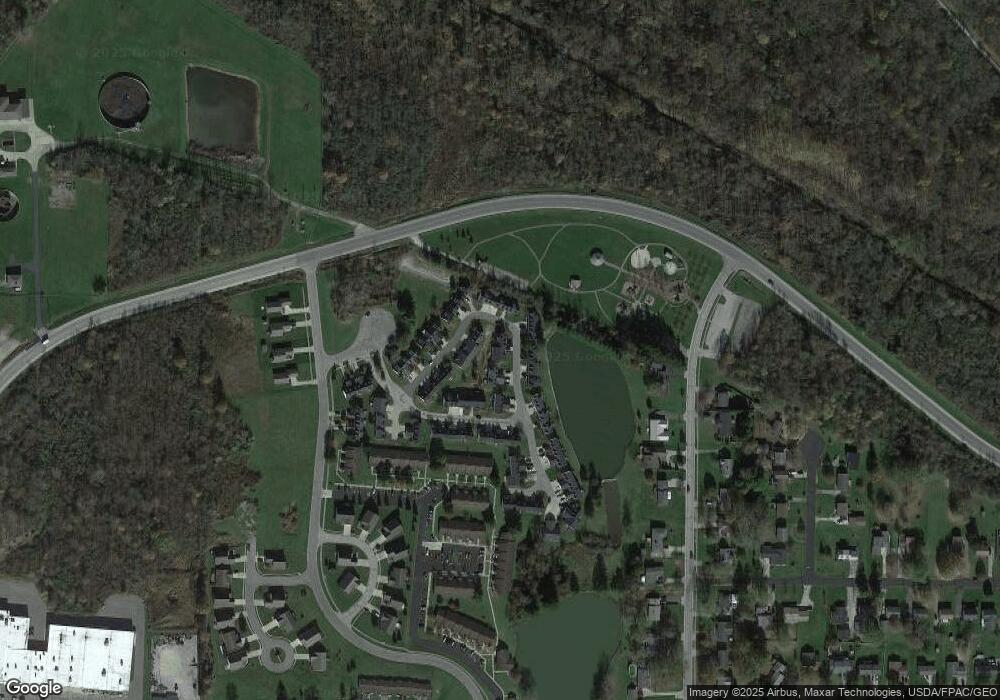

Map

Nearby Homes

- 15648 Elmwood St

- V/L High Pointe Cir

- 15100 Timber Ridge Dr

- 16008 Button St

- 15142 Sawgrass Ln

- 15143 Woodsong Dr

- 15229 Timber Ridge Dr

- 15243 Woodsong Dr

- 15868 Kenwood Dr

- 15660 Georgia Rd

- 14706 Steeplechase Dr

- 16298 Weathervane Dr

- 15791 Madison Rd

- 15720 Jug Rd

- 13888 Goodwin St

- 13137 Old State Rd

- 16310 Madison Rd

- 13661 W Spring St

- 13561 Colony Ln

- 13565 Colony Ln

- 14740 Lakeview Dr

- 14740 Lakeview Dr

- 14750 Lakeview Dr Unit 1

- 14750 Lakeview Dr Unit 2

- 14725 Lakeview Dr

- 14725 Lakeview Dr Unit 1

- 14725 Lakeview Dr

- 14755 Lakeview Dr Unit 2

- 14755 Lakeview Dr Unit 1

- 14755 Lakeview Dr Unit 3

- 14730 Lakeview Dr Unit 16-1

- 14730 Lakeview Dr

- 14730 Lakeview Dr Unit 1

- 14730 Lakeview Dr

- 14730 Lakeview Dr Unit 2

- 14745 Lakeview Dr

- 14745 Lakeview Dr Unit 2

- 14760 Lakeview Dr

- 14760 Lakeview Dr Unit 2

- 14760 Lakeview Dr Unit 1

Your Personal Tour Guide

Ask me questions while you tour the home.