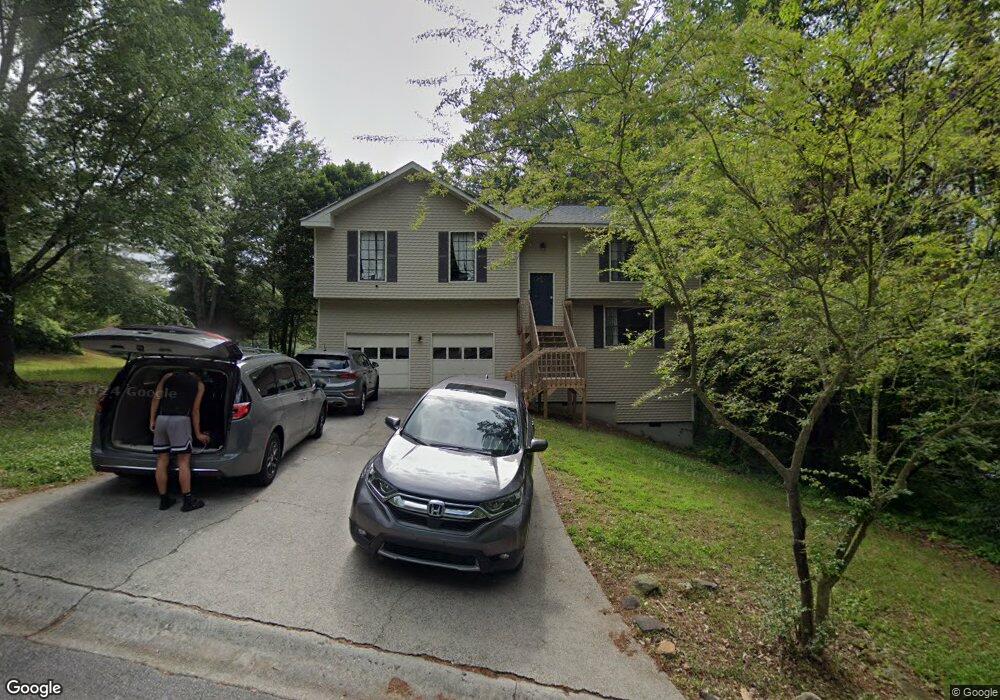

1531 Olde Mill Ct Unit 1 Marietta, GA 30066

Sandy Plains NeighborhoodEstimated Value: $358,000 - $393,187

3

Beds

3

Baths

1,312

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 1531 Olde Mill Ct Unit 1, Marietta, GA 30066 and is currently estimated at $376,547, approximately $287 per square foot. 1531 Olde Mill Ct Unit 1 is a home located in Cobb County with nearby schools including Keheley Elementary School, McCleskey Middle School, and The Garden School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2022

Sold by

Ervin Stephen D

Bought by

Sunstone Holdings Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$927,000

Outstanding Balance

$885,820

Interest Rate

5.78%

Mortgage Type

New Conventional

Estimated Equity

-$509,273

Purchase Details

Closed on

Jan 5, 2006

Sold by

Borg R Eric

Bought by

Ervin Stephen D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$17,200

Interest Rate

6.22%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Mar 24, 2000

Sold by

Tracyy James D and Tracyy Deborah A

Bought by

Martin Amy B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,846

Interest Rate

8.38%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 27, 1996

Sold by

Stephans Tracy William P

Bought by

Tracy James D Deborah A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sunstone Holdings Llc | -- | None Listed On Document | |

| Ervin Stephen D | $172,000 | -- | |

| Martin Amy B | $128,900 | -- | |

| Tracy James D Deborah A | $106,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sunstone Holdings Llc | $927,000 | |

| Previous Owner | Ervin Stephen D | $17,200 | |

| Previous Owner | Martin Amy B | $127,846 | |

| Closed | Tracy James D Deborah A | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,988 | $132,352 | $36,000 | $96,352 |

| 2024 | $4,331 | $143,640 | $34,800 | $108,840 |

| 2023 | $4,331 | $143,640 | $34,800 | $108,840 |

| 2022 | $2,908 | $95,828 | $25,200 | $70,628 |

| 2021 | $2,908 | $95,828 | $25,200 | $70,628 |

| 2020 | $2,527 | $83,260 | $25,200 | $58,060 |

| 2019 | $2,527 | $83,260 | $25,200 | $58,060 |

| 2018 | $2,527 | $83,260 | $25,200 | $58,060 |

| 2017 | $1,761 | $61,248 | $20,000 | $41,248 |

| 2016 | $1,761 | $61,248 | $20,000 | $41,248 |

| 2015 | $1,377 | $46,736 | $14,000 | $32,736 |

| 2014 | $1,389 | $46,736 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2899 Treeside Terrace

- 4791 Jamerson Forest Cir

- 4782 Jamerson Creek Ct

- 4941 Willow Ln

- 4680 Jamerson Forest Pkwy

- 1513 Jamerson Landing

- 1528 Forest Trace

- 4758 Jamerson Forest Cir

- 1634 Barrier Rd

- 4865 Chapelle Ct

- 4855 Rockford Ridge Dr

- 4924 Locklear Way

- 5009 Kingsley Manor Ct

- 4422 Inlet Rd

- 4413 Inlet Rd

- 1244 Hickory Wood Dr NE

- 1765 Blackwillow Dr

- 156 W Oaks Place

- 1511 Olde Mill Ct

- 1530 Olde Mill Ct

- 1520 Olde Mill Ct

- 1510 Olde Mill Ct

- 1501 Olde Mill Ct

- 1540 Olde Mill Ct Unit 1

- 1530 Olde Mill Place

- 1551 Olde Mill Ct

- 1550 Olde Mill Ct

- 4804 Olde Mill Dr

- 4816 Olde Mill Dr

- 1541 Olde Mill Place

- 1540 Olde Mill Place

- 1551 Olde Mill Place

- 4817 Olde Mill Dr

- 1550 Olde Mill Place

- 4820 Olde Mill Dr

- 4805 Olde Mill Dr Unit 1

- 1560 Olde Mill Place

- 4811 Olde Mill Dr Unit 1