1550 Big Bend Beaumont, CA 92223

Estimated Value: $453,000 - $498,666

2

Beds

2

Baths

1,848

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 1550 Big Bend, Beaumont, CA 92223 and is currently estimated at $477,667, approximately $258 per square foot. 1550 Big Bend is a home located in Riverside County with nearby schools including Palm Innovation Academy, San Gorgonio Middle School, and Beaumont Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 13, 2010

Sold by

Chase Home Finance Llc

Bought by

Federal Home Loan Mortgage Corp

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Partida Rita G and Partida Andrew L

Purchase Details

Closed on

Sep 23, 2010

Sold by

Palacio Regina C

Bought by

Chase Home Finance Llc

Purchase Details

Closed on

Jun 29, 2007

Sold by

K Hovnanians Four Seasons Beaumont Llc

Bought by

Palacio Regina C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,350

Interest Rate

7%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Federal Home Loan Mortgage Corp | -- | Accommodation | |

| Partida Rita G | $172,500 | Ticor Title | |

| Chase Home Finance Llc | $169,900 | Accommodation | |

| Palacio Regina C | $308,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Palacio Regina C | $246,350 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,177 | $220,983 | $64,049 | $156,934 |

| 2023 | $3,177 | $212,404 | $61,563 | $150,841 |

| 2022 | $3,094 | $208,240 | $60,356 | $147,884 |

| 2021 | $4,215 | $204,158 | $59,173 | $144,985 |

| 2020 | $4,316 | $202,066 | $58,567 | $143,499 |

| 2019 | $4,261 | $198,105 | $57,419 | $140,686 |

| 2018 | $4,241 | $194,222 | $56,294 | $137,928 |

| 2017 | $4,593 | $190,415 | $55,191 | $135,224 |

Source: Public Records

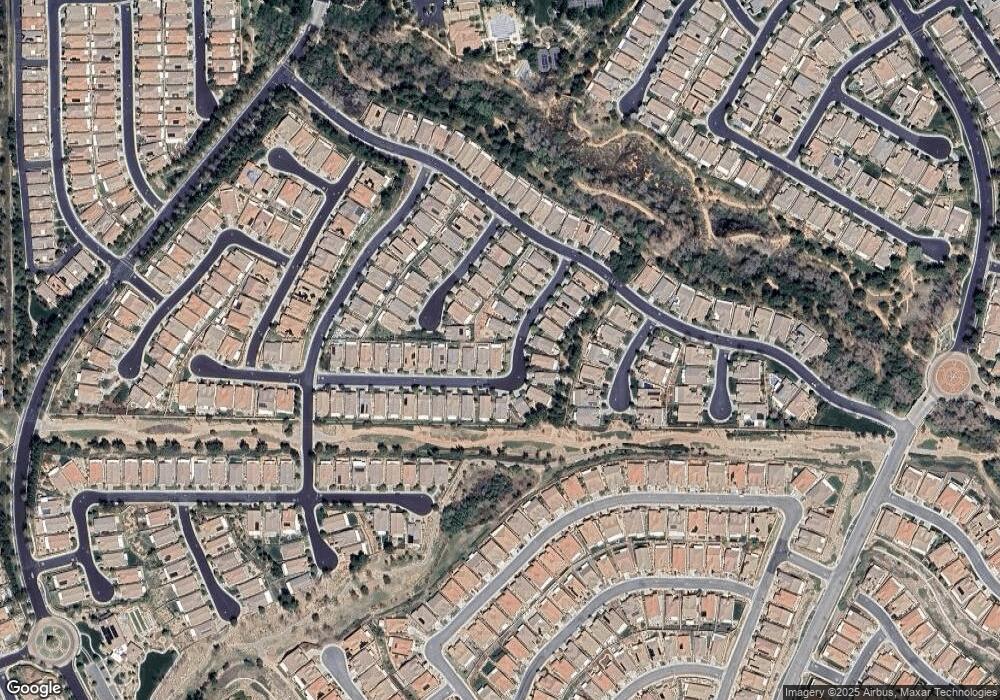

Map

Nearby Homes

- 1549 Big Bend

- 1533 Big Bend

- 1538 Green Creek Trail

- 1576 Timberline

- 1534 Green Creek Trail

- 1514 Green Creek Trail

- 186 Canary Creek

- 322 Forked Run

- 180 Kettle Creek

- 381 Nesting Bird

- 383 Song Bird

- 1518 Kylemore Way

- 283 White Sands St

- 1645 Beaver Creek Unit A

- 125 Slippery Rock Creek

- 1642 Beaver Creek

- 1596 Four Seasons Cir

- 1486 Signal Peak

- 1457 Faircliff St

- 428 Saddlerock

- 1548 Big Bend

- 1548 Big Bend

- 273 Kings Canyon

- 1546 Big Bend

- 1546 Big Bend

- 274 Kings Canyon

- 270 Kings Canyon

- 269 Kings Canyon

- 1551 Big Bend

- 1544 Big Bend

- 1551 Big Bend

- 1549 Big Bend

- 1544 Big Bend

- 278 Kings Canyon

- 1553 Big Bend

- 276 Bridle Trail

- 1555 Big Bend

- 1553 Big Bend

- 268 Kings Canyon

- 1547 Big Bend

Your Personal Tour Guide

Ask me questions while you tour the home.