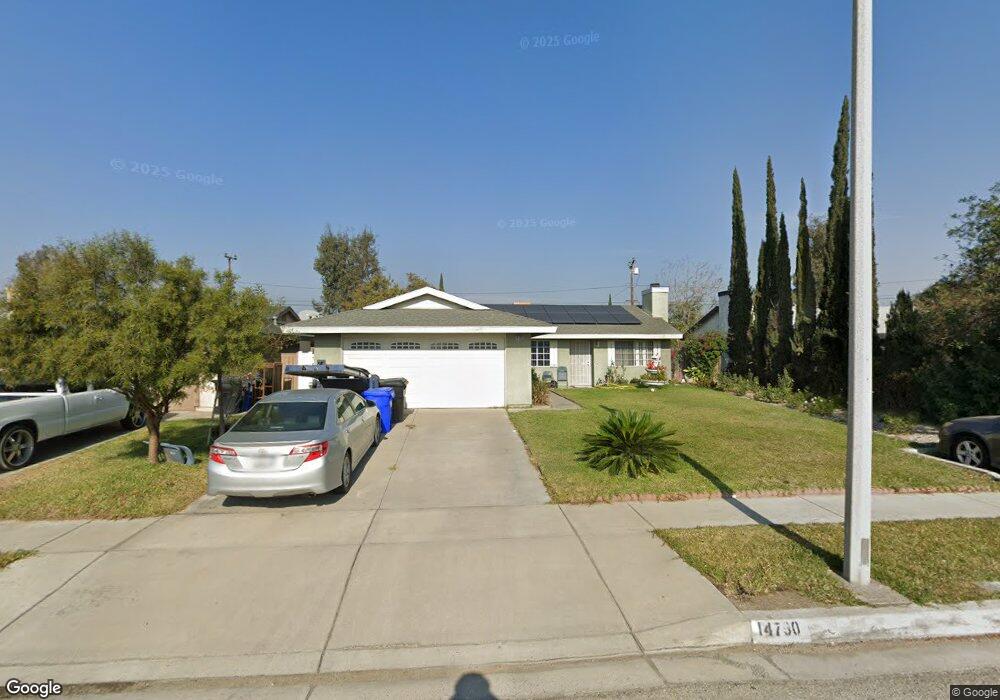

14790 Mallory Dr Fontana, CA 92335

Estimated Value: $532,000 - $577,000

3

Beds

2

Baths

1,098

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 14790 Mallory Dr, Fontana, CA 92335 and is currently estimated at $555,801, approximately $506 per square foot. 14790 Mallory Dr is a home located in San Bernardino County with nearby schools including Poplar Elementary School, Sequoia Middle School, and Henry J. Kaiser High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 15, 2019

Sold by

Saravia Sigredo De Jesus and Saravia Ceferina Claribel

Bought by

Saravia Sigredo De Jesus and Saravia Ceferina Claribel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

3.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 5, 2002

Sold by

Saravia Sigfredo Dejesus

Bought by

Saravia Sigfredo Dejesus and Saravia Ceferina C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,000

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Saravia Sigredo De Jesus | -- | Orange Coast Title | |

| Saravia Sigfredo Dejesus | -- | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Saravia Sigredo De Jesus | $150,000 | |

| Closed | Saravia Sigfredo Dejesus | $118,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,279 | $218,389 | $54,642 | $163,747 |

| 2024 | $2,279 | $214,107 | $53,571 | $160,536 |

| 2023 | $2,220 | $209,909 | $52,521 | $157,388 |

| 2022 | $2,211 | $205,793 | $51,491 | $154,302 |

| 2021 | $2,184 | $201,757 | $50,481 | $151,276 |

| 2020 | $2,179 | $199,688 | $49,963 | $149,725 |

| 2019 | $2,038 | $195,772 | $48,983 | $146,789 |

| 2018 | $2,067 | $191,934 | $48,023 | $143,911 |

| 2017 | $2,054 | $188,170 | $47,081 | $141,089 |

| 2016 | $2,018 | $184,481 | $46,158 | $138,323 |

| 2015 | $2,137 | $181,710 | $45,465 | $136,245 |

| 2014 | $1,986 | $178,150 | $44,574 | $133,576 |

Source: Public Records

Map

Nearby Homes

- 14582 El Molino St

- 17377 20 Valley Blvd

- 9828 Carob Ave

- 15162 Cambria St

- 9326 Bunny Ln

- 10238 Cherry Ave

- 15240 Carob Ln

- 9310 Carob St

- 9756 Elm Ave

- 15278 Boyle Ave

- 14989 Hibiscus Ave

- 9963 Eugenia Ave

- 15317 Athol St

- 15065 Granada Ct

- 9059 Beech Ave

- 15082 Valley Blvd

- 9408 Poplar Ave

- 14770 Boyle Ave

- 15937 Manzanita Dr

- 15798 Slover Ave

- 14786 Mallory Dr

- 14798 Mallory Dr

- 14774 Mallory Dr

- 9846 Arbor Ave

- 14785 El Molino St

- 14775 El Molino St

- 14795 El Molino St

- 14765 El Molino St

- 14762 Mallory Dr

- 14785 Mallory Dr

- 14805 El Molino St

- 14797 Mallory Dr

- 14773 Mallory Dr

- 14755 El Molino St

- 14761 Mallory Dr

- 14750 Mallory Dr

- 14815 El Molino St

- 14755 Mallory Dr

- 14745 El Molino St

- 14738 Mallory Dr