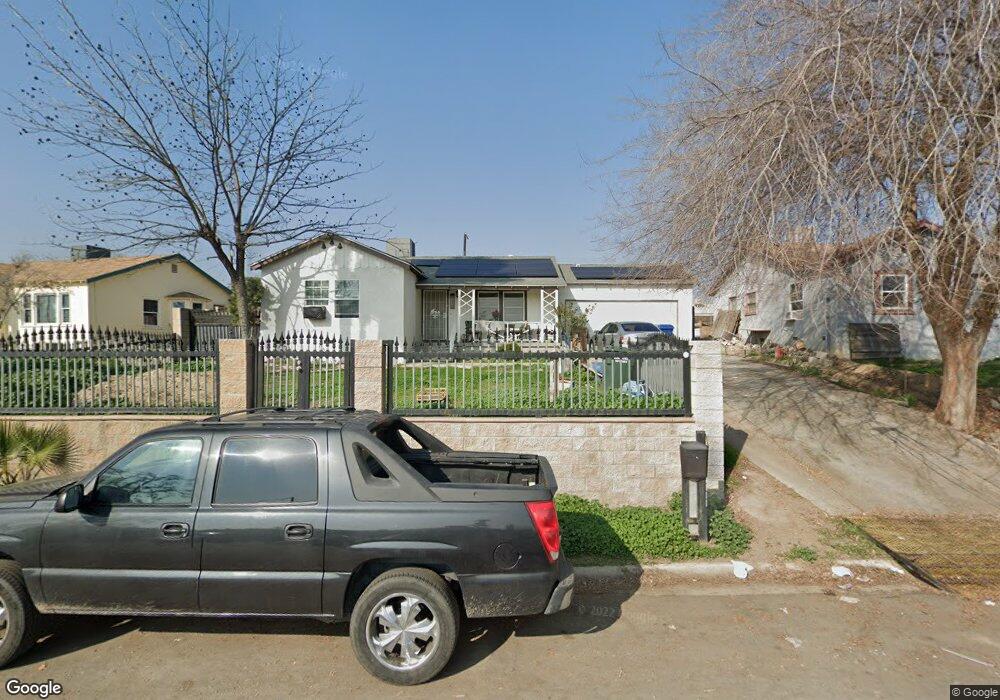

1608 Crestview Dr Bakersfield, CA 93305

East Bakersfield NeighborhoodEstimated Value: $317,678 - $329,000

3

Beds

2

Baths

1,510

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 1608 Crestview Dr, Bakersfield, CA 93305 and is currently estimated at $323,339, approximately $214 per square foot. 1608 Crestview Dr is a home located in Kern County with nearby schools including College Heights Elementary School, Compton Junior High School, and East Bakersfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 8, 2020

Sold by

1608 Crestview Dr Grantor Living Trust

Bought by

Ramos Diana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,500

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 6, 2009

Sold by

Dan Cook Inc

Bought by

Livi Ramos Diana and Livi 1608 Crestview Dr Grantor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

5.37%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Nov 12, 2008

Sold by

C G Miller Trust

Bought by

Gordon Miller 1608 Crestview Trust and 1608 Crestview Trust

Purchase Details

Closed on

Sep 8, 2008

Sold by

Dan Cook Inc

Bought by

C G Miller Trust and L K Patterson Trust

Purchase Details

Closed on

Aug 11, 2008

Sold by

Patterson Kareama Latease

Bought by

Dan Cook Inc and Equity 1-Loans

Purchase Details

Closed on

Jul 23, 2007

Sold by

Miller Gordon C

Bought by

Patterson Kareama Latease

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,266

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramos Diana | -- | Amrock | |

| Livi Ramos Diana | $90,000 | Chicago Title Company | |

| Gordon Miller 1608 Crestview Trust | $45,000 | None Available | |

| C G Miller Trust | $42,000 | None Available | |

| Dan Cook Inc | $164,730 | None Available | |

| Patterson Kareama Latease | $240,000 | First American Title | |

| Patterson Kareama Latease | -- | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ramos Diana | $69,500 | |

| Previous Owner | Livi Ramos Diana | $80,000 | |

| Previous Owner | Patterson Kareama Latease | $126,266 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,533 | $232,403 | $58,366 | $174,037 |

| 2024 | $3,443 | $227,847 | $57,222 | $170,625 |

| 2023 | $3,443 | $223,380 | $56,100 | $167,280 |

| 2022 | $2,033 | $109,460 | $30,403 | $79,057 |

| 2021 | $1,933 | $107,314 | $29,807 | $77,507 |

| 2020 | $1,933 | $106,215 | $29,502 | $76,713 |

| 2019 | $1,832 | $106,215 | $29,502 | $76,713 |

| 2018 | $1,783 | $102,092 | $28,357 | $73,735 |

| 2017 | $1,762 | $100,091 | $27,801 | $72,290 |

| 2016 | $1,533 | $98,129 | $27,256 | $70,873 |

| 2015 | $1,530 | $96,656 | $26,847 | $69,809 |

| 2014 | $1,484 | $94,764 | $26,322 | $68,442 |

Source: Public Records

Map

Nearby Homes

- 1609 Crestview Dr

- 1501 Crestview Dr

- 1725 Bernard St

- 2313 Kamar St

- 1628 Tejon St

- 0 La Naranja Ave

- 1428 Jefferson St

- 2706 Anza St

- 1227 Drury Ln

- 2118 Miller St

- 2131 Berger St

- 1817 Brown St

- 1814 Virginia St

- 1528 Lincoln St

- 1921 Miller St

- 2220 Berger St

- 2119 Robinson St

- 1513 Lincoln St

- 2216 Robinson St

- 1306 Lincoln St

- 1604 Crestview Dr

- 1612 Crestview Dr

- 1600 Crestview Dr

- 1616 Crestview Dr

- 1601 Bernard St

- 1530 Crestview Dr

- 1613 Crestview Dr

- 1529 Bernard St

- 1605 Bernard St

- 1700 Crestview Dr

- 1609 Bernard St

- 1525 Bernard St

- 1526 Crestview Dr

- 1613 Bernard St

- 2130 Milvia St

- 1605 Crestview Dr

- 1701 Crestview Dr

- 1704 Crestview Dr

- 1521 Bernard St

- 1617 Bernard St