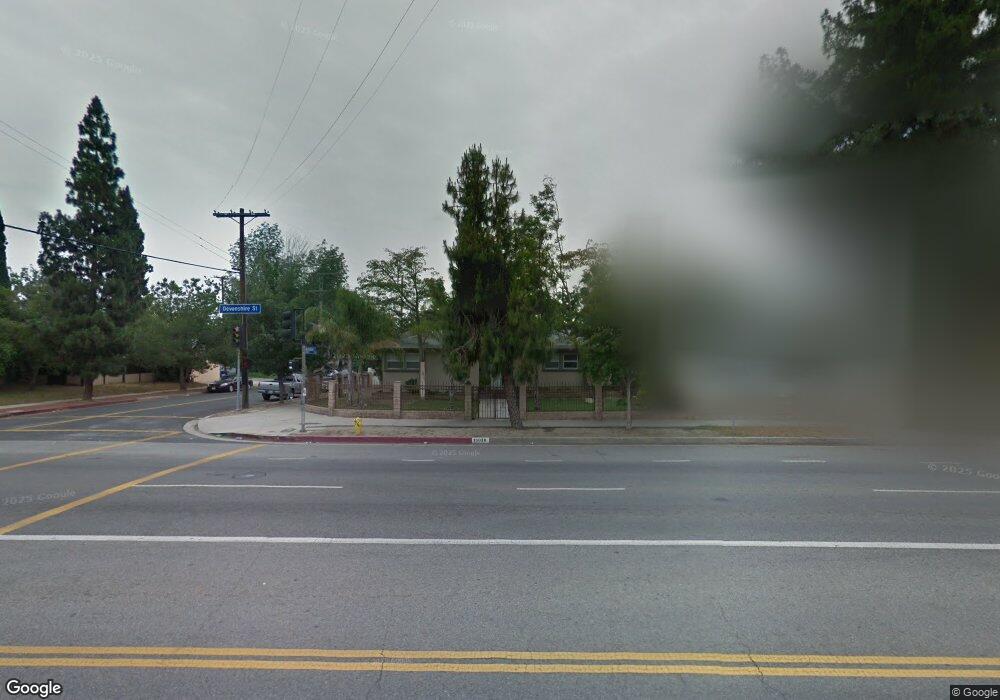

16030 Devonshire St Granada Hills, CA 91344

Estimated Value: $849,026 - $1,015,000

3

Beds

2

Baths

1,234

Sq Ft

$731/Sq Ft

Est. Value

About This Home

This home is located at 16030 Devonshire St, Granada Hills, CA 91344 and is currently estimated at $902,507, approximately $731 per square foot. 16030 Devonshire St is a home located in Los Angeles County with nearby schools including Vintage Math, Science, and Technology Magnet School, Mayall Street Elementary School, and George K. Porter Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2004

Sold by

Saavedra Fernando A

Bought by

Saavedra Fernando A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,000

Outstanding Balance

$121,183

Interest Rate

5%

Mortgage Type

Negative Amortization

Estimated Equity

$781,324

Purchase Details

Closed on

Aug 6, 2002

Sold by

Craig Derek

Bought by

Saavedra Fernando A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,500

Interest Rate

6.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Saavedra Fernando A | -- | Corinthian Title | |

| Saavedra Fernando A | -- | Corinthian Title | |

| Saavedra Fernando A | -- | Corinthian Title | |

| Saavedra Fernando A | -- | Ort | |

| Saavedra Fernando A | $265,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Saavedra Fernando A | $280,000 | |

| Closed | Saavedra Fernando A | $0 | |

| Previous Owner | Saavedra Fernando A | $270,000 | |

| Previous Owner | Saavedra Fernando A | $238,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,734 | $383,784 | $243,308 | $140,476 |

| 2024 | $4,734 | $376,260 | $238,538 | $137,722 |

| 2023 | $4,645 | $368,883 | $233,861 | $135,022 |

| 2022 | $4,432 | $361,651 | $229,276 | $132,375 |

| 2021 | $4,374 | $354,561 | $224,781 | $129,780 |

| 2020 | $4,414 | $350,927 | $222,477 | $128,450 |

| 2019 | $4,245 | $344,047 | $218,115 | $125,932 |

| 2018 | $4,120 | $337,302 | $213,839 | $123,463 |

| 2016 | $3,928 | $324,207 | $205,537 | $118,670 |

| 2015 | $3,870 | $319,338 | $202,450 | $116,888 |

| 2014 | $3,889 | $313,084 | $198,485 | $114,599 |

Source: Public Records

Map

Nearby Homes

- 16038 Devonshire St

- 16053 Devonshire St

- 16001 Tuba St

- 16130 Devonshire St

- 10508 Collett Ave

- 15758 Lemarsh St

- 9945 Gaviota Ave

- 10326 Gothic Ave

- 16301 Stare St

- 15709 Devonshire St

- 15657 Devonshire St

- 10520 Haskell Ave

- 10016 Sophia Ave

- 10345 Blucher Ave

- 15814 Septo St Unit 2

- 15814 Septo St

- 10713 Woodley Ave

- 16051 Los Alimos St

- 10048 Odessa Ave

- 15535 Tuba St

- 16044 Devonshire St

- 16024 Devonshire St

- 16031 Tuba St

- 16037 Tuba St

- 16043 Tuba St

- 10246 Montgomery Ave

- 16050 Devonshire St

- 16018 Devonshire St

- 16033 Devonshire St

- 16041 Devonshire St

- 10240 Montgomery Ave

- 16047 Devonshire St

- 16100 Devonshire St

- 16023 Devonshire St

- 16012 Devonshire St

- 16055 Tuba St

- 16019 Tuba St

- 10225 Montgomery Ave

- 16017 Devonshire St

- 16106 Devonshire St