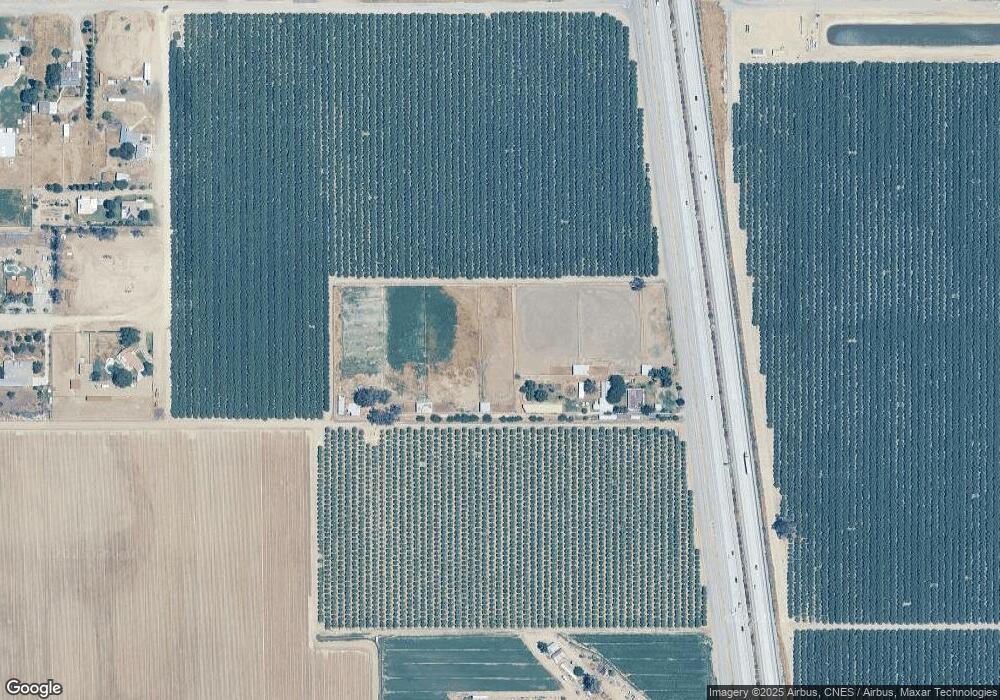

14801 Costajo Rd Bakersfield, CA 93313

Estimated Value: $295,000 - $838,000

3

Beds

2

Baths

1,047

Sq Ft

$560/Sq Ft

Est. Value

About This Home

This home is located at 14801 Costajo Rd, Bakersfield, CA 93313 and is currently estimated at $585,827, approximately $559 per square foot. 14801 Costajo Rd is a home located in Kern County with nearby schools including General Shafter Elementary School, Ridgeview High School, and Gideon Apostolic Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 25, 2001

Sold by

Spasiano Robert

Bought by

Rancho San Roberto Inc

Current Estimated Value

Purchase Details

Closed on

Jul 26, 2001

Sold by

Spasiano Renee L

Bought by

Spasiano Robert

Purchase Details

Closed on

Jul 16, 2001

Sold by

Rancho San Roberto Inc

Bought by

Spasiano Robert

Purchase Details

Closed on

Jun 29, 1999

Sold by

Spasiano Robert

Bought by

Rancho San Roberts Inc

Purchase Details

Closed on

Aug 7, 1998

Sold by

Higgins Jack R and Higgins Donna J

Bought by

Spasiano Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

9.6%

Purchase Details

Closed on

Nov 27, 1996

Sold by

Chrys Chrys S S and Chrys Maria

Bought by

Higgins Jack R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

7.76%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rancho San Roberto Inc | -- | -- | |

| Spasiano Robert | -- | Chicago Title Co | |

| Spasiano Robert | $1,000 | Chicago Title Co | |

| Rancho San Roberts Inc | $50,000 | Fidelity National Title Co | |

| Spasiano Robert | $205,000 | Fidelity National Title Co | |

| Higgins Jack R | $197,000 | American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Spasiano Robert | $164,000 | |

| Previous Owner | Higgins Jack R | $128,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,185 | $328,886 | $192,110 | $136,776 |

| 2024 | $4,081 | $322,439 | $188,344 | $134,095 |

| 2023 | $4,081 | $316,117 | $184,651 | $131,466 |

| 2022 | $3,996 | $309,920 | $181,031 | $128,889 |

| 2021 | $3,886 | $303,844 | $177,482 | $126,362 |

| 2020 | $3,819 | $300,730 | $175,663 | $125,067 |

| 2019 | $3,762 | $300,730 | $175,663 | $125,067 |

| 2018 | $3,665 | $289,054 | $168,843 | $120,211 |

| 2017 | $3,597 | $283,387 | $165,533 | $117,854 |

| 2016 | $3,060 | $277,832 | $162,288 | $115,544 |

| 2015 | $3,029 | $273,660 | $159,851 | $113,809 |

| 2014 | $2,967 | $268,300 | $156,720 | $111,580 |

Source: Public Records

Map

Nearby Homes

- 1509 Porty Ave

- 1523 Kuhio St

- 15852 Wible Rd

- 0 Bear Mountain Blvd

- 10517 McCormac Ave

- 811 Kidlington Ct

- 1301 Taft Hwy Unit 91

- 1301 Taft Hwy Unit 50

- 1301 Taft Hwy

- 1301 Taft Hwy Unit 166

- 1301 Taft Hwy Unit 93

- 1301 Taft Hwy Unit 12

- 1225 Taft Hwy Unit 5

- 1225 Taft Hwy Unit 23

- 1225 Taft Hwy Unit 3

- 1225 Taft Hwy Unit 24

- 0 S Union Ave Unit 202509110

- 9449 S Union Ave

- 400 Stirrup Ave

- 14823 Mccaffrey St

- 14711 Mccaffrey St

- 1525 Cyril Ct

- 1455 Shafter Rd

- 1538 Cyril Ct

- 1501 Shafter Rd

- 1260 Shafter Rd

- 15231 Costajo Rd

- 1601 Shafter Rd

- 1500 Shafter Rd

- 1645 Shafter Rd

- 1510 Shafter Rd

- 15451 Costajo Rd

- 1600 Shafter Rd

- 13764 Costajo Rd

- 0 Costajo Rd

- 1 Costajo Rd

- 14520 S H St

- 14448 Chevalier Rd

- 14424 S H St