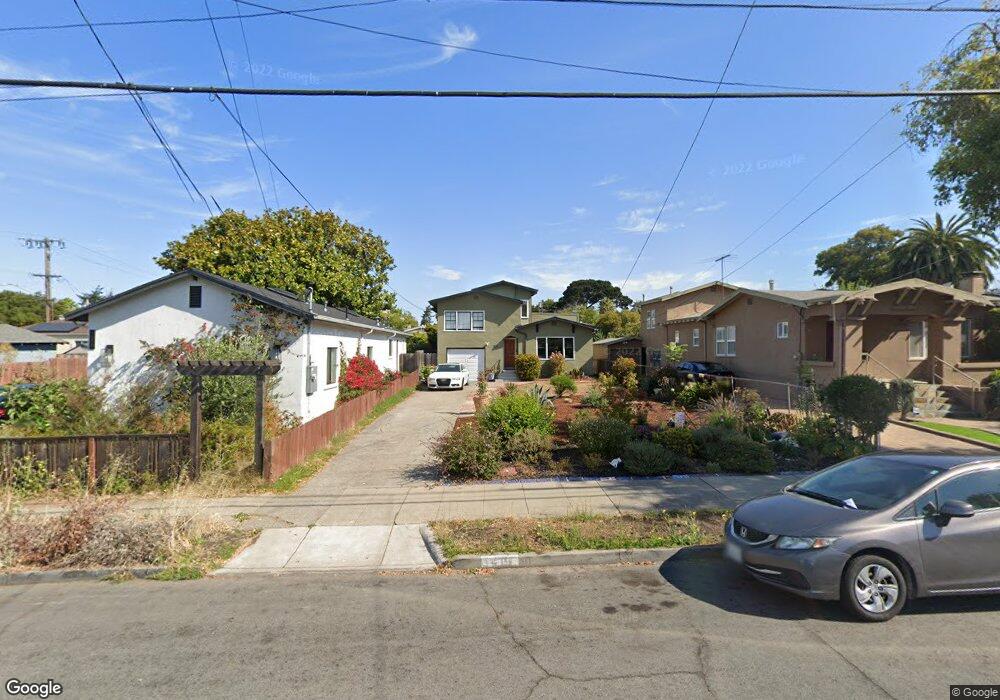

1511 Parker St Berkeley, CA 94703

South Berkeley NeighborhoodEstimated Value: $1,065,000 - $1,439,096

3

Beds

1

Bath

1,359

Sq Ft

$932/Sq Ft

Est. Value

About This Home

This home is located at 1511 Parker St, Berkeley, CA 94703 and is currently estimated at $1,266,274, approximately $931 per square foot. 1511 Parker St is a home located in Alameda County with nearby schools including Washington Elementary School, Malcolm X Elementary School, and Oxford Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2020

Sold by

Ridley Karen J and Ridley Karen Janell

Bought by

Ridley Karen J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$195,450

Interest Rate

2.71%

Mortgage Type

New Conventional

Estimated Equity

$1,070,824

Purchase Details

Closed on

Jan 3, 2020

Sold by

Ridley Karen J

Bought by

Ridley Karen J and Ridley Karen Janell

Purchase Details

Closed on

Nov 20, 2001

Sold by

Robinson Beverly J and Estate Of Katie V Greene

Bought by

Ridley Karen J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,800

Interest Rate

6.57%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ridley Karen J | -- | Placer Title Company | |

| Ridley Karen J | -- | None Available | |

| Ridley Karen J | $362,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ridley Karen J | $220,000 | |

| Closed | Ridley Karen J | $288,800 | |

| Closed | Ridley Karen J | $36,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,941 | $527,302 | $160,423 | $373,879 |

| 2024 | $9,941 | $516,827 | $157,278 | $366,549 |

| 2023 | $9,711 | $513,559 | $154,195 | $359,364 |

| 2022 | $9,489 | $496,489 | $151,172 | $352,317 |

| 2021 | $9,480 | $486,618 | $148,208 | $345,410 |

| 2020 | $8,862 | $488,558 | $146,689 | $341,869 |

| 2019 | $8,394 | $478,980 | $143,813 | $335,167 |

| 2018 | $8,224 | $469,591 | $140,994 | $328,597 |

| 2017 | $7,921 | $460,385 | $138,230 | $322,155 |

| 2016 | $7,586 | $451,360 | $135,520 | $315,840 |

| 2015 | $7,471 | $444,582 | $133,485 | $311,097 |

| 2014 | $7,338 | $435,876 | $130,871 | $305,005 |

Source: Public Records

Map

Nearby Homes