159 Gold Tree Way Hayward, CA 94544

Whitman-Wocine NeighborhoodEstimated Value: $1,167,702 - $1,348,000

5

Beds

3

Baths

2,360

Sq Ft

$547/Sq Ft

Est. Value

About This Home

This home is located at 159 Gold Tree Way, Hayward, CA 94544 and is currently estimated at $1,291,676, approximately $547 per square foot. 159 Gold Tree Way is a home located in Alameda County with nearby schools including Tyrrell Elementary School, Cesar Chavez Middle School, and Tennyson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2011

Sold by

Ali Naushad S

Bought by

Conradd Aiysa Bibi Ismail Eafrozman

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2005

Sold by

Ismail Aiysa B and Conradd Afrozan

Bought by

Ismail Aiysa B and Conradd Afrozan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

1%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Sep 4, 2003

Sold by

Castaneda Robert L and Ho Castaneda Van H

Bought by

Ismail Aiysa B and Conradd Afrozan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,000

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 1, 2000

Sold by

First American Title Guaranty Company

Bought by

Castaneda Robert L and Ho Castaneda Van H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

7.67%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Conradd Aiysa Bibi Ismail Eafrozman | -- | None Available | |

| Ismail Aiysa B | -- | Chicago Title Co | |

| Ismail Aiysa B | $580,000 | Chicago Title Company | |

| Castaneda Robert L | $508,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ismail Aiysa B | $650,000 | |

| Previous Owner | Ismail Aiysa B | $464,000 | |

| Previous Owner | Castaneda Robert L | $400,000 | |

| Closed | Castaneda Robert L | $75,000 | |

| Closed | Ismail Aiysa B | $116,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,958 | $739,170 | $223,851 | $522,319 |

| 2024 | $8,958 | $724,544 | $219,463 | $512,081 |

| 2023 | $8,823 | $717,201 | $215,160 | $502,041 |

| 2022 | $8,649 | $696,140 | $210,942 | $492,198 |

| 2021 | $8,578 | $682,357 | $206,807 | $482,550 |

| 2020 | $8,482 | $682,292 | $204,687 | $477,605 |

| 2019 | $8,550 | $668,915 | $200,674 | $468,241 |

| 2018 | $8,016 | $655,801 | $196,740 | $459,061 |

| 2017 | $7,827 | $642,944 | $192,883 | $450,061 |

| 2016 | $7,388 | $630,337 | $189,101 | $441,236 |

| 2015 | $7,237 | $620,870 | $186,261 | $434,609 |

| 2014 | $6,609 | $585,000 | $175,500 | $409,500 |

Source: Public Records

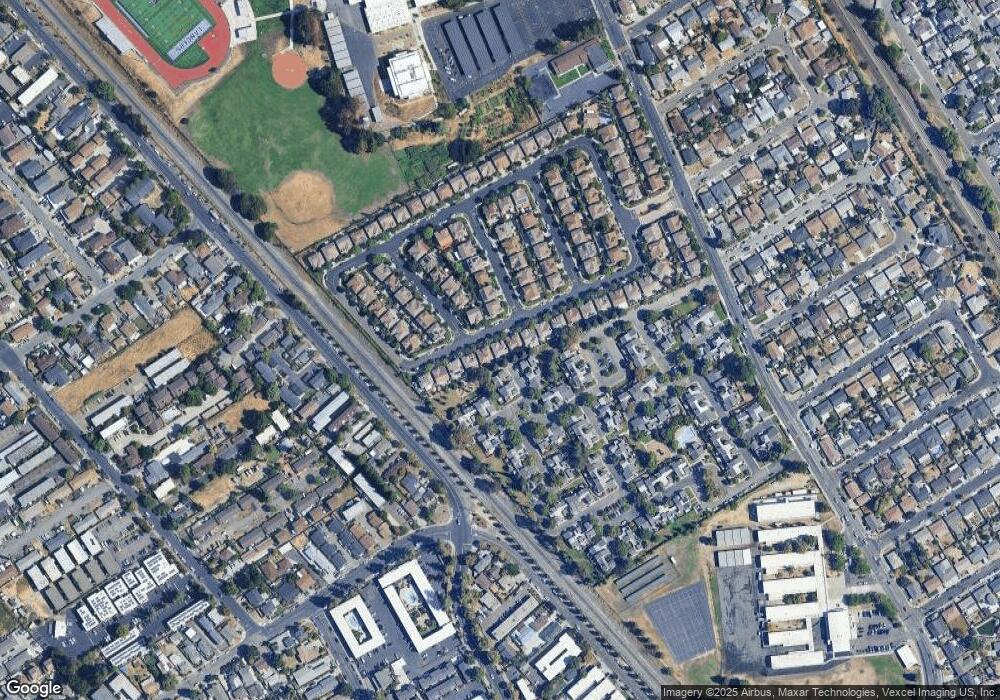

Map

Nearby Homes

- 27639 Eucalyptus Ct

- 27418 Susan Place Unit 3

- 28974 Parkwood Ln Unit 72

- 357 White Dr

- 28030 E 10th St

- 28222 Lustig Ct

- 250 Schafer Rd

- Plan 1 at Fusion - Townhomes

- Plan 5-Alt at Fusion - Live-Work Homes

- Plan 5 at Fusion - Live-Work Homes

- Plan 6 at Fusion - Live-Work Homes

- Plan 2 at Fusion - Townhomes

- Plan 3 at Fusion - Townhomes

- Plan 4 at Fusion - Townhomes

- 28315 Rochelle Ave

- 725 Auburn Place Unit 106

- 41 Astrida Dr Unit 9

- 32 Astrida Dr Unit 2

- 444 Schafer Rd Unit 2

- 399 Schafer Rd

- 151 Gold Tree Way

- 167 Gold Tree Way

- 27640 Eucalyptus Ct

- 143 Gold Tree Way

- 175 Gold Tree Way

- 27647 Eucalyptus Ct

- 27648 Eucalyptus Ct

- 27489 Mangrove Rd

- 154 Gold Tree Way

- 205 Gold Tree Way

- 135 Gold Tree Way

- 27666 Eucalyptus Ct

- 27475 Mangrove Rd

- 94 Cassia Dr

- 27460 Green Hazel Rd

- 127 Gold Tree Way

- 27487 Green Hazel Rd

- 213 Gold Tree Way

- 27490 Mangrove Rd

- 27659 Persimmon Dr