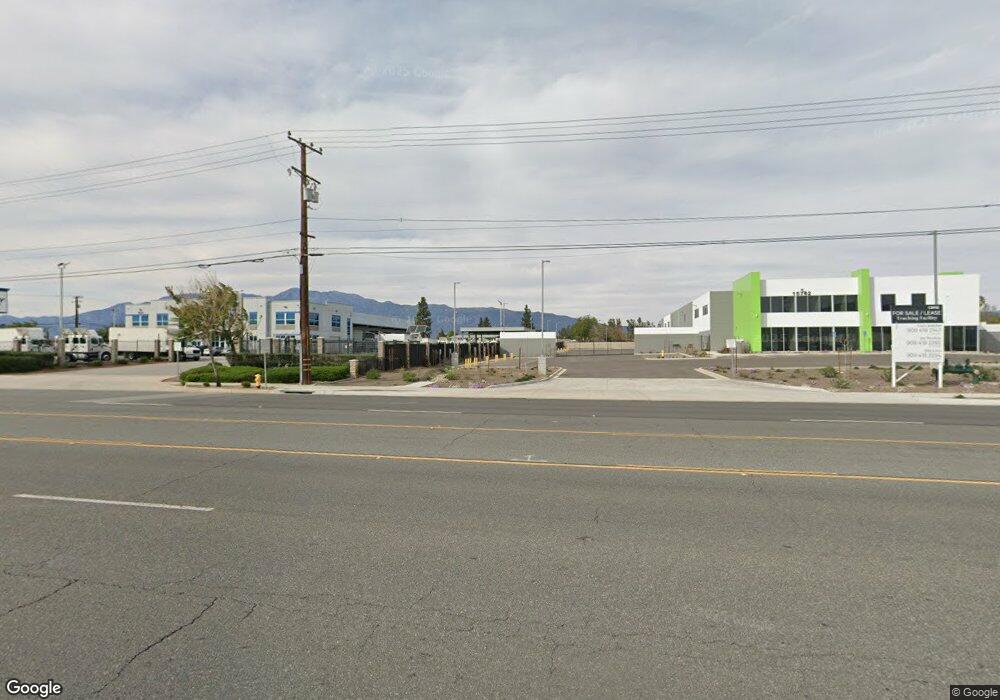

15762 Valley Blvd Fontana, CA 92335

Estimated Value: $17,463,514

--

Bed

--

Bath

30,660

Sq Ft

$570/Sq Ft

Est. Value

About This Home

This home is located at 15762 Valley Blvd, Fontana, CA 92335 and is currently estimated at $17,463,514, approximately $569 per square foot. 15762 Valley Blvd is a home located in San Bernardino County with nearby schools including Poplar Elementary School, Harry S. Truman Middle School, and Jurupa Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2021

Sold by

Pride Group Enterprises Llc

Bought by

Valley Boulevard Fontana Holding Corp

Current Estimated Value

Purchase Details

Closed on

Jan 29, 2021

Sold by

Ayala Holdings No 11 Llc

Bought by

Pride Group Enterprises Llc

Purchase Details

Closed on

Aug 21, 2017

Sold by

15770 Valley Blvd Llc

Bought by

Ayala Ralph G and The Ralph G Ayala Jr Family Tr

Purchase Details

Closed on

Jul 31, 2017

Sold by

Ayala Ralph G

Bought by

Ayala Holdings #11 Llc

Purchase Details

Closed on

Sep 10, 2008

Sold by

Ayala Ralph G

Bought by

15770 Valley Blvd Llc

Purchase Details

Closed on

Feb 15, 1994

Sold by

Ayala Ralph G

Bought by

Ayala Ralph G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valley Boulevard Fontana Holding Corp | -- | Accommodation | |

| Pride Group Enterprises Llc | $5,854,500 | First American Title | |

| Ayala Ralph G | -- | None Available | |

| Ayala Holdings #11 Llc | -- | None Available | |

| 15770 Valley Blvd Llc | -- | None Available | |

| Ayala Ralph G | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $136,576 | $17,047,059 | $6,337,059 | $10,710,000 |

| 2024 | $136,576 | $12,932,804 | $6,212,804 | $6,720,000 |

| 2023 | $63,924 | $6,090,984 | $6,090,984 | $0 |

| 2022 | $64,386 | $5,971,553 | $5,971,553 | $0 |

| 2021 | $5,547 | $512,702 | $382,554 | $130,148 |

| 2020 | $5,533 | $507,444 | $378,631 | $128,813 |

| 2019 | $5,365 | $497,494 | $371,207 | $126,287 |

| 2018 | $5,447 | $487,739 | $363,928 | $123,811 |

| 2017 | $5,417 | $478,175 | $356,792 | $121,383 |

| 2016 | $5,327 | $468,799 | $349,796 | $119,003 |

| 2015 | $5,259 | $461,757 | $344,542 | $117,215 |

| 2014 | $5,263 | $452,712 | $337,793 | $114,919 |

Source: Public Records

Map

Nearby Homes

- 15082 Valley Blvd

- 9963 Eugenia Ave

- 14770 Boyle Ave

- 9756 Elm Ave

- 15798 Slover Ave

- 15937 Manzanita Dr

- 10149 Oleander Ave

- 9831 Oleander Ave

- 15278 Boyle Ave

- 9828 Carob Ave

- 9408 Poplar Ave

- 15994 Sequoia Ave

- 17377 20 Valley Blvd

- 16448 Washington Dr

- 15162 Cambria St

- 9906 Cypress Ave

- 15939 Tyrol Dr

- 9850 Cypress Ave

- 9825 Chantry Ave

- 15240 Carob Ln

- 14336 Valley Blvd

- 16655 Valley Blvd

- 9970 Almeria Ave

- 9968 Almeria Ave

- 9972 Almeria Ave

- 15777 Valley Blvd

- 9968 Almeria Ct

- 10060 Poplar Ave

- 15697 Iris Dr

- 9966 Almeria Ave

- 9952 Almeria Ave

- 9974 Almeria Ave

- 9978 Almeria Ave

- 9982 Almeria Ave

- 9944 Almeria Ave

- 15685 Iris Dr

- 9986 Almeria Ave

- 9974 Poplar Ave

- 15673 Iris Dr

- 9936 Almeria Ave