1590 Via Chaparral Fallbrook, CA 92028

Estimated Value: $1,508,531 - $2,350,000

5

Beds

4

Baths

3,483

Sq Ft

$500/Sq Ft

Est. Value

About This Home

This home is located at 1590 Via Chaparral, Fallbrook, CA 92028 and is currently estimated at $1,740,383, approximately $499 per square foot. 1590 Via Chaparral is a home located in San Diego County with nearby schools including Live Oak Elementary School, James E. Potter Intermediate School, and Fallbrook High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2016

Sold by

Millen Scott and Millen Carol

Bought by

Millen Scott R and Millen Carol A

Current Estimated Value

Purchase Details

Closed on

Jun 14, 1999

Sold by

Grindle Lincoln & Betty P Trs

Bought by

Millen Scott and Yen Carol

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$442,500

Interest Rate

7.01%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 10, 1983

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Millen Scott R | -- | None Available | |

| Millen Scott | $567,500 | Chicago Title Co | |

| -- | $485,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Millen Scott | $442,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,524 | $883,392 | $332,057 | $551,335 |

| 2024 | $9,524 | $866,072 | $325,547 | $540,525 |

| 2023 | $9,232 | $849,091 | $319,164 | $529,927 |

| 2022 | $9,235 | $832,443 | $312,906 | $519,537 |

| 2021 | $8,932 | $816,121 | $306,771 | $509,350 |

| 2020 | $8,798 | $807,754 | $303,626 | $504,128 |

| 2019 | $8,624 | $791,917 | $297,673 | $494,244 |

| 2018 | $8,493 | $776,390 | $291,837 | $484,553 |

| 2017 | $8,327 | $761,167 | $286,115 | $475,052 |

| 2016 | $8,121 | $746,243 | $280,505 | $465,738 |

| 2015 | $7,993 | $735,035 | $276,292 | $458,743 |

| 2014 | $7,840 | $720,637 | $270,880 | $449,757 |

Source: Public Records

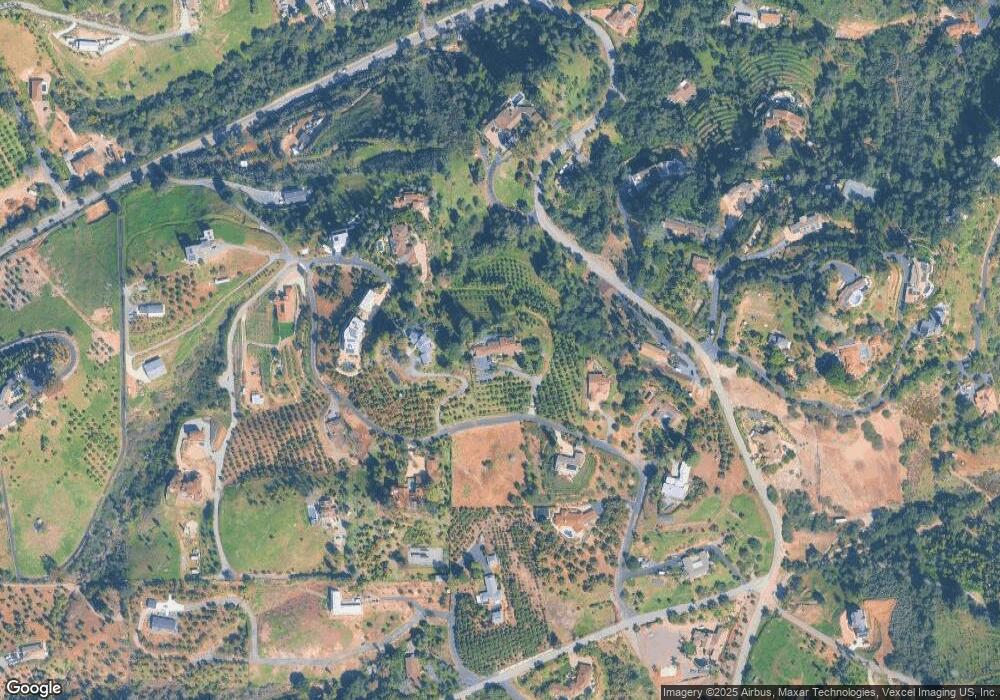

Map

Nearby Homes

- 1482 Wilt Rd

- 1409 Tecalote Dr

- 3770 Peony Dr Unit 20

- 3909 Reche Rd Unit 112

- 3909 Reche Rd Unit 157

- 3909 Reche Rd Unit 117

- 3909 Reche Rd Unit 118

- 3909 Reche Rd Unit 141

- 3352 Via Zara

- 3129 Reche Rd

- 1691 Tecalote Dr

- 35555 Orchard Trail

- 1718 Tecalote Dr Unit 14

- 2125 Puerto Del Mundo

- 0 Lupine Ln

- 3655 Lupine Ln

- 725 Yucca Rd

- 2925 Los Alisos Dr

- 4023 Pala Mesa Oaks Dr Unit 25

- 1861 Fox Bridge Ct

- 1580 Via Chaparral

- 1620 Via Chaparral

- 1514 Via Chaparral

- 1605 Via Chaparral

- 1615 Wilt Rd

- 1520 Via Chaparral

- 1510 Via Chaparral

- 1632 Via Chaparral

- 1549 Via Chaparral

- 1575 Via Chaparral

- 1657 Via Chaparral

- 1604 Wilt Rd

- 1504 Via Chaparral Unit 38

- 1504 Via Chaparral

- 1562 Wilt Rd

- 1608 Wilt Rd

- 1650 Via Chaparral

- 00 Dos Ninos Rd

- 0 Dos Ninos Rd

- 0 Dos Ninos Rd Unit NDP2102195