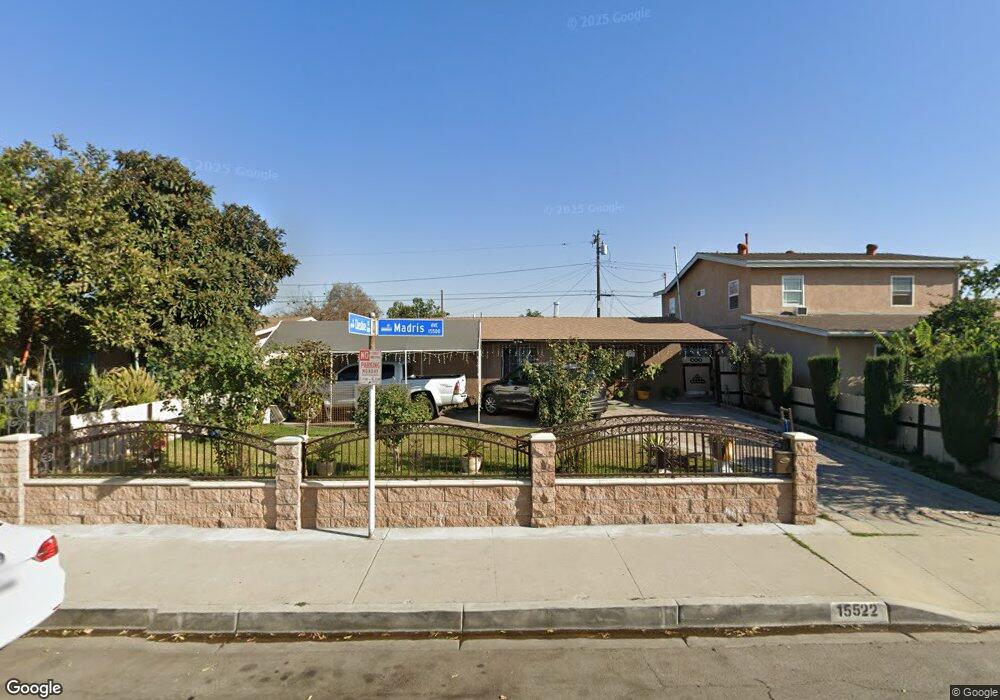

15522 Madris Ave Norwalk, CA 90650

Estimated Value: $632,000 - $718,000

3

Beds

1

Bath

956

Sq Ft

$699/Sq Ft

Est. Value

About This Home

This home is located at 15522 Madris Ave, Norwalk, CA 90650 and is currently estimated at $667,870, approximately $698 per square foot. 15522 Madris Ave is a home located in Los Angeles County with nearby schools including John Dolland Elementary School, Nettie L. Waite Middle School, and John H. Glenn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2006

Sold by

Ibarra Jose Jorge

Bought by

Ibarra Gloria L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Outstanding Balance

$98,420

Interest Rate

6.36%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$569,450

Purchase Details

Closed on

May 9, 2002

Sold by

Ibarra Jose Jorge

Bought by

Ibarra Gloria L

Purchase Details

Closed on

Jul 24, 1996

Sold by

Wilmington Trust Company

Bought by

Ibarra Jose Jorge and Ibarra Gloria L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,456

Interest Rate

8.32%

Mortgage Type

FHA

Purchase Details

Closed on

May 16, 1996

Sold by

Great Western Bank Fsb

Bought by

Wilmington Trust Company and Reo Property Trust 1996

Purchase Details

Closed on

Apr 5, 1996

Sold by

Reus Ireneo P and Reus Nicetas A

Bought by

Great Western Bank Fsb

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ibarra Gloria L | -- | Chicago Title | |

| Ibarra Gloria L | -- | -- | |

| Ibarra Jose Jorge | $105,000 | Fidelity National Title | |

| Wilmington Trust Company | -- | Fidelity National Title | |

| Great Western Bank Fsb | $80,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ibarra Gloria L | $165,000 | |

| Closed | Ibarra Jose Jorge | $104,456 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,504 | $170,983 | $132,561 | $38,422 |

| 2024 | $2,504 | $167,631 | $129,962 | $37,669 |

| 2023 | $2,427 | $164,345 | $127,414 | $36,931 |

| 2022 | $2,384 | $161,123 | $124,916 | $36,207 |

| 2021 | $2,347 | $157,965 | $122,467 | $35,498 |

| 2019 | $2,282 | $153,283 | $118,836 | $34,447 |

| 2018 | $2,144 | $150,278 | $116,506 | $33,772 |

| 2016 | $2,045 | $144,444 | $111,983 | $32,461 |

| 2015 | $2,024 | $142,275 | $110,301 | $31,974 |

| 2014 | $1,901 | $139,489 | $108,141 | $31,348 |

Source: Public Records

Map

Nearby Homes

- 15712 Madris Ave

- 15627 Belshire Ave

- 12167 Cheshire St

- 12157 Lowemont St

- 12139 Barnwall St

- 12512 Sandycreek Ln

- 16118 Rockyriver Ln

- 12038 Cheshire St

- 12028 Nava St

- 15312 Roper Ave

- 16329 Cherry Fall Ln

- 12121 163rd St

- 16308 Indian Creek Rd

- 14718 Ibex Ave

- 16429 Westbrook Ln

- 11864 Hayford St

- 16611 Shenandoah Ave

- 11871 162nd St

- 16442 Elaine Ave

- 12422 Cuesta Dr Unit 71

- 15516 Madris Ave

- 15526 Madris Ave

- 15519 Claretta Ave

- 15512 Madris Ave

- 15532 Madris Ave

- 15523 Claretta Ave

- 15513 Claretta Ave

- 15529 Claretta Ave

- 15509 Claretta Ave

- 12348 Cheshire St

- 15538 Madris Ave

- 15527 Madris Ave

- 15517 Madris Ave

- 15533 Claretta Ave

- 12362 Cheshire St

- 15533 Madris Ave

- 15511 Madris Ave

- 15602 Madris Ave

- 15537 Madris Ave

- 15603 Claretta Ave