16 Oak Park Dr Bettendorf, IA 52722

Estimated Value: $530,041 - $645,000

7

Beds

4

Baths

4,178

Sq Ft

$140/Sq Ft

Est. Value

About This Home

This home is located at 16 Oak Park Dr, Bettendorf, IA 52722 and is currently estimated at $584,010, approximately $139 per square foot. 16 Oak Park Dr is a home located in Scott County with nearby schools including Mark Twain Elementary School, Bettendorf Middle School, and Bettendorf High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2025

Sold by

Kretschmer Steven

Bought by

Stopulos Ellen and Kretschmer Ellen

Current Estimated Value

Purchase Details

Closed on

Aug 16, 2022

Sold by

Michael D Stopulos Declaration Of Trust

Bought by

Kretschmer Ellen and Kretschmer Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$310,000

Interest Rate

5.51%

Mortgage Type

Balloon

Purchase Details

Closed on

Jul 13, 2021

Sold by

Stopulos Michael D and Stopulos Mary F

Bought by

Stopulos Michael D and Michael D Stopulos Declaration Of Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stopulos Ellen | -- | None Listed On Document | |

| Kretschmer Ellen | $500,000 | None Listed On Document | |

| Stopulos Michael D | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kretschmer Ellen | $310,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,884 | $608,800 | $165,500 | $443,300 |

| 2024 | $7,822 | $509,700 | $84,200 | $425,500 |

| 2023 | $8,569 | $509,700 | $84,200 | $425,500 |

| 2022 | $8,188 | $478,920 | $84,240 | $394,680 |

| 2021 | $8,188 | $478,920 | $84,240 | $394,680 |

| 2020 | $7,772 | $437,030 | $84,240 | $352,790 |

| 2019 | $8,004 | $437,030 | $84,240 | $352,790 |

| 2018 | $8,000 | $437,030 | $84,240 | $352,790 |

| 2017 | $2,431 | $437,030 | $84,240 | $352,790 |

| 2016 | $8,430 | $460,680 | $0 | $0 |

| 2015 | $8,430 | $441,860 | $0 | $0 |

| 2014 | $8,180 | $441,860 | $0 | $0 |

| 2013 | $8,000 | $0 | $0 | $0 |

| 2012 | -- | $446,330 | $84,240 | $362,090 |

Source: Public Records

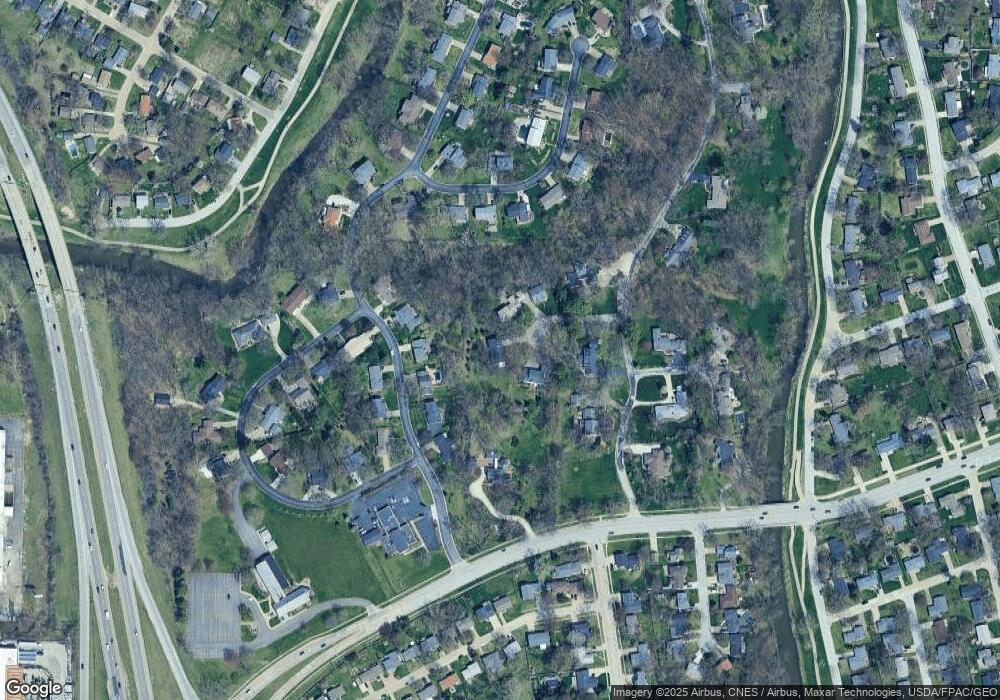

Map

Nearby Homes

- 1 Oak Park Dr

- 1212 Meadow Lane Dr

- 1209 Meadow Lane Dr

- 60 Parklane Cir

- 1101 Hawthorne Dr

- 1520 Parklane Dr

- 2507 Holly Dr

- 1705 Elmwood Dr

- 2612 Crestview Dr

- 2625 Holly Dr

- 2620 Harmony Dr

- 1902 Parkway Dr

- 2704 Magnolia Dr

- 1718 Fairmeadows Dr

- 2821 Hillside Ct

- 16 Wildwood Trail

- 2846 Magnolia Dr

- 1113 Summit Hills Dr

- 6817 Matthews Ct

- 3418 Middle Rd