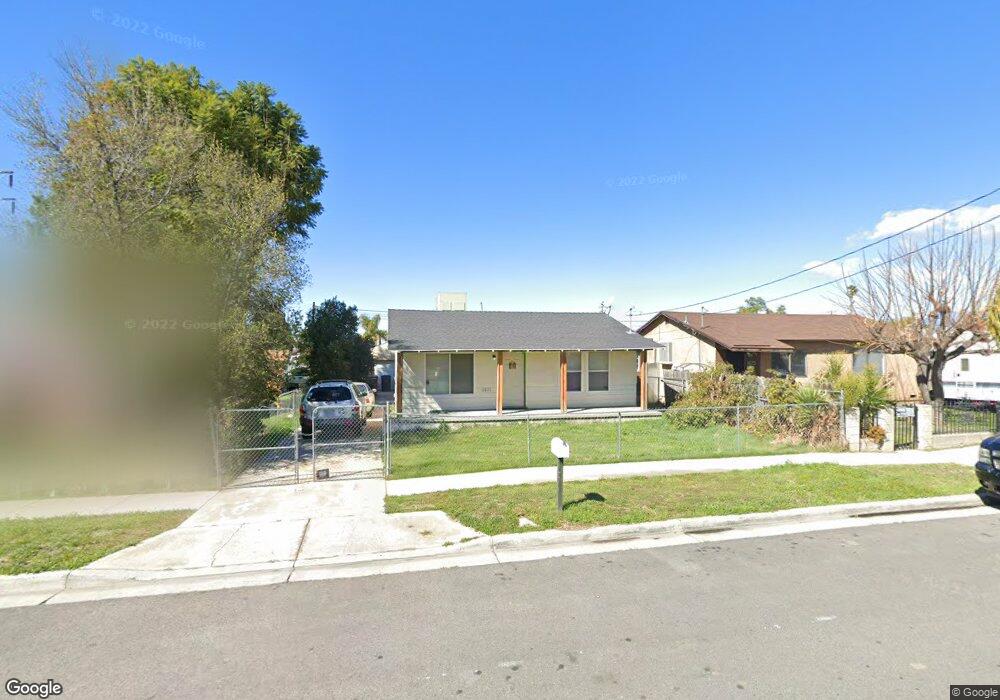

1611 Clay St Redlands, CA 92374

North Redlands NeighborhoodEstimated Value: $383,554 - $433,000

2

Beds

1

Bath

744

Sq Ft

$563/Sq Ft

Est. Value

About This Home

This home is located at 1611 Clay St, Redlands, CA 92374 and is currently estimated at $418,889, approximately $563 per square foot. 1611 Clay St is a home located in San Bernardino County with nearby schools including Lugonia Elementary School, Clement Middle School, and Citrus Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 6, 2022

Sold by

Israel Marjorie Lynn

Bought by

Marjorie Lynn Israel Separate Property Trust

Current Estimated Value

Purchase Details

Closed on

Dec 20, 2001

Sold by

County Of San Bernardino

Bought by

Ayers Marjorie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,350

Interest Rate

6.51%

Purchase Details

Closed on

Feb 7, 2001

Sold by

Hud

Bought by

Department Economic & Comnty Development

Purchase Details

Closed on

Feb 29, 2000

Sold by

Cortez Manuel M and Cortez Linda

Bought by

Gmac Mtg Corp and Gmac Mtg Corp Of Pa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marjorie Lynn Israel Separate Property Trust | -- | -- | |

| Ayers Marjorie | $93,000 | Commonwealth Land Title Co | |

| Department Economic & Comnty Development | -- | Commonwealth Land Title Co | |

| Gmac Mtg Corp | $60,460 | Stewart Title | |

| Hud | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ayers Marjorie | $88,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,628 | $137,394 | $48,752 | $88,642 |

| 2024 | $1,628 | $134,700 | $47,796 | $86,904 |

| 2023 | $1,626 | $132,059 | $46,859 | $85,200 |

| 2022 | $1,603 | $129,469 | $45,940 | $83,529 |

| 2021 | $1,632 | $126,930 | $45,039 | $81,891 |

| 2020 | $1,608 | $125,628 | $44,577 | $81,051 |

| 2019 | $1,564 | $123,165 | $43,703 | $79,462 |

| 2018 | $1,526 | $120,750 | $42,846 | $77,904 |

| 2017 | $1,513 | $118,382 | $42,006 | $76,376 |

| 2016 | $1,496 | $116,060 | $41,182 | $74,878 |

| 2015 | $1,485 | $114,316 | $40,563 | $73,753 |

| 2014 | $1,459 | $112,076 | $39,768 | $72,308 |

Source: Public Records

Map

Nearby Homes

- 1636 Webster St

- 402 Baldwin Ave

- 1734 Orange St

- 102 Mulvihill Ave

- 325 Deodar St

- 102 E Pioneer Ave

- 1845 Furlow Dr

- 1450 Washington St

- 140 W Pioneer Ave Unit 76

- 140 W Pioneer Ave Unit 93

- 1808 Cave St

- 1602 Glover St

- 1909 Crystal Cove Ct

- 1324 Clay St

- 874 Royal Knight Trail

- 1312 Calhoun St

- 2050 Furlow Dr

- 2167 Bergamot St

- 1510 Karon St

- 1231 Webster St