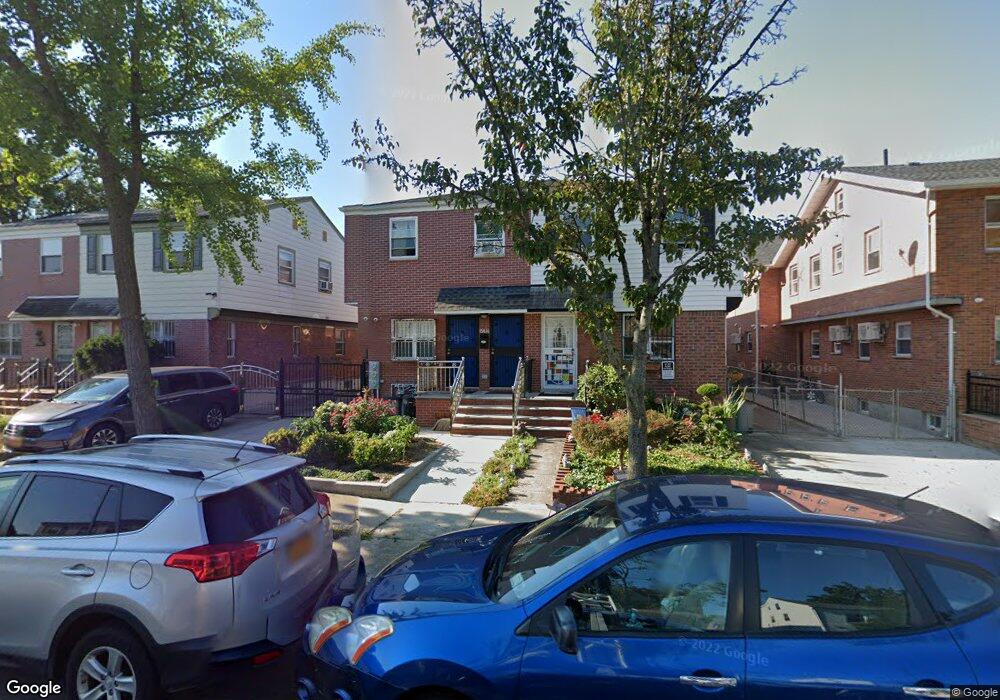

15436 58th Rd Flushing, NY 11355

Flushing NeighborhoodEstimated Value: $1,266,000 - $1,514,000

4

Beds

2

Baths

2,211

Sq Ft

$627/Sq Ft

Est. Value

About This Home

This home is located at 15436 58th Rd, Flushing, NY 11355 and is currently estimated at $1,385,694, approximately $626 per square foot. 15436 58th Rd is a home located in Queens County with nearby schools including Rachel Carson I.S. 237Q, Francis Lewis High School, and The Lowell School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2013

Sold by

Chan Kin Sun and Cheah Lai Seong

Bought by

Chen Ci Shan and Zhu Chun Ping

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,000

Outstanding Balance

$245,933

Interest Rate

4.29%

Mortgage Type

New Conventional

Estimated Equity

$1,139,761

Purchase Details

Closed on

Feb 7, 2005

Sold by

Suet Chan and Suet Chun

Bought by

Chan Kin Sun and Cheah Lai Seong

Purchase Details

Closed on

Aug 1, 2000

Sold by

Moy Chai Ming Fee and Moy Ho Geik

Bought by

Chu Suet Chun and Chan Kin Sun

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,700

Interest Rate

8.1%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 25, 1999

Sold by

Chiu Wei Chieh

Bought by

Moy Chai Ming Fee and Moy Ho Geik

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,200

Interest Rate

7.83%

Purchase Details

Closed on

Dec 9, 1998

Sold by

Chiu Wei Chieh and Yeh Shia Lan

Bought by

Chiu Wei Chieh

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chen Ci Shan | $600,000 | -- | |

| Chen Ci Shan | $600,000 | -- | |

| Chan Kin Sun | -- | -- | |

| Chan Kin Sun | -- | -- | |

| Chu Suet Chun | $229,000 | -- | |

| Chu Suet Chun | $229,000 | -- | |

| Moy Chai Ming Fee | $228,000 | -- | |

| Chai Ming Fee | $228,000 | -- | |

| Chiu Wei Chieh | -- | -- | |

| Chiu Wei Chieh | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chen Ci Shan | $330,000 | |

| Closed | Chen Ci Shan | $330,000 | |

| Previous Owner | Chu Suet Chun | $210,700 | |

| Previous Owner | Chai Ming Fee | $205,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,193 | $53,100 | $10,263 | $42,837 |

| 2024 | $10,193 | $50,748 | $9,860 | $40,888 |

| 2023 | $9,737 | $48,480 | $10,003 | $38,477 |

| 2022 | $9,350 | $82,380 | $17,580 | $64,800 |

| 2021 | $9,750 | $68,640 | $17,580 | $51,060 |

| 2020 | $9,366 | $59,040 | $17,580 | $41,460 |

| 2019 | $8,847 | $50,580 | $17,580 | $33,000 |

| 2018 | $7,359 | $36,100 | $13,973 | $22,127 |

| 2017 | $6,323 | $31,020 | $11,288 | $19,732 |

| 2016 | $6,116 | $31,020 | $11,288 | $19,732 |

| 2015 | $3,310 | $28,865 | $13,170 | $15,695 |

| 2014 | $3,310 | $27,232 | $13,135 | $14,097 |

Source: Public Records

Map

Nearby Homes

- 5728 Parsons Blvd Unit Front

- 57-19 Parsons Blvd

- 15308 58th Rd

- 153-51 Horace Harding Expy

- 5944 159th St

- 57-12 153rd St

- 159-08 59th Ave

- 15062 Booth Memorial Ave

- 154-39 64th Ave

- 160-12 Booth Memorial Ave

- 54-29 153rd St

- 6133 157th St

- 5423 153rd St

- 150-40 60th Ave

- 150-30 Booth Memorial Ave

- 54-25 152nd St

- 150-12 59th Ave

- 156-14 65th Ave

- 58-13 150th St

- 58-33 150th St