15112 Shining Star Ln San Leandro, CA 94579

Heron Bay NeighborhoodEstimated Value: $1,169,000 - $1,452,000

4

Beds

3

Baths

2,570

Sq Ft

$513/Sq Ft

Est. Value

About This Home

This home is located at 15112 Shining Star Ln, San Leandro, CA 94579 and is currently estimated at $1,318,625, approximately $513 per square foot. 15112 Shining Star Ln is a home located in Alameda County with nearby schools including Dayton Elementary School, Washington Manor Middle School, and Arroyo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2025

Sold by

Fu Wengkee and Du Sue Zhen

Bought by

Fu/Du Family Trust and Fu

Current Estimated Value

Purchase Details

Closed on

Jan 23, 2003

Sold by

Fu Wengkee

Bought by

Fu Wengkee and Du Sue Zhen

Purchase Details

Closed on

Jan 14, 2002

Sold by

Du Sue Zhen

Bought by

Fu Weng Kee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

6.84%

Purchase Details

Closed on

Nov 18, 1996

Sold by

H F Properties Ltd

Bought by

Vogt David A and Vogt Jeannine L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fu/Du Family Trust | -- | None Listed On Document | |

| Fu Wengkee | -- | -- | |

| Fu Weng Kee | -- | North American Title Co | |

| Fu Weng Kee | $580,000 | North American Title Co | |

| Vogt David A | $297,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fu Weng Kee | $380,000 | |

| Previous Owner | Vogt David A | $237,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,726 | $702,056 | $251,124 | $457,932 |

| 2024 | $8,726 | $688,154 | $246,200 | $448,954 |

| 2023 | $8,678 | $681,527 | $241,374 | $440,153 |

| 2022 | $8,558 | $661,164 | $236,641 | $431,523 |

| 2021 | $8,325 | $648,065 | $232,002 | $423,063 |

| 2020 | $8,149 | $648,350 | $229,624 | $418,726 |

| 2019 | $8,170 | $635,639 | $225,122 | $410,517 |

| 2018 | $7,739 | $623,178 | $220,709 | $402,469 |

| 2017 | $7,378 | $610,962 | $216,382 | $394,580 |

| 2016 | $7,211 | $598,986 | $212,141 | $386,845 |

| 2015 | $7,055 | $589,991 | $208,955 | $381,036 |

| 2014 | $6,949 | $578,437 | $204,863 | $373,574 |

Source: Public Records

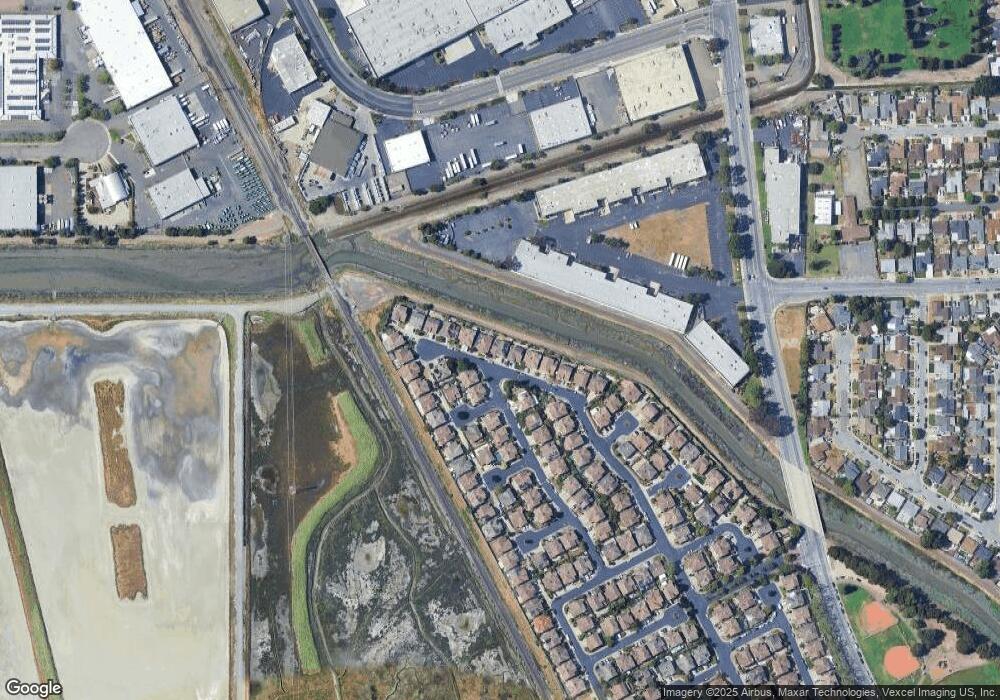

Map

Nearby Homes

- 509 Santa Ynez

- 112 Santa Teresa

- 14617 Doolittle Dr

- 14587 Doolittle Dr

- 117 Santa Teresa

- 1875 Willow Ave

- 14512 Trinidad Rd

- 2213 Wigeon Ct

- 154 Santa Teresa

- 2444 Belvedere Ave

- 362 Santa Paula

- 1315 Mersey Ave

- 2262 Bermuda Ave

- 14075 Doolittle Dr

- 2515 Galleon Place Unit 129

- 14666 Wiley St

- 1803 Cedar Ave

- 15102 Chapel Ct

- 14408 Outrigger Dr

- 1950 Randy St

- 15116 Shining Star Ln

- 15110 Shining Star Ln

- 15118 Shining Star Ln

- 15108 Shining Star Ln

- 15109 Shining Star Ln

- 15100 Flying Mist Rd

- 15120 Shining Star Ln

- 15122 Flying Mist Rd

- 15106 Shining Star Ln

- 15107 Shining Star Ln

- 2025 Mayflower Place

- 15122 Shining Star Ln

- 15102 Shining Star Ln

- 15123 Flying Mist Rd

- 15129 Shining Star Ln

- 15126 Flying Mist Rd

- 15105 Shining Star Ln

- 2027 Mayflower Place

- 15126 Shining Star Ln

- 15125 Flying Mist Rd