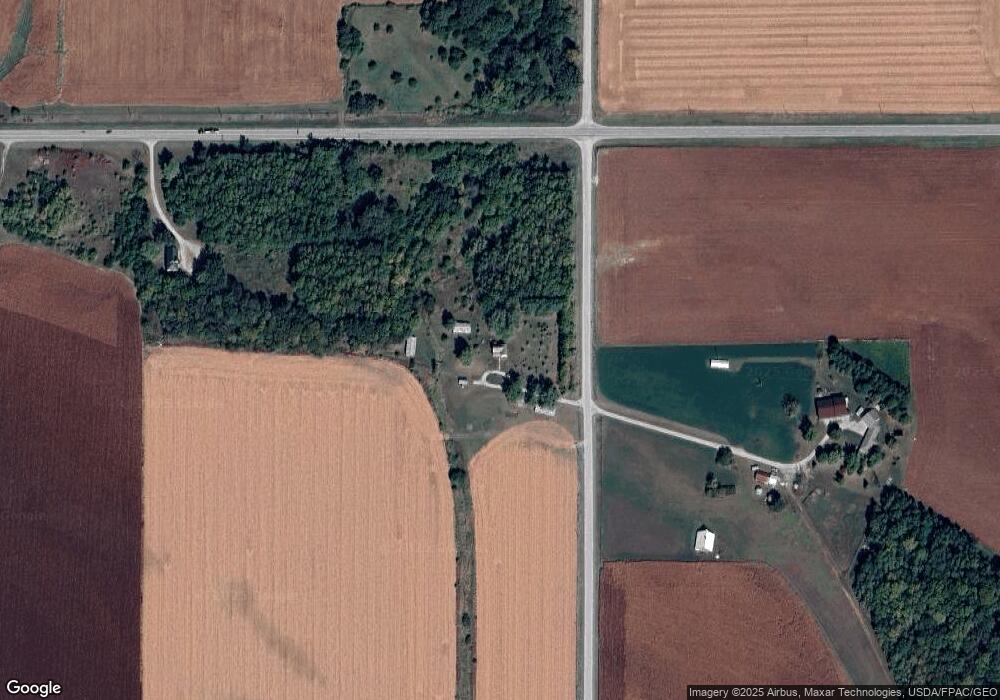

14873 O Ave Columbus Junction, IA 52738

Estimated Value: $170,000 - $284,000

3

Beds

1

Bath

1,808

Sq Ft

$128/Sq Ft

Est. Value

About This Home

This home is located at 14873 O Ave, Columbus Junction, IA 52738 and is currently estimated at $230,799, approximately $127 per square foot. 14873 O Ave is a home located in Louisa County with nearby schools including Roundy Elementary School and Columbus Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2021

Sold by

Lawrence Keith P and Lawrence Kathrine L

Bought by

Lawrence Keith P and Lawrence Kathrine L

Current Estimated Value

Purchase Details

Closed on

Apr 16, 2008

Sold by

Lawrence Michelle D

Bought by

Lawrence Keith P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lawrence Keith P | -- | None Listed On Document | |

| Lawrence Keith P | $31,000 | None Listed On Document | |

| Lawrence Keith P | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,114 | $126,020 | $41,400 | $84,620 |

| 2024 | $1,090 | $118,980 | $41,400 | $77,580 |

| 2023 | $1,090 | $118,980 | $41,400 | $77,580 |

| 2022 | $1,110 | $104,150 | $41,400 | $62,750 |

| 2021 | $1,106 | $104,150 | $41,400 | $62,750 |

| 2020 | $1,106 | $96,230 | $41,400 | $54,830 |

| 2019 | $1,066 | $96,230 | $41,400 | $54,830 |

| 2018 | $1,048 | $85,480 | $41,400 | $44,080 |

| 2017 | $1,048 | $84,350 | $0 | $0 |

| 2016 | $1,232 | $84,350 | $35,340 | $49,010 |

| 2015 | $1,232 | $84,350 | $35,340 | $49,010 |

| 2014 | $1,162 | $84,350 | $35,340 | $49,010 |

Source: Public Records

Map

Nearby Homes

- 17297 Highway 92

- 17297 Iowa 92

- 17297 State Hwy 92

- 00 140th St

- 000 140th St

- 18173 115th St

- 260 Colonels Dr

- 0 Iowa 92

- 409 2nd St

- 20513 County Road G40

- 824 3rd St

- 303 Gamble St

- 1175 Oakview Dr

- 804 Union St

- 209 Flat Iron Dr

- 125 N Cherry St

- 830 Colonial Ave

- 2209 Philadelphia St

- 2902 Water St

- 1371 260th St