159 SW Florence Ave Unit 36 Gresham, OR 97080

Hollybrook NeighborhoodEstimated Value: $224,000 - $242,000

2

Beds

1

Bath

904

Sq Ft

$258/Sq Ft

Est. Value

About This Home

This home is located at 159 SW Florence Ave Unit 36, Gresham, OR 97080 and is currently estimated at $233,613, approximately $258 per square foot. 159 SW Florence Ave Unit 36 is a home located in Multnomah County with nearby schools including Dexter McCarty Middle School, Gresham High School, and Gresham Arthur Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2015

Sold by

Parsley Cyrus Dean

Bought by

Heath Marsha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,950

Outstanding Balance

$58,010

Interest Rate

3.81%

Mortgage Type

New Conventional

Estimated Equity

$175,603

Purchase Details

Closed on

May 18, 2010

Sold by

Thompson Jean C

Bought by

Parsley Cyrus Dean

Purchase Details

Closed on

Apr 19, 1995

Sold by

Florence Terrace Investors Ltd Prtnrshp

Bought by

Thompson Jean C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,600

Interest Rate

8.77%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Heath Marsha | $124,950 | First American | |

| Parsley Cyrus Dean | $116,950 | First American | |

| Thompson Jean C | $64,900 | Oregon Title Insurance Compa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Heath Marsha | $74,950 | |

| Previous Owner | Thompson Jean C | $45,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,443 | $120,050 | -- | $120,050 |

| 2024 | $2,339 | $116,560 | -- | $116,560 |

| 2023 | $2,339 | $113,170 | -- | $113,170 |

| 2022 | $2,071 | $109,880 | $0 | $0 |

| 2021 | $2,019 | $106,680 | $0 | $0 |

| 2020 | $1,900 | $103,580 | $0 | $0 |

| 2019 | $1,850 | $100,570 | $0 | $0 |

| 2018 | $1,764 | $97,650 | $0 | $0 |

| 2017 | $1,693 | $94,810 | $0 | $0 |

| 2016 | $1,493 | $92,050 | $0 | $0 |

| 2015 | $1,460 | $89,370 | $0 | $0 |

| 2014 | $1,377 | $86,240 | $0 | $0 |

Source: Public Records

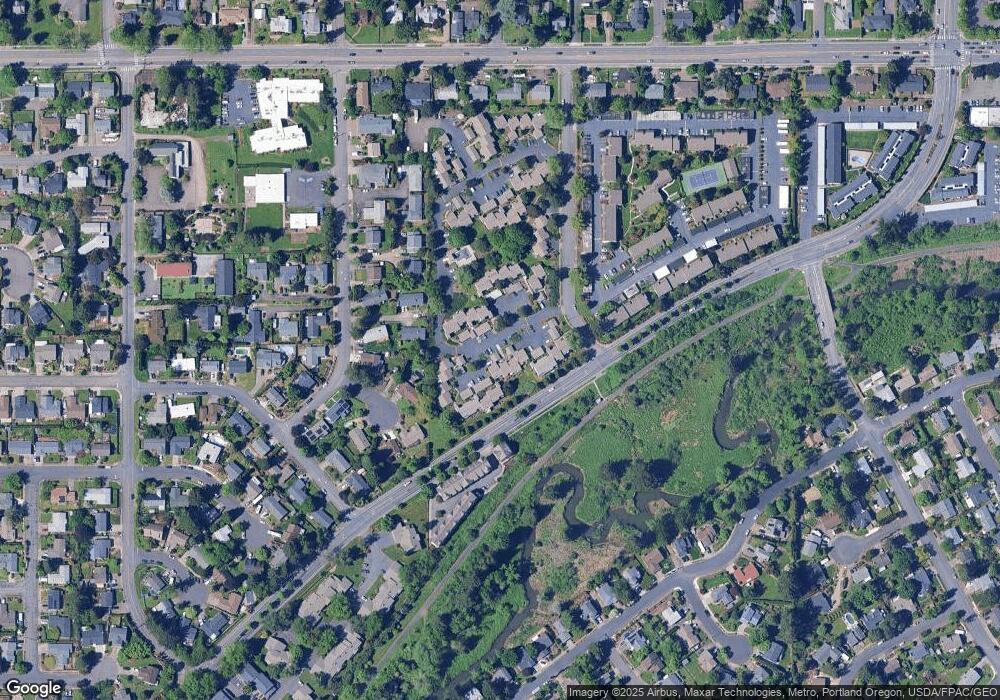

Map

Nearby Homes

- 159 SW Florence Ave Unit 64

- 159 SW Florence Ave

- 200 SW Florence Ave Unit C6

- 200 SW Florence Ave Unit D15

- 1113 W Powell Blvd

- 512 SW Eastman Pkwy Unit 13

- 638 SW 7th St

- 317 SW Angeline Ave

- 625 SW Miller Ct

- 994 NW Wallula Ave

- 1745 NW 7th Place

- 2360 NW 3rd St

- 0 NE 5th St

- 256 NW Mawrcrest Ave

- 272 NW Mawrcrest Ave

- 21 NW Mawrcrest Ave

- 284 NW Mawrcrest Ave

- 296 NW Mawrcrest Ave

- 63 NW Mawrcrest Ave

- 85 NW Mawrcrest Ave

- 159 SW Florence Ave Unit B6

- 159 SW Florence Ave Unit B9

- 159 SW Florence Ave Unit B8

- 159 SW Florence Ave Unit B7

- 159 SW Florence Ave Unit 30

- 159 SW Florence Ave Unit 18

- 159 SW Florence Ave Unit 78

- 159 SW Florence Ave Unit 77

- 159 SW Florence Ave Unit 76

- 159 SW Florence Ave Unit 75

- 159 SW Florence Ave Unit 74

- 159 SW Florence Ave Unit 73

- 159 SW Florence Ave Unit 72

- 159 SW Florence Ave Unit 71

- 159 SW Florence Ave Unit 70

- 159 SW Florence Ave Unit 69

- 159 SW Florence Ave Unit 68

- 159 SW Florence Ave Unit 66

- 159 SW Florence Ave Unit 65

- 159 SW Florence Ave Unit 63