Estimated Value: $208,000 - $234,000

4

Beds

2

Baths

1,678

Sq Ft

$131/Sq Ft

Est. Value

About This Home

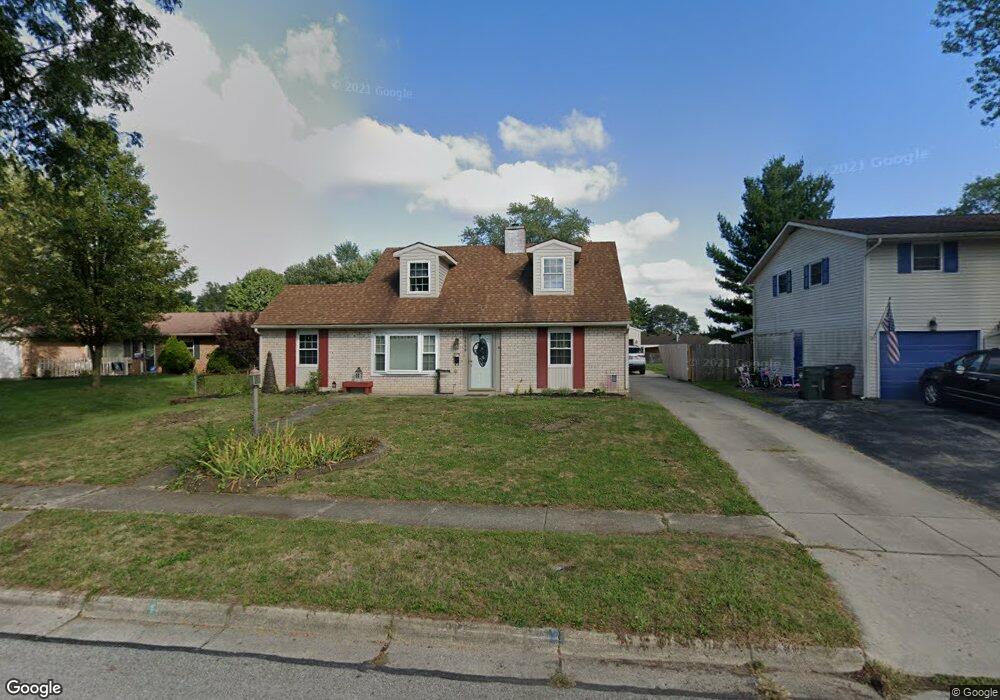

This home is located at 1580 N Texas Ct, Xenia, OH 45385 and is currently estimated at $219,062, approximately $130 per square foot. 1580 N Texas Ct is a home located in Greene County with nearby schools including Xenia High School and Summit Academy Community School for Alternative Learners - Xenia.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2025

Sold by

Erbaugh Josh

Bought by

Erbaugh Jessica

Current Estimated Value

Purchase Details

Closed on

Apr 8, 2019

Sold by

The Rmac Trust

Bought by

Erbaugh Josh and Erbaugh Jessica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,405

Interest Rate

4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 22, 2019

Sold by

Bruhn Vicky

Bought by

Us Bank Na and Rmac Trust

Purchase Details

Closed on

Mar 31, 2005

Sold by

Gabbard Henry and Gabbard Michelle G

Bought by

Bruhn Don and Bruhn Vicky

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,800

Interest Rate

5.62%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Erbaugh Jessica | -- | None Listed On Document | |

| Erbaugh Josh | $129,900 | Fidelity National Ttl Group | |

| Us Bank Na | $60,000 | Insight Title Company | |

| Bruhn Don | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Erbaugh Josh | $123,405 | |

| Previous Owner | Bruhn Don | $92,800 | |

| Closed | Bruhn Don | $23,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,500 | $58,430 | $12,080 | $46,350 |

| 2023 | $2,500 | $58,430 | $12,080 | $46,350 |

| 2022 | $2,109 | $42,040 | $7,110 | $34,930 |

| 2021 | $2,137 | $42,040 | $7,110 | $34,930 |

| 2020 | $2,048 | $42,040 | $7,110 | $34,930 |

| 2019 | $1,856 | $35,870 | $6,880 | $28,990 |

| 2018 | $1,863 | $35,870 | $6,880 | $28,990 |

| 2017 | $1,810 | $35,870 | $6,880 | $28,990 |

| 2016 | $1,732 | $32,720 | $6,880 | $25,840 |

| 2015 | $1,737 | $32,720 | $6,880 | $25,840 |

| 2014 | $1,663 | $32,720 | $6,880 | $25,840 |

Source: Public Records

Map

Nearby Homes

- 1403 Texas Dr

- 1769 Gayhart Dr

- 1829 Gayhart Dr

- 1778 Arapaho Dr

- 1653 Seneca Dr

- 1618 Navajo Dr

- 1908 Whitt St

- 1866 Roxbury Dr

- 1255 Colorado Dr

- 1107 Arkansas Dr

- 2142 Michigan Dr

- 2257 Maryland Dr

- 2758 Wyoming Dr

- 1568 Cheyenne Dr

- 1272 Bellbrook Ave

- 414 Whisper Ln

- 1208 Bellbrook Ave

- 2545 Harmony Dr

- 161 Montana Dr

- 219 Kansas Dr