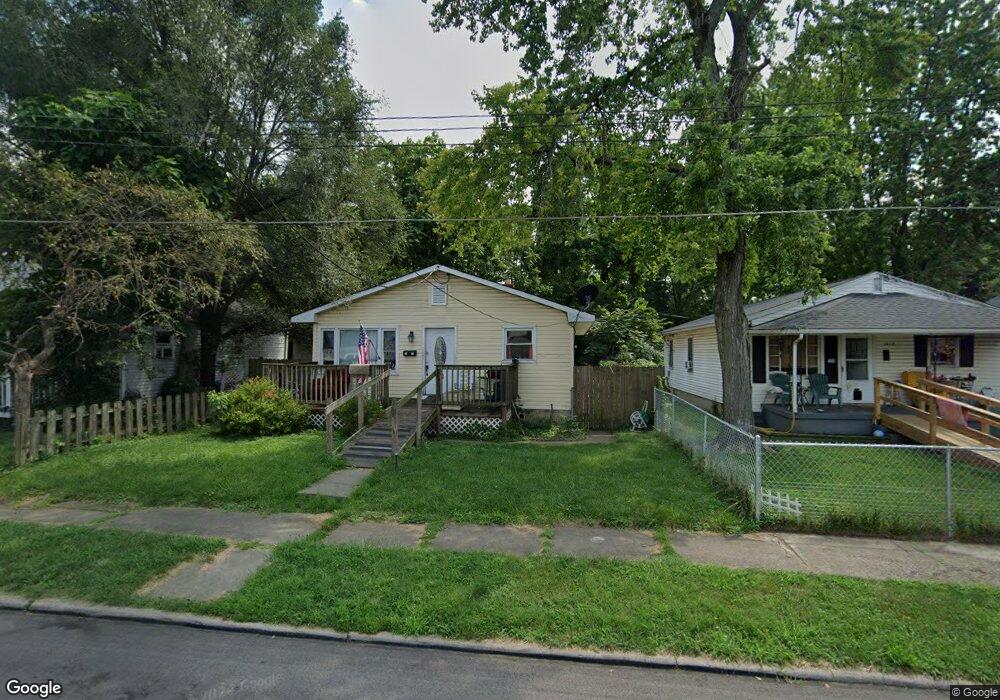

1614 Meadow Ave Middletown, OH 45044

Meadowlawn NeighborhoodEstimated Value: $103,000 - $150,000

3

Beds

1

Bath

1,040

Sq Ft

$116/Sq Ft

Est. Value

About This Home

This home is located at 1614 Meadow Ave, Middletown, OH 45044 and is currently estimated at $120,206, approximately $115 per square foot. 1614 Meadow Ave is a home located in Butler County with nearby schools including Amanda Elementary School, Highview 6th Grade Center, and Middletown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 8, 2015

Sold by

Williams Jason Todd

Bought by

Hudson Rodney A

Current Estimated Value

Purchase Details

Closed on

Apr 20, 2007

Sold by

The Bank Of New York

Bought by

Williams Jason Todd

Purchase Details

Closed on

Jan 4, 2007

Sold by

Abbott Lewis E

Bought by

The Bank Of New York and Eqcc Asset Backed Certificates Series 20

Purchase Details

Closed on

Nov 17, 1997

Sold by

Martin David

Bought by

Abbott Lewis E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,235

Interest Rate

7.43%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 10, 1993

Purchase Details

Closed on

May 1, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hudson Rodney A | $28,000 | None Available | |

| Hudson Rodney A | $28,000 | Attorney | |

| Williams Jason Todd | $26,200 | None Available | |

| The Bank Of New York | $40,200 | None Available | |

| Abbott Lewis E | $65,800 | -- | |

| -- | $41,000 | -- | |

| -- | $33,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Abbott Lewis E | $65,235 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,030 | $27,480 | $4,240 | $23,240 |

| 2023 | $1,826 | $26,900 | $4,240 | $22,660 |

| 2022 | $2,151 | $19,850 | $4,240 | $15,610 |

| 2021 | $1,139 | $19,850 | $4,240 | $15,610 |

| 2020 | $1,186 | $19,850 | $4,240 | $15,610 |

| 2019 | $1,328 | $18,320 | $4,590 | $13,730 |

| 2018 | $1,186 | $18,320 | $4,590 | $13,730 |

| 2017 | $1,189 | $18,320 | $4,590 | $13,730 |

| 2016 | $1,086 | $16,030 | $4,590 | $11,440 |

| 2015 | $1,042 | $16,030 | $4,590 | $11,440 |

| 2014 | $1,275 | $16,030 | $4,590 | $11,440 |

| 2013 | $1,275 | $21,350 | $4,590 | $16,760 |

Source: Public Records

Map

Nearby Homes

- 1511 Meadow Ave

- 1808 Meadow Ave

- 1713 Lafayette Ave

- 2012 Pearl St

- 1514 Taylor Ave

- 1503 Brown St

- 1717 Pershing Ave

- 1702 Glenwood Ave

- 2900 Morgan St

- 1613 Sheridan Ave

- 3107 Rufus St

- 3113 Rufus St

- 3004 Judy Dr

- 3102 Omaha St

- 712 Buena Ave

- 3209 Rufus St

- 1209 Grove St

- 2004 Minnesota St

- 3111 Omaha St

- 3009 Seneca St

- 1612 Meadow Ave

- 1616 Meadow Ave

- 1618 Meadow Ave

- 1608 Meadow Ave

- 1620 Meadow Ave

- 1606 Meadow Ave

- 1622 Meadow Ave

- 1615 Meadow Ave

- 1613 Meadow Ave

- 1617 Meadow Ave

- 1611 Meadow Ave

- 1600 Meadow Ave

- 1600 Meadow Ave

- 1624 Meadow Ave

- 1619 Meadow Ave

- 1609 Meadow Ave

- 1623 Meadow Ave

- 1607 Meadow Ave

- 1700 Meadow Ave

- 1605 Meadow Ave