15853 Fan Palm St Fontana, CA 92336

Citrus Heights NeighborhoodEstimated Value: $776,000 - $818,000

3

Beds

4

Baths

3,344

Sq Ft

$241/Sq Ft

Est. Value

About This Home

This home is located at 15853 Fan Palm St, Fontana, CA 92336 and is currently estimated at $804,671, approximately $240 per square foot. 15853 Fan Palm St is a home located in San Bernardino County with nearby schools including Sierra Lakes Elementary School, Wayne Ruble Middle School, and Summit High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2009

Sold by

Sc Fontana Development Corporation

Bought by

Richmond American Homes Of California In

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$397,406

Outstanding Balance

$260,523

Interest Rate

5.97%

Mortgage Type

VA

Estimated Equity

$544,148

Purchase Details

Closed on

Dec 17, 2008

Sold by

Richmond American Homes Of Maryland Inc

Bought by

Varela Paul A and Varela Cheryln C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$397,406

Outstanding Balance

$260,523

Interest Rate

5.97%

Mortgage Type

VA

Estimated Equity

$544,148

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richmond American Homes Of California In | -- | Chicago Title Company | |

| Varela Paul A | $397,500 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Varela Paul A | $397,406 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,102 | $511,768 | $98,516 | $413,252 |

| 2024 | $8,102 | $501,733 | $96,584 | $405,149 |

| 2023 | $7,587 | $491,895 | $94,690 | $397,205 |

| 2022 | $7,639 | $482,250 | $92,833 | $389,417 |

| 2021 | $7,581 | $472,794 | $91,013 | $381,781 |

| 2020 | $7,588 | $467,946 | $90,080 | $377,866 |

| 2019 | $7,492 | $458,771 | $88,314 | $370,457 |

| 2018 | $7,548 | $449,775 | $86,582 | $363,193 |

| 2017 | $7,516 | $440,956 | $84,884 | $356,072 |

| 2016 | $7,440 | $432,310 | $83,220 | $349,090 |

| 2015 | $7,368 | $425,816 | $81,970 | $343,846 |

| 2014 | $7,345 | $417,475 | $80,364 | $337,111 |

Source: Public Records

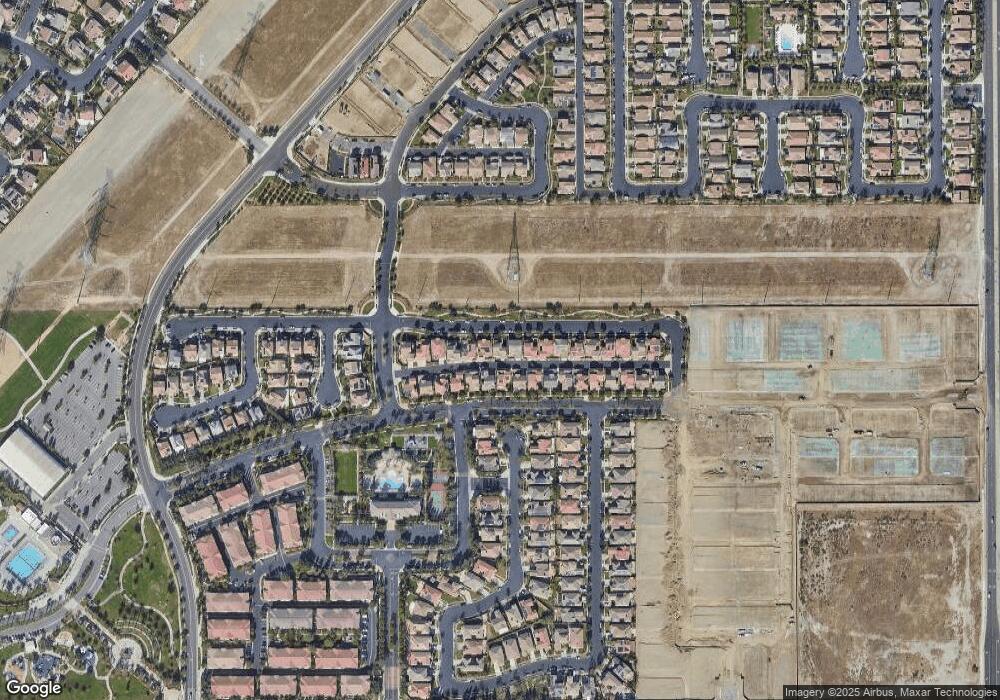

Map

Nearby Homes

- 5611 Scharf Ave

- 15992 Jamie Ln Unit 8

- 5662 Galasso Ave

- 16052 Montenegro Ln

- 15723 Parkhouse Dr Unit 59

- 15723 Parkhouse Dr Unit 6

- 15723 Parkhouse Dr Unit 97

- 15723 Parkhouse Dr Unit 40

- 15723 Parkhouse Dr Unit 105

- 16054 Montenegro Ln

- 16079 Montenegro Ln

- Residence 1650 Plan at Citrus & Summit

- Residence 1914 Plan at Citrus & Summit

- Residence 1805 Plan at Citrus & Summit

- 16056 Montenegro Ln

- 16051 Montenegro Ln

- 5381 Campania Way

- 5604 Altamura Way Unit 8

- 5264 Darwin Ln

- 5604 Altamura Way Unit 11

- 15847 Fan Palm St

- 15861 Fan Palm St

- 15839 Fan Palm St

- 15869 Fan Palm St

- 15852 Parkhouse Dr

- 15846 Parkhouse Dr

- 15838 Parkhouse Dr

- 15831 Fan Palm St

- 15877 Fan Palm St

- 15870 Parkhouse Dr

- 15830 Parkhouse Dr

- 15876 Parkhouse Dr

- 15823 Fan Palm St

- 15885 Fan Palm St

- 15822 Parkhouse Dr

- 15884 Parkhouse Dr

- 15817 Fan Palm St

- 15893 Fan Palm St

- 15814 Parkhouse Dr