15990 Shedd Rd Middlefield, OH 44062

Estimated Value: $262,000 - $340,000

4

Beds

1

Bath

1,044

Sq Ft

$286/Sq Ft

Est. Value

About This Home

This home is located at 15990 Shedd Rd, Middlefield, OH 44062 and is currently estimated at $298,325, approximately $285 per square foot. 15990 Shedd Rd is a home located in Geauga County with nearby schools including Jordak Elementary School, Cardinal Middle School, and Cardinal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2018

Sold by

Yoder Joseph Alan and Yoder Maria

Bought by

Miller Wayne P and Yoder Miriam

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,000

Outstanding Balance

$131,315

Interest Rate

5.16%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$167,010

Purchase Details

Closed on

Jul 23, 2013

Sold by

Wenger Steven

Bought by

Yoder Joseph Alan and Yoder Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,673

Interest Rate

4.02%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Wayne P | $185,000 | None Available | |

| Yoder Joseph Alan | $148,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller Wayne P | $148,000 | |

| Previous Owner | Yoder Joseph Alan | $118,673 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,448 | $81,410 | $22,750 | $58,660 |

| 2023 | $3,448 | $81,410 | $22,750 | $58,660 |

| 2022 | $3,311 | $65,350 | $18,970 | $46,380 |

| 2021 | $3,302 | $65,350 | $18,970 | $46,380 |

| 2020 | $3,400 | $65,350 | $18,970 | $46,380 |

| 2019 | $3,390 | $60,030 | $18,970 | $41,060 |

| 2018 | $3,378 | $60,030 | $18,970 | $41,060 |

| 2017 | $3,229 | $60,030 | $18,970 | $41,060 |

| 2016 | $2,777 | $59,150 | $22,400 | $36,750 |

| 2015 | $2,505 | $59,150 | $22,400 | $36,750 |

| 2014 | $2,505 | $59,150 | $22,400 | $36,750 |

| 2013 | $2,522 | $59,150 | $22,400 | $36,750 |

Source: Public Records

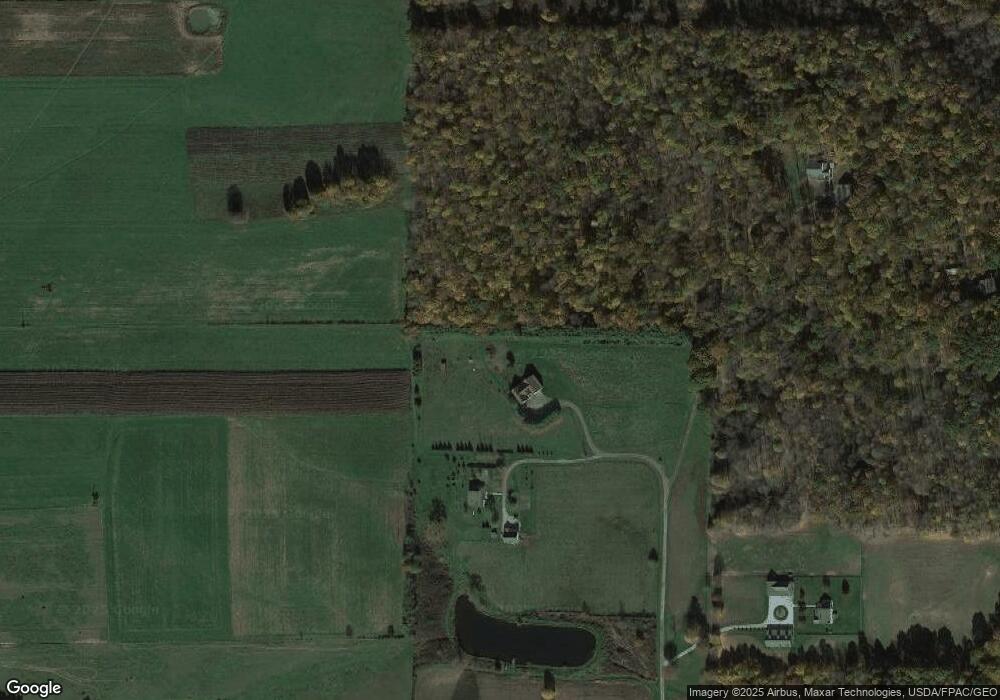

Map

Nearby Homes

- 16310 Madison Rd

- 15791 Madison Rd

- 15660 Georgia Rd

- 15142 Sawgrass Ln

- 16765 Old State Rd

- 14706 Steeplechase Dr

- 16298 Weathervane Dr

- 14607 Erwin Dr

- 15720 Jug Rd

- Parcel C Nash Rd

- 0 Nash Rd Unit 5142384

- 16510 Bundysburg Rd

- 17050 Nash Rd

- 16990 Nash Rd

- 8070 Parkman Mesopotamia Rd

- 14752 Evergreen Dr

- 16169 Mccall Rd

- 18386 Mills Rd

- 13829 Carlton St

- 17808 Nash Rd

- 15980 Shedd Rd

- 16010 Shedd Rd

- 15930 Shedd Rd

- 15920 Shedd Rd

- 15950 Shedd Rd

- 16014 Shedd Rd

- 15886 Shedd Rd

- 15836 Shedd Rd

- 15949 Newcomb Rd

- 16163 Newcomb Rd

- 15989 Shedd Rd

- 15951 Newcomb Rd

- 16089 Newcomb Rd

- 16140 Shedd Rd

- 16060 Shedd Rd

- 15816 Shedd Rd

- 16013 Newcomb Rd

- 16074 Shedd Rd

- 16035 Newcomb Rd

- 16035 Newcomb Rd