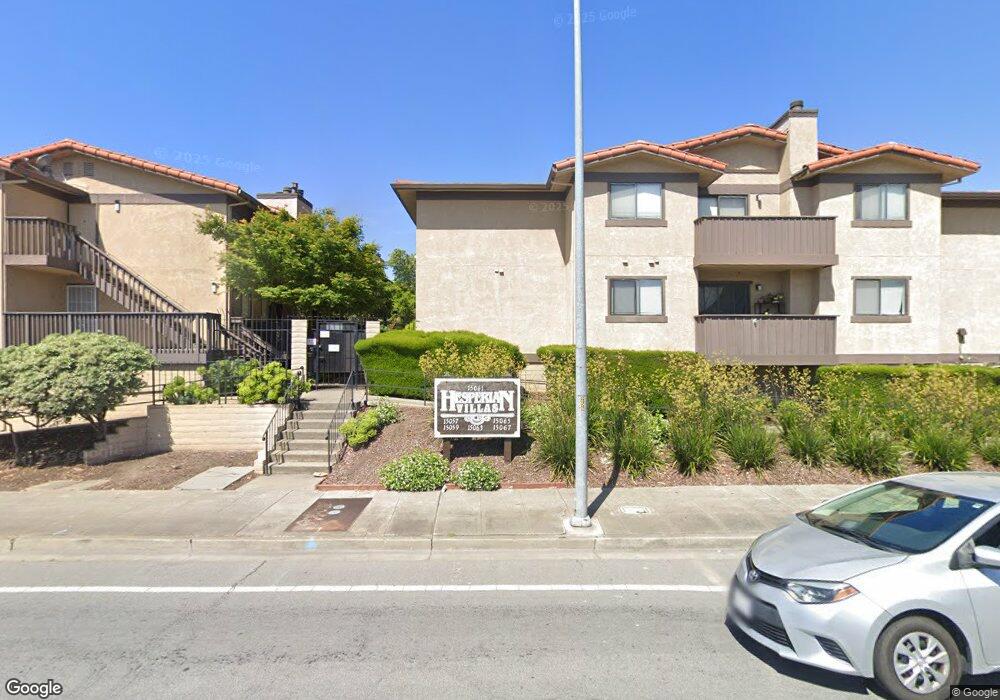

15059 Hesperian Blvd Unit 32 San Leandro, CA 94578

Lower Bal NeighborhoodEstimated Value: $355,000 - $386,000

2

Beds

1

Bath

745

Sq Ft

$497/Sq Ft

Est. Value

About This Home

This home is located at 15059 Hesperian Blvd Unit 32, San Leandro, CA 94578 and is currently estimated at $370,132, approximately $496 per square foot. 15059 Hesperian Blvd Unit 32 is a home located in Alameda County with nearby schools including Jefferson Elementary School, Bancroft Middle School, and San Leandro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2013

Sold by

Sabadell United Bank Na

Bought by

Navarro Jorge

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$84,681

Interest Rate

3.54%

Mortgage Type

New Conventional

Estimated Equity

$285,451

Purchase Details

Closed on

Feb 5, 2013

Sold by

Stephens Tracy

Bought by

Sabadell United Bank Na

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$84,681

Interest Rate

3.54%

Mortgage Type

New Conventional

Estimated Equity

$285,451

Purchase Details

Closed on

Aug 17, 2005

Sold by

Gallegos Antonio G and Gallegos Maria Lynnette

Bought by

Stephens Tracy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

1%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Jan 28, 2005

Sold by

Gomez Sandra Y and Rodriguez Karina L

Bought by

Gallegos Antonio G and Gallegos Maria Lynnette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,800

Interest Rate

7.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 5, 2003

Sold by

Alameda County Allied Housing Program

Bought by

Gomez Sandra Y and Rodriguez Karina L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,580

Interest Rate

5.53%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 16, 1997

Sold by

Hud

Bought by

Alameda County Allied Housing Program

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,407

Interest Rate

8.14%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 3, 1997

Sold by

First Nationwide Mtg Corp

Bought by

Hud

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,407

Interest Rate

8.14%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 26, 1996

Sold by

Evans Jon M and Evans Marla M

Bought by

First Nationwide Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Navarro Jorge | $150,000 | Lawyers Title | |

| Sabadell United Bank Na | $345,719 | Accommodation | |

| Stephens Tracy | $350,000 | First American Title Co | |

| Gallegos Antonio G | $301,000 | New Century Title Company | |

| Gomez Sandra Y | $214,000 | Alliance Title Company | |

| Alameda County Allied Housing Program | $80,000 | North American Title Co | |

| Hud | -- | American Title Ins Co | |

| First Nationwide Mtg Corp | $133,582 | American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Navarro Jorge | $120,000 | |

| Previous Owner | Stephens Tracy | $280,000 | |

| Previous Owner | Gallegos Antonio G | $240,800 | |

| Previous Owner | Gomez Sandra Y | $207,580 | |

| Previous Owner | Alameda County Allied Housing Program | $76,407 | |

| Closed | Gallegos Antonio G | $60,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,807 | $177,706 | $55,412 | $129,294 |

| 2024 | $2,807 | $174,085 | $54,325 | $126,760 |

| 2023 | $2,826 | $177,534 | $53,260 | $124,274 |

| 2022 | $2,727 | $167,054 | $52,216 | $121,838 |

| 2021 | $2,637 | $163,642 | $51,192 | $119,450 |

| 2020 | $2,558 | $168,893 | $50,668 | $118,225 |

| 2019 | $2,472 | $165,583 | $49,675 | $115,908 |

| 2018 | $2,423 | $162,337 | $48,701 | $113,636 |

| 2017 | $2,288 | $159,154 | $47,746 | $111,408 |

| 2016 | $2,213 | $156,034 | $46,810 | $109,224 |

Source: Public Records

Map

Nearby Homes

- 1112 Adason Dr

- 475 Nabor St

- 1426 153rd Ave

- 14850 Donna St

- 14875 Western Ave

- 15244 Upton Ave

- 14955 Lark St

- 14972 Lark St

- 527 Colby St

- 1207 147th Ave Unit D

- 1525 Thrush Ave

- 15263 Hesperian Blvd Unit 13

- 14625 Bancroft Ave

- 1450 Thrush Ave Unit 17

- 14828 Martell Ave

- 15860 Connolly Ave

- 1540 Mono Ave

- 0 Saturn Dr

- 15956 E 14th St Unit 303

- 365 Caliente Cir

- 15065 Hesperian Blvd

- 15059 Hesperian Blvd Unit 40

- 15059 Hesperian Blvd Unit 37

- 15059 Hesperian Blvd Unit 36

- 15059 Hesperian Blvd Unit 35

- 15059 Hesperian Blvd Unit 34

- 15059 Hesperian Blvd Unit 33

- 15059 Hesperian Blvd Unit 31

- 15057 Hesperian Blvd Unit 6

- 15057 Hesperian Blvd Unit 105

- 15065 Hesperian Blvd Unit 23

- 15065 Hesperian Blvd Unit 22

- 15065 Hesperian Blvd Unit 21

- 15067 Hesperian Blvd Unit 20

- 15067 Hesperian Blvd Unit 19

- 15067 Hesperian Blvd Unit 18

- 15067 Hesperian Blvd Unit 17

- 15067 Hesperian Blvd Unit 16

- 15067 Hesperian Blvd Unit 15

- 15067 Hesperian Blvd Unit 14