15475 Heron Dr Unit 134 San Leandro, CA 94579

Heron Bay NeighborhoodEstimated Value: $876,000 - $1,008,000

4

Beds

3

Baths

1,651

Sq Ft

$565/Sq Ft

Est. Value

About This Home

This home is located at 15475 Heron Dr Unit 134, San Leandro, CA 94579 and is currently estimated at $933,635, approximately $565 per square foot. 15475 Heron Dr Unit 134 is a home located in Alameda County with nearby schools including Madison Elementary School, John Muir Middle School, and San Leandro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2024

Sold by

Leung Hop Ming & Wing Fun Ching

Bought by

Wing Fun Ching Leung And Hop Ming Leung Revoc and Leung

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2012

Sold by

Leung Hop Ming and Ching Wing Fun

Bought by

Leung Hop Ming and Ching Wing Fun

Purchase Details

Closed on

Mar 13, 2000

Sold by

Bernal Cesario and Bernal Mari Lou

Bought by

Leung Hop Ming and Ching Wing Fun

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

8.34%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 27, 1998

Sold by

Financial Title Company

Bought by

Bernal Cesario and Bernal Mari Lou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,200

Interest Rate

7.17%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wing Fun Ching Leung And Hop Ming Leung Revoc | -- | None Listed On Document | |

| Leung Hop Ming | -- | None Available | |

| Leung Hop Ming | $340,000 | First American Title Guarant | |

| Bernal Cesario | $243,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leung Hop Ming | $250,000 | |

| Previous Owner | Bernal Cesario | $218,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,496 | $515,388 | $122,951 | $399,437 |

| 2024 | $7,496 | $505,146 | $120,540 | $391,606 |

| 2023 | $7,506 | $502,106 | $118,177 | $383,929 |

| 2022 | $7,090 | $485,262 | $115,860 | $376,402 |

| 2021 | $6,890 | $475,613 | $113,589 | $369,024 |

| 2020 | $6,722 | $477,667 | $112,425 | $365,242 |

| 2019 | $6,597 | $468,303 | $110,221 | $358,082 |

| 2018 | $6,410 | $459,122 | $108,060 | $351,062 |

| 2017 | $6,286 | $450,122 | $105,942 | $344,180 |

| 2016 | $5,963 | $441,298 | $103,865 | $337,433 |

| 2015 | $5,847 | $434,670 | $102,305 | $332,365 |

| 2014 | $5,802 | $426,155 | $100,301 | $325,854 |

Source: Public Records

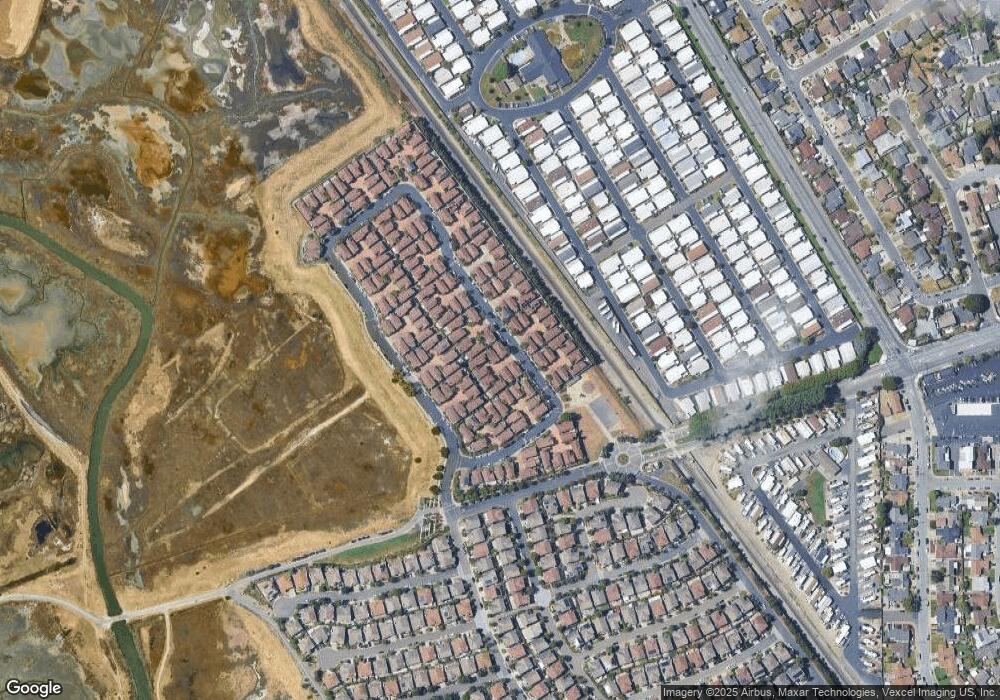

Map

Nearby Homes

- 2213 Wigeon Ct

- 362 Santa Paula

- 2218 Charter Way

- 440 Santa Monica

- 154 Santa Teresa

- 1950 Randy St

- 509 Santa Ynez

- 117 Santa Teresa

- 112 Santa Teresa

- 1562 Randy St

- 15771 Via Nueva

- 1781 Via Rancho

- 15382 Andover St

- 15102 Chapel Ct

- 1311 Hubbard Ave

- 15356 Sullivan Ave

- 1655 Via Escondido

- 15535 Sedgeman St

- 987 Via Bregani

- 1631 Via Ventana

- 2227 Raven Ct Unit 133

- 2235 Raven Ct Unit 132

- 2245 Raven Ct Unit 131

- 2248 Raven Ct Unit 130

- 2238 Raven Ct

- 2232 Raven Ct Unit 128

- 15477 Heron Dr Unit 127

- 15489 Tern Ct Unit 121

- 2245 Pipit Ct Unit 138

- 2248 Pipit Ct Unit 137

- 2238 Pipit Ct Unit 136

- 15471 Heron Dr Unit 135

- 15469 Heron Dr Unit 140

- 2235 Pipit Ct

- 15483 Heron Dr

- 15486 Tern Ct Unit 125

- 15488 Tern Ct Unit 124

- 15490 Tern Ct

- 15491 Tern Ct Unit 122

- 15487 Tern Ct Unit 120