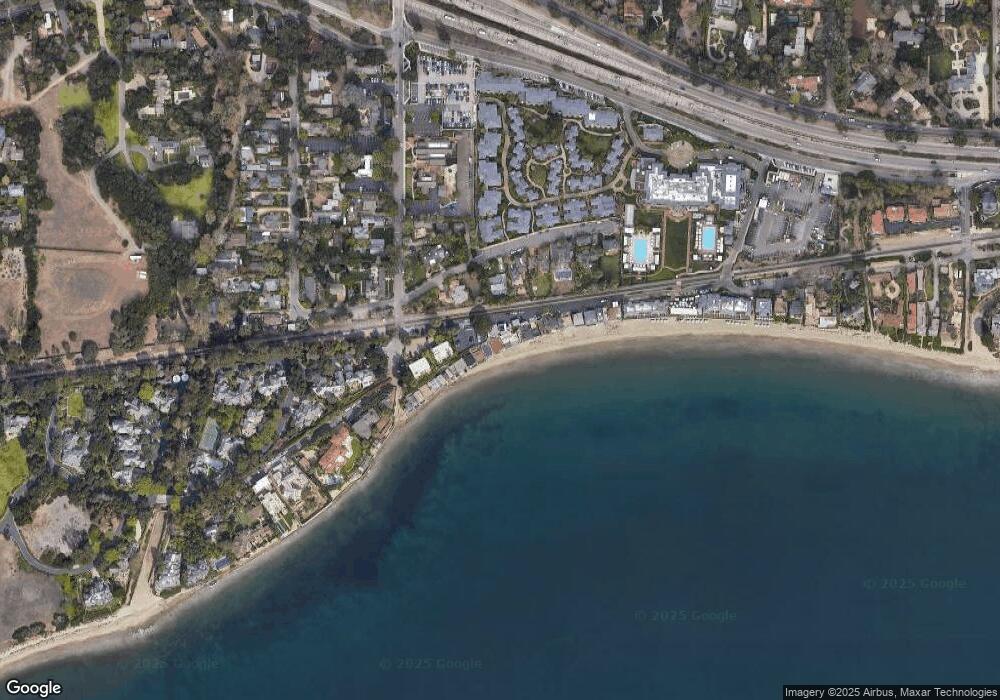

1528 Miramar Beach Unit B Montecito, CA 93108

Estimated Value: $4,529,000 - $5,416,000

2

Beds

2

Baths

1,160

Sq Ft

$4,410/Sq Ft

Est. Value

About This Home

This home is located at 1528 Miramar Beach Unit B, Montecito, CA 93108 and is currently estimated at $5,115,766, approximately $4,410 per square foot. 1528 Miramar Beach Unit B is a home located in Santa Barbara County with nearby schools including Santa Barbara Junior High School, Santa Barbara Senior High School, and Adelante Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2016

Sold by

Funk Jonathan E and Purcell Christine F

Bought by

Funk Family Llc

Current Estimated Value

Purchase Details

Closed on

Oct 21, 2015

Sold by

Freeman Newton W

Bought by

Funk Jonathan E and Purcell Christine F

Purchase Details

Closed on

Sep 21, 2015

Sold by

Bryn Mawr Trust Company Of Delaware

Bought by

Js Agoglia Llc

Purchase Details

Closed on

Sep 10, 2015

Sold by

Petry Gerard K

Bought by

Bryn Mawr Trust Company

Purchase Details

Closed on

Mar 30, 2015

Sold by

Funk Jonathan E and Purcell Christine F

Bought by

Funk Jonathan E and Purcell Christine F

Purchase Details

Closed on

Aug 25, 2014

Sold by

Agoglia Anthony I

Bought by

Agoglia John Steven and Agoglia Gayla

Purchase Details

Closed on

Oct 29, 2013

Sold by

Agoglia John J

Bought by

Agoglia Anthony T

Purchase Details

Closed on

Oct 18, 2013

Sold by

Agoglia John J

Bought by

Agoglia John J

Purchase Details

Closed on

Dec 19, 2012

Sold by

Frunk Robert Donald and Funk Ann Willrich

Bought by

Freeman Newton W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Funk Family Llc | -- | None Available | |

| Funk Jonathan E | -- | None Available | |

| Js Agoglia Llc | -- | None Available | |

| Bryn Mawr Trust Company | -- | None Available | |

| Funk Jonathan E | -- | None Available | |

| Agoglia John Steven | $594,500 | Chicago Title Company | |

| Agoglia Anthony T | -- | None Available | |

| Agoglia John J | -- | None Available | |

| Freeman Newton W | $630,000 | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $51,910 | $4,912,086 | $4,223,971 | $688,115 |

| 2023 | $51,910 | $2,127,678 | $1,551,909 | $575,769 |

| 2022 | $23,812 | $2,085,960 | $1,521,480 | $564,480 |

| 2021 | $23,350 | $2,045,060 | $1,491,648 | $553,412 |

| 2020 | $23,136 | $2,024,091 | $1,476,353 | $547,738 |

| 2019 | $22,718 | $1,984,404 | $1,447,405 | $536,999 |

| 2018 | $22,316 | $1,945,495 | $1,419,025 | $526,470 |

| 2017 | $21,827 | $1,907,349 | $1,391,201 | $516,148 |

| 2016 | $21,131 | $1,869,951 | $1,363,923 | $506,028 |

| 2015 | $20,590 | $1,841,863 | $1,343,436 | $498,427 |

| 2014 | $16,757 | $1,463,131 | $965,573 | $497,558 |

Source: Public Records

Map

Nearby Homes

- 1508 Miramar Beach

- 1647 Posilipo Ln Unit B

- 1623 Posilipo Ln

- 1630 N Jameson Ln

- 135 Pomar Ln

- 86 Seaview Dr

- 1520 Willina Ln

- 67 Seaview Dr

- 36 Seaview Dr

- 1301 Plaza de Sonadores

- 1301 Plaza Pacifica Unit 1

- 184 Tiburon Bay Ln

- 240 Miramar Ave

- 99 La Vuelta Rd

- 1445 School House Rd

- 1932 N Jameson Ln Unit B Ln Unit B

- 1932 N Jameson Ln Unit B

- 1399 School House Rd

- 1940 N Jameson Ln Unit A

- 1114 Hill Rd

- 1528 Miramar Beach Unit C

- 1526 Miramar Beach

- 1528 Miramar Beach #C

- 1528 Miramar Beach Unit B

- 1528 Miramar Beach Unit C

- 1530 Miramar Beach

- 1524 Miramar Beach

- 1522 Miramar Beach

- 1536 Miramar Beach

- 1520 Miramar Beach

- 1538 Miramar Beach

- 1540 Miramar Beach

- 1516 Miramar Beach

- 1542 Miramar Beach

- 1542 Miramar Beach Unit B

- 1514 Miramar Beach

- 1542 Miramar Beach Dr Unit B

- 22 Miramar Ave

- 1500 Miramar Beach Unit D

- 1512 Miramar Beach