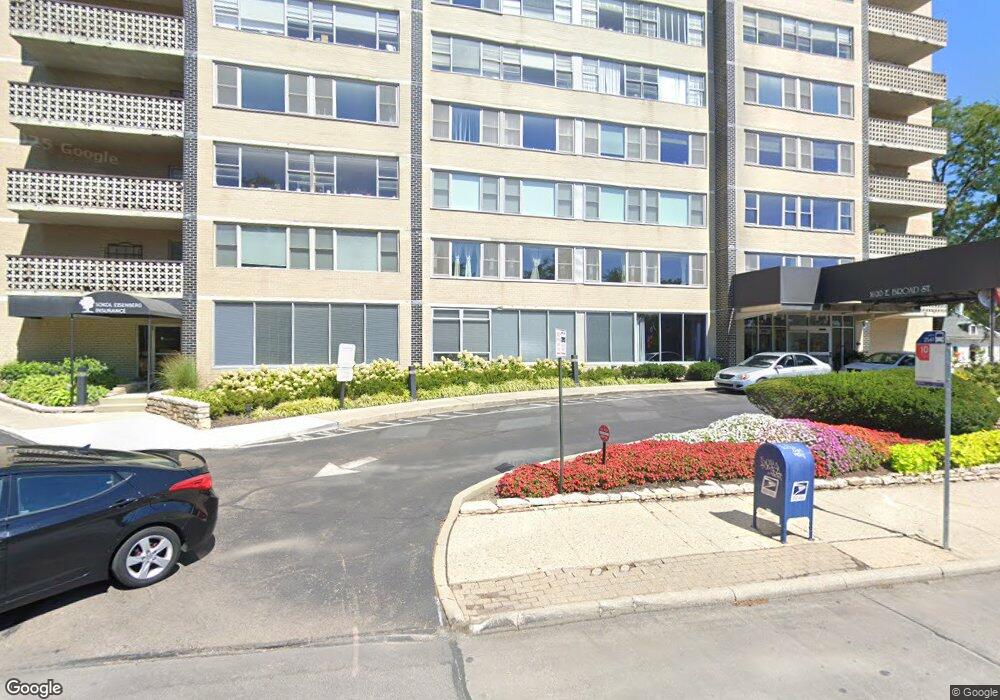

Park Towers 1620 E Broad St Unit 1701 Columbus, OH 43203

Woodland Park NeighborhoodEstimated Value: $96,000 - $176,000

1

Bed

1

Bath

773

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 1620 E Broad St Unit 1701, Columbus, OH 43203 and is currently estimated at $131,509, approximately $170 per square foot. 1620 E Broad St Unit 1701 is a home located in Franklin County with nearby schools including Eastgate Elementary School, Champion Middle School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 4, 2025

Sold by

Abankwah Michael and Anastasia Gyesaw

Bought by

Sage Property Partners Llc

Current Estimated Value

Purchase Details

Closed on

Jan 22, 2025

Sold by

Sheriff Of Franklin County Ohio

Bought by

Abankwah Michael and Abankwah Anastasia Gyesaw

Purchase Details

Closed on

Dec 21, 2006

Sold by

Wilcoxon Amy and Wilcoxon Gary N

Bought by

Lee Hogop

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,250

Interest Rate

9.05%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jan 4, 2001

Sold by

Driscoll Morse Scott R and Driscoll James R

Bought by

Weatherall Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,700

Interest Rate

7.69%

Purchase Details

Closed on

Dec 9, 1992

Bought by

Morse Scott R

Purchase Details

Closed on

Jun 11, 1992

Purchase Details

Closed on

Nov 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sage Property Partners Llc | $105,000 | Amerititle | |

| Abankwah Michael | $101,100 | None Listed On Document | |

| Lee Hogop | $45,000 | Chicago Tit | |

| Weatherall Amy | $32,300 | -- | |

| Morse Scott R | $380,000 | -- | |

| -- | $500,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lee Hogop | $38,250 | |

| Previous Owner | Weatherall Amy | $25,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,464 | $53,870 | $23,450 | $30,420 |

| 2024 | $11,464 | $53,870 | $23,450 | $30,420 |

| 2023 | $3,459 | $53,865 | $23,450 | $30,415 |

| 2022 | $6,959 | $11,660 | $1,230 | $10,430 |

| 2021 | $1,526 | $11,660 | $1,230 | $10,430 |

| 2020 | $1,335 | $11,660 | $1,230 | $10,430 |

| 2019 | $1,038 | $8,340 | $880 | $7,460 |

| 2018 | $683 | $8,340 | $880 | $7,460 |

| 2017 | $688 | $8,340 | $880 | $7,460 |

| 2016 | $820 | $10,470 | $1,050 | $9,420 |

| 2015 | $698 | $10,470 | $1,050 | $9,420 |

| 2014 | $649 | $10,470 | $1,050 | $9,420 |

| 2013 | $449 | $13,055 | $1,295 | $11,760 |

Source: Public Records

About Park Towers

Map

Nearby Homes

- 1620 E Broad St Unit 608

- 1620 E Broad St Unit 606

- 34 Woodland Ave

- 54 Woodland Ave

- 39 Auburn Ave

- 1517 Hawthorne Ave

- 1622 Clifton Ave

- 90-92 Burt St Unit 90

- 220 Parkwood Ave Unit 222

- 1577 Richmond Ave

- 1562 Richmond Ave

- 1714 Oak St

- 1575 Granville St

- 280 Taylor Ave

- 1319 Madison Ave

- 1581 Franklin Ave Unit 581

- 1571 Franklin Ave

- 1418 Phale D Hale Dr

- 266 Miller Ave Unit 268

- 156 Winner Ave

- 1620 E Broad St Unit 1202

- 1620 E Broad St Unit 1403

- 1620 E Broad St Unit 1003

- 1620 E Broad St Unit 1208

- 1620 E Broad St Unit 1501

- 1620 E Broad St Unit 1006

- 1620 E Broad St

- 1620 E Broad St Unit 1402

- 1620 E Broad St

- 1620 E Broad St Unit 1503

- 1620 E Broad St Unit 1405

- 1620 E Broad St Unit 1509

- 1620 E Broad St Unit 1702

- 1620 E Broad St Unit 1109

- 1620 E Broad St Unit 1510

- 1620 E Broad St Unit 1207

- 1620 E Broad St Unit 1004

- 1620 E Broad St Unit 1008

- 1620 E Broad St Unit 1601

- 1620 E Broad St Unit 1505