1554 Matheson Rd Unit AB Concord, CA 94521

Heather Glen NeighborhoodEstimated Value: $521,355 - $846,000

1

Bed

1

Bath

630

Sq Ft

$1,078/Sq Ft

Est. Value

About This Home

This home is located at 1554 Matheson Rd Unit AB, Concord, CA 94521 and is currently estimated at $678,839, approximately $1,077 per square foot. 1554 Matheson Rd Unit AB is a home located in Contra Costa County with nearby schools including Silverwood Elementary School, Pine Hollow Middle School, and College Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2016

Sold by

Calhoun George and Calhoun Manuela

Bought by

The Calhoun Family Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,900

Outstanding Balance

$264,156

Interest Rate

3.57%

Mortgage Type

New Conventional

Estimated Equity

$414,683

Purchase Details

Closed on

Jun 30, 2015

Sold by

Calhoun George and Calhoun Manuela

Bought by

The Calhoun Family Trust

Purchase Details

Closed on

Dec 16, 2014

Sold by

Michael Glenn P and Westover Daena R

Bought by

Calhoun George Leroy and Calhoun Manuela A Torralba

Purchase Details

Closed on

Nov 23, 1998

Sold by

Decker Zed L and Decker Bruce L

Bought by

Michael Glenn P and Michael Shirley A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Interest Rate

6.69%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Calhoun Family Trust | -- | Old Republic Title Company | |

| Calhoun George | -- | Old Republic Title Company | |

| The Calhoun Family Trust | -- | None Available | |

| Calhoun George Leroy | $615,000 | Old Republic Title Company | |

| Michael Glenn P | $300,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Calhoun George | $331,900 | |

| Previous Owner | Michael Glenn P | $290,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,106 | $216,324 | $168,254 | $48,070 |

| 2024 | $3,979 | $212,083 | $164,955 | $47,128 |

| 2023 | $3,979 | $207,925 | $161,721 | $46,204 |

| 2022 | $3,873 | $203,849 | $158,550 | $45,299 |

| 2021 | $3,736 | $199,853 | $155,442 | $44,411 |

| 2019 | $3,630 | $193,928 | $150,833 | $43,095 |

| 2018 | $3,463 | $190,126 | $147,876 | $42,250 |

| 2017 | $3,310 | $186,399 | $144,977 | $41,422 |

| 2016 | $3,165 | $182,745 | $142,135 | $40,610 |

| 2015 | $1,526 | $42,576 | $33,632 | $8,944 |

| 2014 | $1,421 | $41,743 | $32,974 | $8,769 |

Source: Public Records

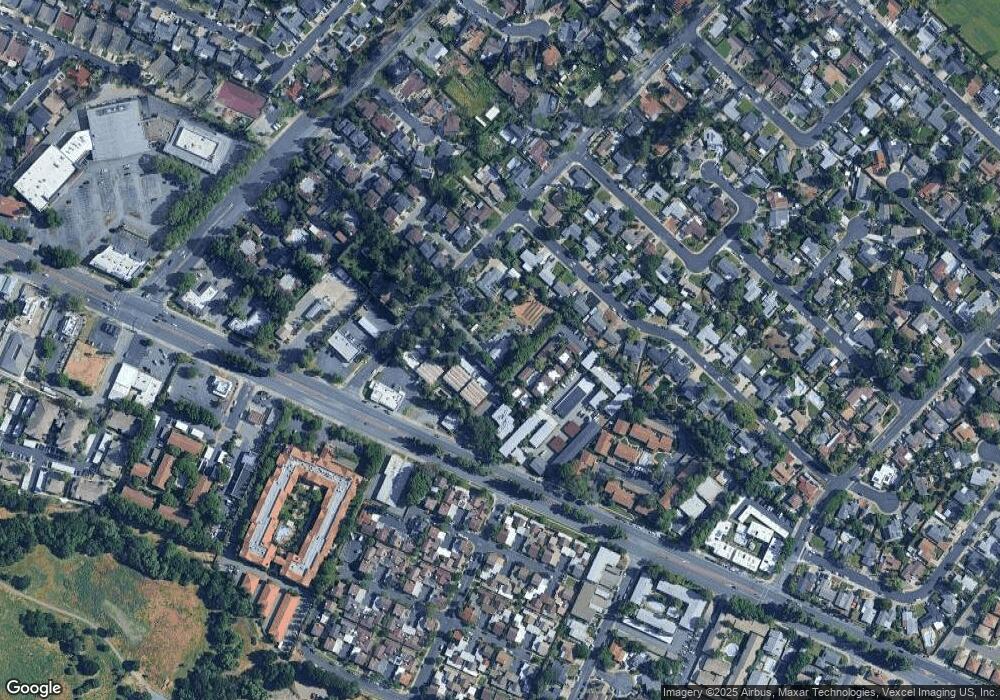

Map

Nearby Homes

- 1544 Bailey Rd Unit 30

- 1455 Latour Ln Unit 43

- 4839 Boxer Blvd

- 4888 Clayton Rd Unit 6

- 4719 Springwood Way

- 4655 Melody Dr Unit A

- 4632 Melody Dr Unit E

- 4944 Boxer Blvd

- 4656 Benbow Ct

- 1459 Wharton Way Unit C

- 5055 Valley Crest Dr Unit 196

- 1732 Elmhurst Ln

- 5050 Valley Crest Dr Unit 63

- 4398 N Canoe Birch Ct

- 5080 Valley Crest Dr Unit 32

- 4403 Winterberry Ct

- 1555 Ayers Rd

- 5091 Saint Celestine Ct

- 1591 Glazier Dr

- 1435 Bel Air Dr Unit C

- 1554 Matheson Rd Unit 8

- 1540 Matheson Rd

- 1572 Matheson Rd Unit 1574

- 1524 Matheson Rd

- 1524 Matheson Rd Unit 26

- 1524 Matheson Rd Unit 25

- 1524 Matheson Rd Unit 24

- 1524 Matheson Rd Unit 23

- 1524 Matheson Rd Unit 22

- 1524 Matheson Rd Unit 21

- 1524 Matheson Rd Unit 20

- 1524 Matheson Rd Unit 19

- 1524 Matheson Rd Unit 18

- 1524 Matheson Rd Unit 17

- 1524 Matheson Rd Unit 16

- 1524 Matheson Rd Unit 15

- 1524 Matheson Rd Unit 13

- 1524 Matheson Rd Unit 12

- 1524 Matheson Rd Unit 11

- 1524 Matheson Rd Unit 10