15 Pound Ridge Rd Cheshire, CT 06410

Estimated Value: $531,000 - $701,000

4

Beds

7

Baths

2,044

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 15 Pound Ridge Rd, Cheshire, CT 06410 and is currently estimated at $595,906, approximately $291 per square foot. 15 Pound Ridge Rd is a home located in New Haven County with nearby schools including Darcey School, Norton School, and Dodd Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2011

Sold by

Demakovsky Ronald and Gallenstein Teresa L

Bought by

Boggs Angela A and Boggs Douglas L

Current Estimated Value

Purchase Details

Closed on

Jun 28, 2000

Sold by

Perez Thomas M and Perez Sandra G

Bought by

Demakovsky Ronald and Gallenstein Teresa L

Purchase Details

Closed on

Jun 30, 1998

Sold by

Bhuranesh Urmila and Kobla Bhuranesh

Bought by

Perez Thomas M and Perez Sandra G

Purchase Details

Closed on

Jun 25, 1991

Sold by

Fullmer David and Fullmer Tiare

Bought by

Bhuvanesh Urmila and Kobla Bhuvanesh

Purchase Details

Closed on

Jun 15, 1989

Sold by

Alterman Laurence

Bought by

Fullmer David

Purchase Details

Closed on

Dec 23, 1987

Sold by

Fritz Dennis

Bought by

Alterman Laurence

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Boggs Angela A | $300,000 | -- | |

| Boggs Angela A | $300,000 | -- | |

| Demakovsky Ronald | $235,000 | -- | |

| Demakovsky Ronald | $235,000 | -- | |

| Perez Thomas M | $207,000 | -- | |

| Bhuvanesh Urmila | $199,000 | -- | |

| Fullmer David | $222,000 | -- | |

| Alterman Laurence | $215,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alterman Laurence | $256,000 | |

| Closed | Alterman Laurence | $235,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,612 | $289,590 | $83,930 | $205,660 |

| 2024 | $7,952 | $289,590 | $83,930 | $205,660 |

| 2023 | $7,538 | $214,820 | $83,950 | $130,870 |

| 2022 | $7,373 | $214,820 | $83,950 | $130,870 |

| 2021 | $7,244 | $214,820 | $83,950 | $130,870 |

| 2020 | $7,136 | $214,820 | $83,950 | $130,870 |

| 2019 | $7,136 | $214,820 | $83,950 | $130,870 |

| 2018 | $7,113 | $218,060 | $84,290 | $133,770 |

| 2017 | $6,965 | $218,060 | $84,290 | $133,770 |

| 2016 | $6,801 | $218,060 | $84,290 | $133,770 |

| 2015 | $6,692 | $218,060 | $84,290 | $133,770 |

| 2014 | $6,596 | $218,060 | $84,290 | $133,770 |

Source: Public Records

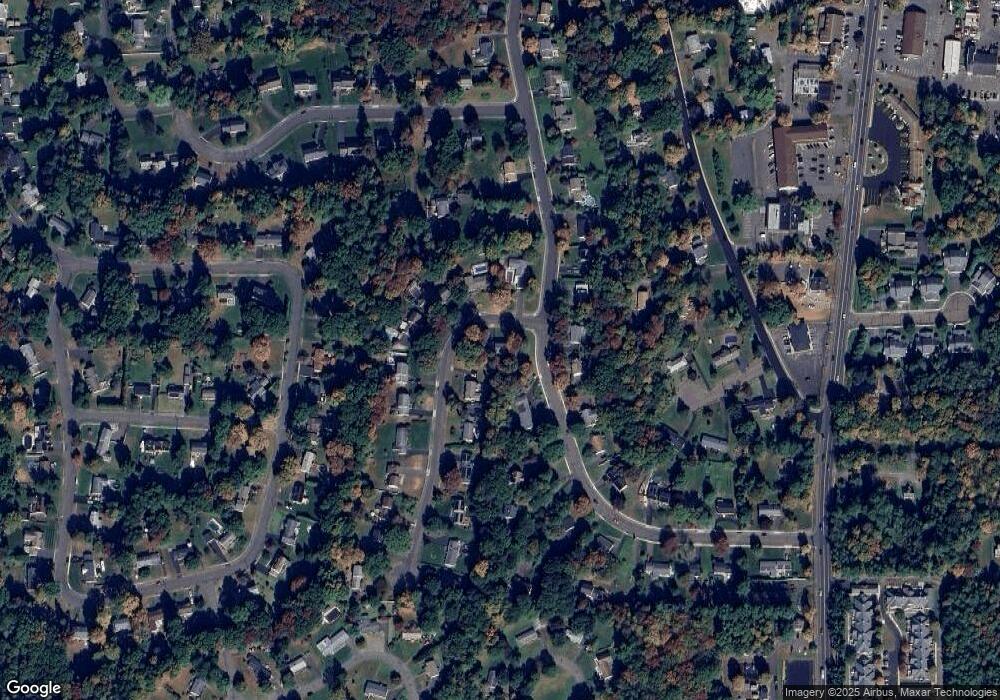

Map

Nearby Homes

- 21 Hawthorne Dr

- 40 Southwick Ct Unit 106

- 70 Southwick Ct Unit 110

- 164 S Brooksvale Rd

- 115 S Brooksvale Rd

- 1325 Avon Blvd

- 1364 Avon Blvd

- 118 Harrison Rd

- 50 Heritage Dr

- 1600 S Main St

- 1600 S Main St Unit BFraser Model

- 1600 S Main St Unit Model A (Charter Oak

- 1600RR S Main St

- Lot 2 Mount Sanford Rd

- Lot 1 Mount Sanford Rd

- Lot 3 Mount Sanford Rd

- 1681 Orchard Hill Rd

- 30 Elmwood Dr

- 353 Mount Sanford Rd

- 31 Iris Ct

- 55 Pound Ridge Rd

- 85 Brentwood Dr

- 115 Brentwood Dr

- 20 Pound Ridge Rd

- 65 Pound Ridge Rd

- 100 Brentwood Dr

- 90 Brentwood Dr

- 30 Pound Ridge Rd

- 40 Pound Ridge Rd

- 50 Pound Ridge Rd

- 110 Brentwood Dr

- 60 Pound Ridge Rd

- 80 Brentwood Dr

- 75 Brentwood Dr

- 75 Pound Ridge Rd

- 125 Brentwood Dr

- 120 Brentwood Dr

- 135 Brentwood Dr

- 70 Pound Ridge Rd

- 70 Brentwood Dr