15020 State Route 83 Rd Grafton, OH 44044

Estimated Value: $321,000 - $630,568

2

Beds

1

Bath

985

Sq Ft

$454/Sq Ft

Est. Value

About This Home

This home is located at 15020 State Route 83 Rd, Grafton, OH 44044 and is currently estimated at $446,892, approximately $453 per square foot. 15020 State Route 83 Rd is a home with nearby schools including Midview West Elementary School, Midview North Elementary School, and Midview East Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 7, 2011

Sold by

Starkey Allison S

Bought by

Starkey Gay W

Current Estimated Value

Purchase Details

Closed on

Oct 28, 2004

Sold by

Baird John and Baird John R

Bought by

Starkey Gay W and Starkey Allison

Purchase Details

Closed on

Feb 14, 2000

Sold by

Baird Kathleen

Bought by

Baird John

Purchase Details

Closed on

Jan 24, 2000

Sold by

Wamsley Glen W

Bought by

Baird John Raymond

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,900

Interest Rate

10.5%

Purchase Details

Closed on

Dec 2, 1999

Sold by

Wamsley Glen W and Wamsley Rebecca L

Bought by

Ashworth Larry W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,900

Interest Rate

10.5%

Purchase Details

Closed on

Oct 9, 1998

Sold by

Horta Timothy M and Horta Ann M

Bought by

Wamsley Glen W and Wamsley Rebecca L

Purchase Details

Closed on

Oct 8, 1998

Sold by

Bruce Lee Vern and Bruce Cynthia A

Bought by

Horta Timothy M and Horta Ann M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Starkey Gay W | -- | Attorney | |

| Starkey Gay W | $150,000 | Lawyers Title Insurance Co | |

| Baird John | -- | Title First Agency Inc | |

| Baird John Raymond | -- | Ticorp Natl Title | |

| Wamsley Glen W | -- | Ticorp Natl Title | |

| Ashworth Larry W | -- | -- | |

| Wamsley Glen W | $75,000 | Midland Title | |

| Horta Timothy M | $65,000 | Midland Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ashworth Larry W | $54,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,724 | $179,197 | $71,649 | $107,548 |

| 2023 | $6,738 | $143,759 | $53,333 | $90,426 |

| 2022 | $6,628 | $143,759 | $53,333 | $90,426 |

| 2021 | $6,648 | $143,759 | $53,333 | $90,426 |

| 2020 | $5,915 | $120,400 | $44,670 | $75,730 |

| 2019 | $5,894 | $120,400 | $44,670 | $75,730 |

| 2018 | $5,963 | $120,400 | $44,670 | $75,730 |

| 2017 | $5,761 | $108,420 | $51,390 | $57,030 |

| 2016 | $6,428 | $108,420 | $51,390 | $57,030 |

| 2015 | $6,463 | $108,420 | $51,390 | $57,030 |

| 2014 | $6,340 | $104,240 | $49,410 | $54,830 |

| 2013 | $6,483 | $106,470 | $49,410 | $57,060 |

Source: Public Records

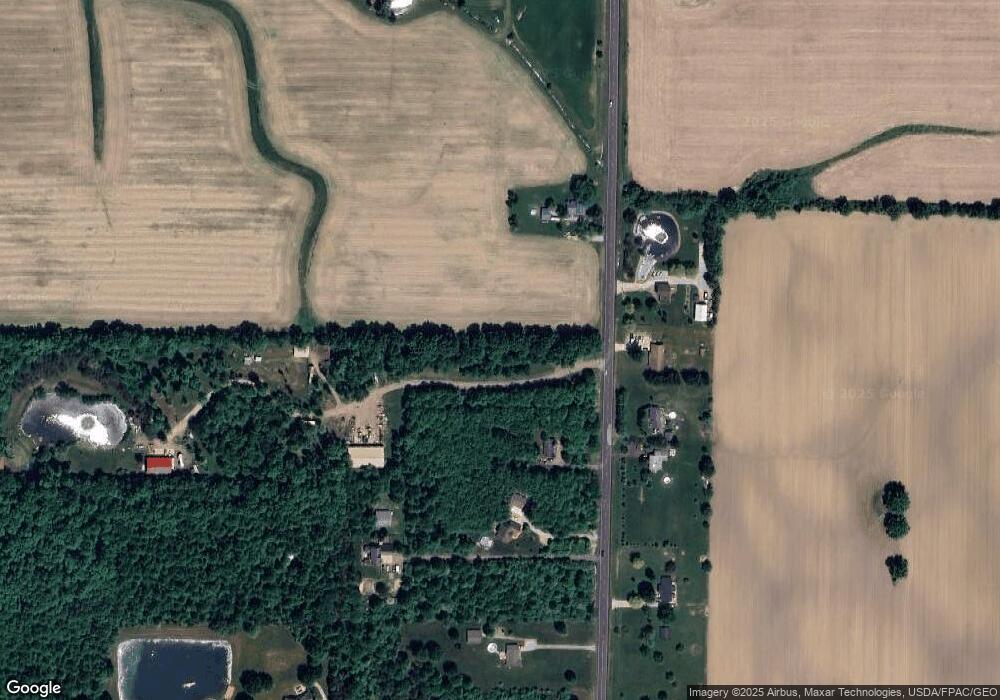

Map

Nearby Homes

- 34630 N Legends Way

- 1013 N Willow St

- 16000 Island Rd

- 1065 Sunshine Ct

- 966 Oak St

- 697 Main St

- 1041 Plymouth Dr

- V/L Capel Rd

- 1129 Novak Rd

- 551 N Main St

- 1077 Yarmouth Rd

- 13743 Cowley Rd

- 1040 Timber Trail

- 13400 Cowley Rd

- 35293 Elm Rd

- 33840 Willow Creek Ct

- 1099 Huntsman Ct

- 1129 Fox Run

- 1167 Fox Run

- Bramante Ranch w/ Finished Basement Plan at Fox Run

- 15110 Avon Belden Rd

- 15000 Avon Belden Rd

- 14945 Avon Belden Rd

- 15000 Ohio 83

- 15114 Avon Belden Rd

- 15039 Avon Belden Rd

- 15089 Avon Belden Rd

- 15120 Avon Belden Rd

- 15131 Avon Belden Rd

- 15162 Avon Belden Rd

- 15120 Ohio 83

- 15191 Avon Belden Rd

- 15200 Avon Belden Rd

- 15231 Avon Belden Rd

- 15239 Avon Belden Rd

- 15236 Ohio 83

- 15236 State Route 83 Rd

- 15263 Avon Belden Rd

- 15281 Avon Belden Rd

- 15317 Avon Belden Rd