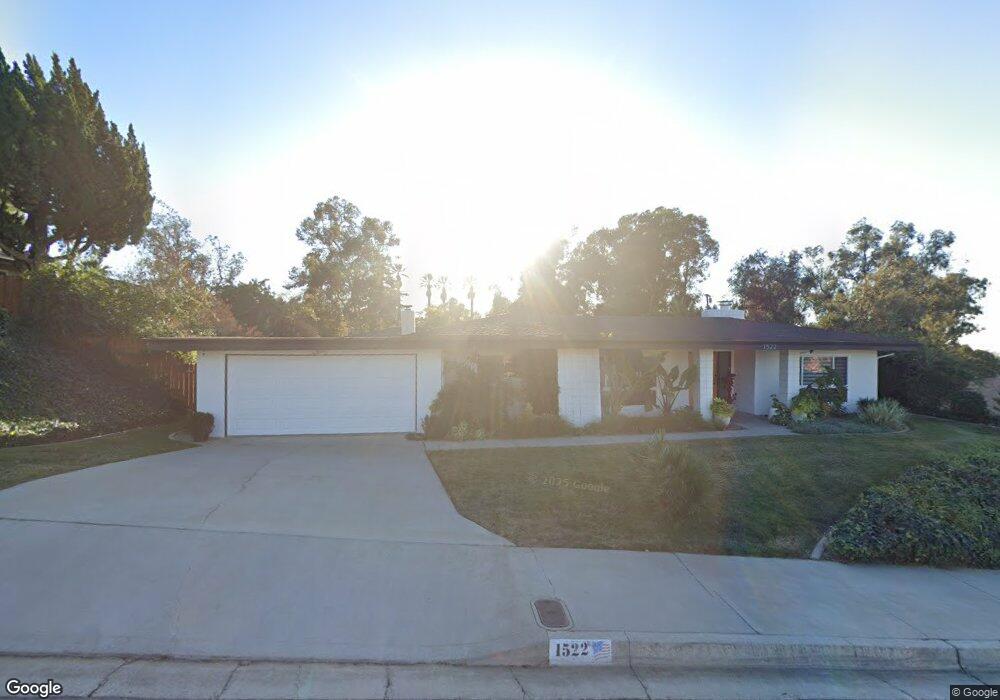

1522 Pamela Crescent Redlands, CA 92373

South Redlands NeighborhoodEstimated Value: $831,000 - $1,010,000

4

Beds

3

Baths

2,557

Sq Ft

$354/Sq Ft

Est. Value

About This Home

This home is located at 1522 Pamela Crescent, Redlands, CA 92373 and is currently estimated at $905,046, approximately $353 per square foot. 1522 Pamela Crescent is a home located in San Bernardino County with nearby schools including Mariposa Elementary School, Moore Middle School, and Redlands East Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2021

Sold by

Zimbro Kyle and Zimbro Adrienne

Bought by

Zimbro Kyle P and Zimbro Adrienne L

Current Estimated Value

Purchase Details

Closed on

Feb 21, 2020

Sold by

Waldum Michael C and Waldum Harold P

Bought by

Zimbro Kyle and Zimbro Adrienne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$492,000

Outstanding Balance

$433,956

Interest Rate

3.4%

Mortgage Type

New Conventional

Estimated Equity

$471,090

Purchase Details

Closed on

Aug 13, 1998

Sold by

Waldum Harold P and Waldum Renata R

Bought by

Waldum Harold F and Waldum Renata R

Purchase Details

Closed on

Mar 5, 1998

Sold by

Waldum Harold P and Waldum Renata R

Bought by

Waldum Harold P and Waldum Renata R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,600

Interest Rate

7.11%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zimbro Kyle P | -- | None Available | |

| Zimbro Kyle | $615,000 | Fidelity National Title Co | |

| Waldum Harold F | -- | -- | |

| Waldum Harold P | -- | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zimbro Kyle | $492,000 | |

| Previous Owner | Waldum Harold P | $52,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,792 | $672,592 | $196,856 | $475,736 |

| 2024 | $7,792 | $659,404 | $192,996 | $466,408 |

| 2023 | $7,783 | $646,475 | $189,212 | $457,263 |

| 2022 | $7,670 | $633,799 | $185,502 | $448,297 |

| 2021 | $7,810 | $621,372 | $181,865 | $439,507 |

| 2020 | $1,295 | $107,463 | $14,575 | $92,888 |

| 2019 | $1,258 | $105,356 | $14,289 | $91,067 |

| 2018 | $1,226 | $103,290 | $14,009 | $89,281 |

| 2017 | $1,214 | $101,264 | $13,734 | $87,530 |

| 2016 | $1,199 | $99,279 | $13,465 | $85,814 |

| 2015 | $1,189 | $97,788 | $13,263 | $84,525 |

| 2014 | $1,166 | $95,872 | $13,003 | $82,869 |

Source: Public Records

Map

Nearby Homes

- 1517 Pamela Crest

- 1435 Patricia Dr

- 446 E Sunset Dr N

- 505 E Sunset Dr N

- 435 Marilyn Ln

- 512 Golden Dr W

- 533 Via Vista Dr

- 1525 Lynne Ct

- 225 Sunset Dr

- 419 Marcia St

- 612 Golden Dr W

- 613 E Sunset Dr N

- 608 Via Vista Dr

- 620 E Sunset Dr N

- 0 Garden St Unit EV23054640

- 375 Franklin Ave

- 507 E Mariposa Dr

- 1705 Rossmont Dr

- 0 Ford St

- 1627 Halsey St

- 1522 Pamela Crest

- 1526 Pamela Crescent

- 1518 Pamela Crescent

- 1530 Pamela Crescent

- 1521 Pamela Crescent

- 409 E Sunset Dr N

- 1525 Pamela Crescent

- 1514 Pamela Crescent

- 1534 Pamela Crescent

- 1517 Pamela Crescent

- 1529 Pamela Crescent

- 1510 Pamela Crescent

- 0 Juanita Ln

- 1533 Pamela Crest

- 1538 Pamela Crescent

- 1533 Pamela Crescent

- 1513 Pamela Crescent

- 420 E Sunset Dr N

- 428 E Sunset Dr N

- 1509 Pamela Crescent