14745 Lakeview Dr Unit 2 Middlefield, OH 44062

Estimated Value: $170,000 - $180,000

3

Beds

2

Baths

1,286

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 14745 Lakeview Dr Unit 2, Middlefield, OH 44062 and is currently estimated at $173,457, approximately $134 per square foot. 14745 Lakeview Dr Unit 2 is a home located in Geauga County with nearby schools including Jordak Elementary School, Cardinal Middle School, and Cardinal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2001

Sold by

Hammond Kristy A

Bought by

Zsemlye Karen L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,900

Interest Rate

7.07%

Purchase Details

Closed on

Jun 27, 2000

Sold by

Phyllis Carpenter

Bought by

Hammond Kristy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

8.66%

Purchase Details

Closed on

Jun 24, 1993

Bought by

Carpenter Leonard R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zsemlye Karen L | $107,400 | Lawyers Title Ins Corp | |

| Hammond Kristy A | $105,000 | Insignia Title Agency Ltd | |

| Carpenter Leonard R | $85,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Zsemlye Karen L | $39,900 | |

| Previous Owner | Hammond Kristy A | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,641 | $42,700 | $5,250 | $37,450 |

| 2023 | $1,641 | $42,700 | $5,250 | $37,450 |

| 2022 | $1,560 | $33,530 | $4,550 | $28,980 |

| 2021 | $1,563 | $33,530 | $4,550 | $28,980 |

| 2020 | $1,613 | $33,530 | $4,550 | $28,980 |

| 2019 | $165 | $31,640 | $4,550 | $27,090 |

| 2018 | $1,647 | $31,640 | $4,550 | $27,090 |

| 2017 | $1,647 | $31,640 | $4,550 | $27,090 |

| 2016 | $1,382 | $30,380 | $6,300 | $24,080 |

| 2015 | $1,234 | $30,380 | $6,300 | $24,080 |

| 2014 | $1,234 | $30,380 | $6,300 | $24,080 |

| 2013 | $1,219 | $30,380 | $6,300 | $24,080 |

Source: Public Records

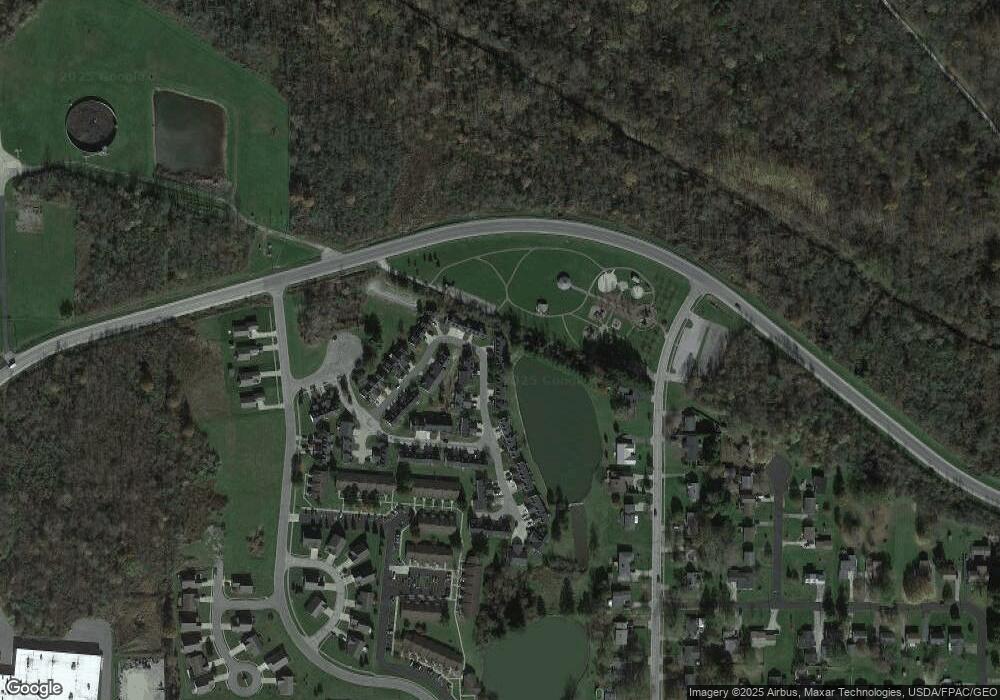

Map

Nearby Homes

- 15410 High Pointe Cir

- V/L High Pointe Cir

- 15111 Timber Ridge Dr

- 16008 Button St

- 15243 Woodsong Dr

- S/L 189 Oak Hill Dr

- 0 Old State Rd Unit 5157703

- 14706 Steeplechase Dr

- 16298 Weathervane Dr

- 14753 Madison Rd

- 13689 Old State Rd

- 14607 Erwin Dr

- 14452 Burton Windsor Rd

- 14752 Evergreen Dr

- 15990 Old State Rd

- 14028 Goodwin St

- 14685 Hubbard Rd

- 14778 S Cheshire St

- 13407 Madison Rd

- 16310 Madison Rd

- 14745 Lakeview Dr

- 14730 Lakeview Dr Unit 16-1

- 14730 Lakeview Dr

- 14730 Lakeview Dr Unit 1

- 14730 Lakeview Dr

- 14730 Lakeview Dr Unit 2

- 14740 Lakeview Dr

- 14740 Lakeview Dr

- 14740 Lakeview Dr Unit 1

- 14755 Lakeview Dr Unit 2

- 14755 Lakeview Dr Unit 1

- 14755 Lakeview Dr Unit 3

- 14750 Lakeview Dr Unit 1

- 14750 Lakeview Dr Unit 2

- 14720 Lakeview Dr

- 14720 Lakeview Dr

- 14720 Lakeview Dr

- 14720 Lakeview Dr Unit 3

- 14720 Lakeview Dr Unit 1

- 14720 Lakeview Dr Unit 2