15171 Magnolia Blvd Unit D Sherman Oaks, CA 91403

Estimated Value: $707,779 - $980,000

3

Beds

3

Baths

1,570

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 15171 Magnolia Blvd Unit D, Sherman Oaks, CA 91403 and is currently estimated at $795,195, approximately $506 per square foot. 15171 Magnolia Blvd Unit D is a home located in Los Angeles County with nearby schools including Kester Avenue Elementary School, Van Nuys High School, and Ivy Bound Academy of Math Sci and Tech Charter Middle.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2017

Sold by

Korol Alexander

Bought by

Korol Alexander and Korol Rimma

Current Estimated Value

Purchase Details

Closed on

Oct 17, 2016

Sold by

Korol Galena

Bought by

Korol Alexander and Korol Rimma

Purchase Details

Closed on

Dec 9, 2013

Sold by

Korol Alexander

Bought by

Korol Alexander and Korol Rimma

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,000

Interest Rate

4.47%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 16, 2013

Sold by

Korol Alexander and Korol Rimma

Bought by

Korol Alexander and Korol Rimma

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Korol Alexander | -- | None Available | |

| Korol Alexander | -- | Accommodation | |

| Korol Alexander | -- | Chicago Title Company | |

| Korol Alexander | -- | Accommodation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Korol Alexander | $266,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,746 | $393,220 | $106,166 | $287,054 |

| 2024 | $4,746 | $385,511 | $104,085 | $281,426 |

| 2023 | $4,654 | $377,953 | $102,045 | $275,908 |

| 2022 | $4,436 | $370,544 | $100,045 | $270,499 |

| 2021 | $4,374 | $363,280 | $98,084 | $265,196 |

| 2019 | $4,323 | $352,507 | $95,176 | $257,331 |

| 2018 | $5,652 | $459,710 | $130,327 | $329,383 |

| 2016 | $4,085 | $332,179 | $89,688 | $242,491 |

| 2015 | $4,027 | $327,190 | $88,341 | $238,849 |

| 2014 | $4,045 | $320,782 | $86,611 | $234,171 |

Source: Public Records

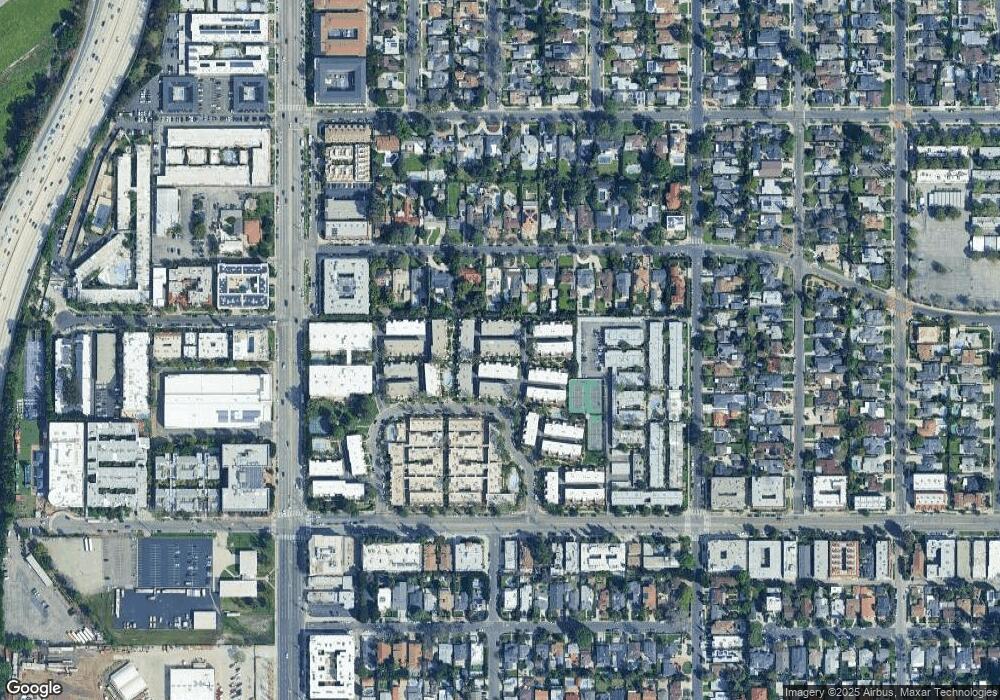

Map

Nearby Homes

- 15215 Magnolia Blvd Unit 102

- 15215 Magnolia Blvd Unit 131

- 15137 Magnolia Blvd Unit A

- 15161 Magnolia Blvd Unit F

- 15133 Magnolia Blvd Unit E

- 15248 Clark St Unit 104

- 15330 Weddington St

- 15344 Weddington St

- 5425 Halbrent Ave

- 5306 Norwich Ave

- 5351 Lemona Ave

- 5510 Columbus Ave

- 15123 Killion St

- 15220 Valleyheart Dr

- 15217 Burbank Blvd

- 5115 Kester Ave Unit 14

- 5115 Kester Ave Unit 202

- 14857 Hartsook St

- 5521 Kester Ave Unit 7

- 5070 Kester Ave Unit 12

- 15173 Magnolia Blvd Unit B

- 15219 Magnolia Blvd Unit E

- 15229 Magnolia Blvd Unit A

- 15177 Magnolia Blvd Unit A

- 15171 Magnolia Blvd Unit A

- 15169 Magnolia Blvd Unit A

- 15225 Magnolia Blvd Unit F

- 15175 Magnolia Blvd Unit C

- 15167 Magnolia Blvd Unit A

- 15225 Magnolia Blvd Unit A

- 15223 Magnolia Blvd Unit E

- 15223 Magnolia Blvd Unit D

- 15223 Magnolia Blvd Unit C

- 15223 Magnolia Blvd Unit B

- 15223 Magnolia Blvd Unit A

- 15221 Magnolia Blvd Unit E

- 15221 Magnolia Blvd Unit D

- 15221 Magnolia Blvd Unit C

- 15221 Magnolia Blvd Unit B

- 15221 Magnolia Blvd Unit A