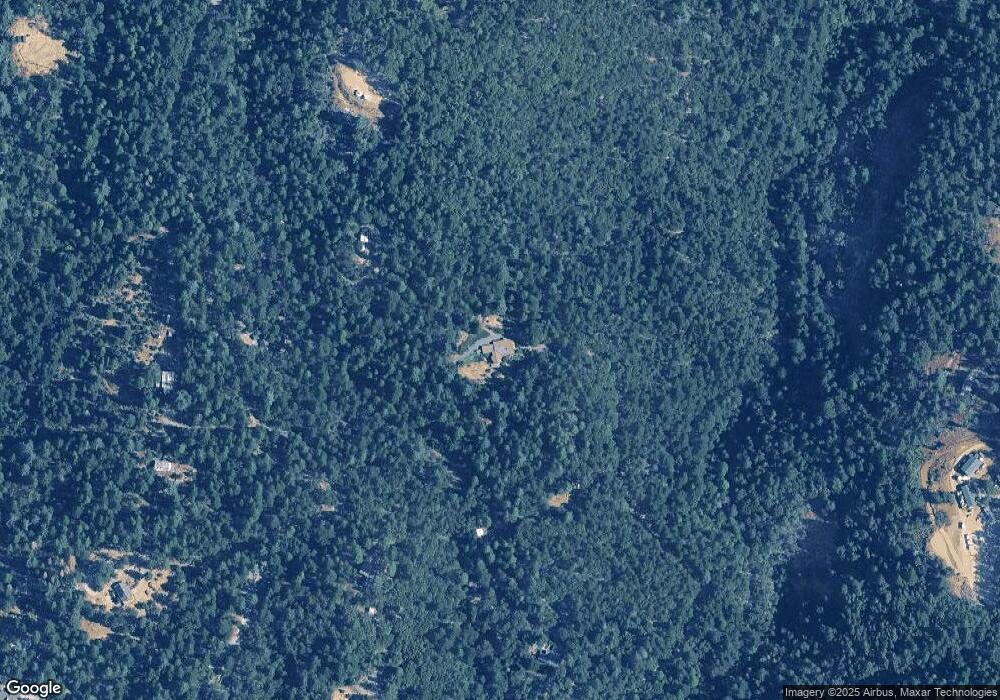

15594 Flying Cloud Dr Grass Valley, CA 95945

Estimated Value: $646,000 - $893,791

3

Beds

2

Baths

2,535

Sq Ft

$295/Sq Ft

Est. Value

About This Home

This home is located at 15594 Flying Cloud Dr, Grass Valley, CA 95945 and is currently estimated at $747,948, approximately $295 per square foot. 15594 Flying Cloud Dr is a home located in Nevada County with nearby schools including Bell Hill Academy, Margaret G. Scotten Elementary School, and Lyman Gilmore Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2002

Sold by

Lindauer Larry J and Lindauer Marilyn Becker

Bought by

Lindauer Larry J and Lindauer Marilyn Becker

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Outstanding Balance

$211,960

Interest Rate

6.71%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$535,988

Purchase Details

Closed on

Jan 25, 2002

Sold by

Fox Charles and Fox Keith George

Bought by

Lindauer Larry L and Lindauer Marilyn Becker

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

7.15%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 28, 2000

Sold by

Rose David M

Bought by

Fox Charles and Fox Keith George

Purchase Details

Closed on

Sep 29, 1999

Sold by

Rose David M and Morton David Morton

Bought by

The Lapointe Family Revocable Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lindauer Larry J | -- | Fidelity National Title Co | |

| Lindauer Larry L | $166,500 | Fidelity National Title Co | |

| Fox Charles | $150,000 | California Land Title Co | |

| The Lapointe Family Revocable Trust | $5,000 | California Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lindauer Larry J | $500,000 | |

| Closed | Lindauer Larry L | $200,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,670 | $716,655 | $245,957 | $470,698 |

| 2024 | $7,481 | $702,604 | $241,135 | $461,469 |

| 2023 | $7,481 | $688,828 | $236,407 | $452,421 |

| 2022 | $7,410 | $675,322 | $231,772 | $443,550 |

| 2021 | $7,228 | $662,081 | $227,228 | $434,853 |

| 2020 | $7,219 | $655,294 | $224,899 | $430,395 |

| 2019 | $6,920 | $642,446 | $220,490 | $421,956 |

| 2018 | $6,888 | $629,850 | $216,167 | $413,683 |

| 2017 | $6,614 | $617,501 | $211,929 | $405,572 |

| 2016 | $6,371 | $605,394 | $207,774 | $397,620 |

| 2015 | $6,279 | $596,302 | $204,654 | $391,648 |

| 2014 | $6,181 | $584,623 | $200,646 | $383,977 |

Source: Public Records

Map

Nearby Homes

- 0 Belle Star Rd

- 13928 Manion Canyon Rd

- 13787 Manion Canyon Rd

- 13625 Pegasus Place

- 13971 Ryans Ranch Rd

- 13712 Altair Dr

- 13558 Greenstone Ct

- 12595 Blackberry Trail

- 16805 Jones Ridge Rd

- 14752 Little Greenhorn Rd

- 16949 Jones Ridge Rd

- 13027 Robin Rd

- 13100 Banner Lava Cap Rd

- 13136 Woodstock Dr

- 13036 Capitol Dr

- 17631 Greenhorn Rd

- 12790 Madrone Forest Dr

- 14289 Banner Mtn Lookout Rd

- 14622 Banner Lava Cap Rd

- 18100 Greenhorn Rd

- 14373 Belle Starr Rd

- 14441 Belle Starr Rd

- 14320 Belle Star Rd

- 15768 Flying Cloud Dr

- 14446 Ott Way

- 15846 Coon Hollow Ct

- 16004 Greenhorn Rd

- 14496 Mill Creek Ln

- 15863 Coon Hollow Ct

- 15928 Greenhorn Rd

- 14360 Mill Creek Ln

- 16038 Flying Cloud Dr

- 14194 Belle Starr Rd

- 14242 Peaceful Pines Ct

- 14276 Mill Creek Ln

- 13816 Belle Star Rd

- 14040 Peaceful Pines Ct

- 16190 Greenhorn Rd

- 14594 Mill Creek Ln

- 14495 Mill Creek Ln

Your Personal Tour Guide

Ask me questions while you tour the home.