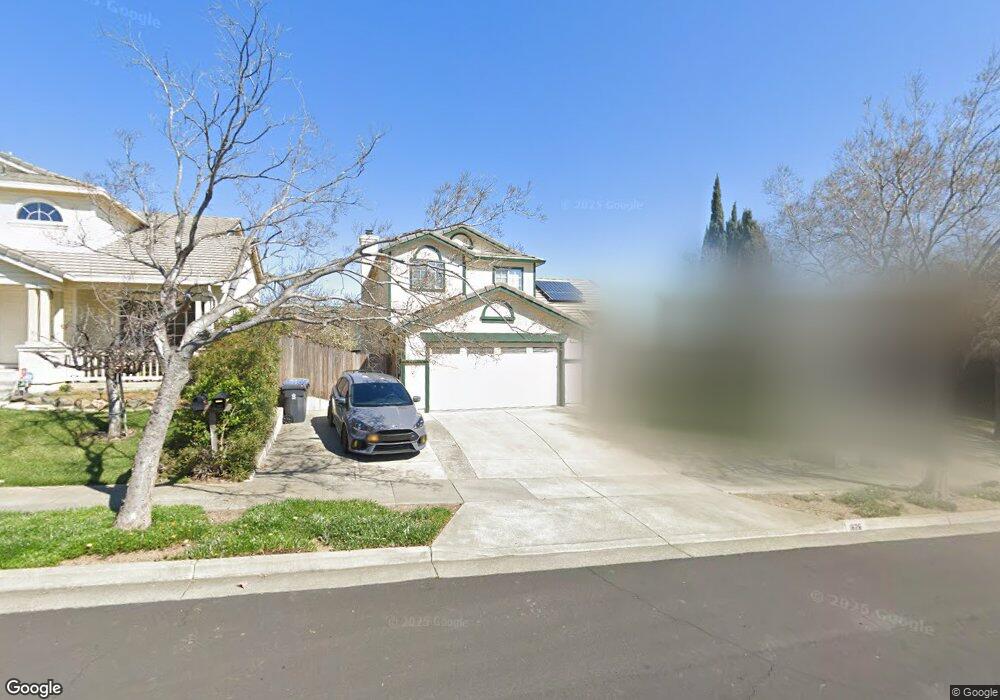

1626 Highland Cir Fairfield, CA 94534

Estimated Value: $626,432 - $683,000

4

Beds

3

Baths

1,718

Sq Ft

$377/Sq Ft

Est. Value

About This Home

This home is located at 1626 Highland Cir, Fairfield, CA 94534 and is currently estimated at $647,858, approximately $377 per square foot. 1626 Highland Cir is a home located in Solano County with nearby schools including Cordelia Hills Elementary School, Green Valley Middle School, and Angelo Rodriguez High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 4, 2009

Sold by

Deutsche Bank National Trust Company

Bought by

Hampton Joshua H and Hampton Bethany A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,070

Outstanding Balance

$151,922

Interest Rate

5.04%

Mortgage Type

FHA

Estimated Equity

$495,936

Purchase Details

Closed on

Nov 18, 2008

Sold by

Chanthaphat Somdee and Douangpanya Chandy

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Jul 22, 1994

Sold by

Albert D Seeno Construction Co

Bought by

Chanthaphat Somdee and Douangpanya Chandy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,900

Interest Rate

8.38%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hampton Joshua H | $244,500 | Chicago Title Insurance Co | |

| Deutsche Bank National Trust Company | $327,340 | None Available | |

| Chanthaphat Somdee | $166,500 | Frontier Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hampton Joshua H | $240,070 | |

| Previous Owner | Chanthaphat Somdee | $132,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,759 | $314,850 | $83,701 | $231,149 |

| 2024 | $3,759 | $308,677 | $82,060 | $226,617 |

| 2023 | $3,631 | $302,625 | $80,451 | $222,174 |

| 2022 | $3,586 | $296,692 | $78,874 | $217,818 |

| 2021 | $3,532 | $290,876 | $77,328 | $213,548 |

| 2020 | $3,653 | $287,895 | $76,536 | $211,359 |

| 2019 | $3,623 | $282,251 | $75,036 | $207,215 |

| 2018 | $3,725 | $276,717 | $73,565 | $203,152 |

| 2017 | $3,728 | $271,292 | $72,123 | $199,169 |

| 2016 | $3,702 | $265,973 | $70,709 | $195,264 |

| 2015 | $3,495 | $261,978 | $69,647 | $192,331 |

| 2014 | $3,469 | $256,847 | $68,283 | $188,564 |

Source: Public Records

Map

Nearby Homes

- 1756 Fawn Glen Cir

- 4732 Opus Cir

- 2197 Yellow Rose Cir

- 824 Crescendo St

- 840 Crescendo St

- 848 Crescendo St

- 1946 Leaning Oak Ct

- The Dulcian Plan at Cadence at Gold Hill

- The Adagio Plan at Cadence at Gold Hill

- The Cornet Plan at Cadence at Gold Hill

- The Entrata Plan at Cadence at Gold Hill

- The Bolero Plan at Cadence at Gold Hill

- 4927 Claremont Ct

- 4538 Paseo Dr

- 4881 Regency Place

- 828 Stoneridge Cir

- 5062 Brookdale Cir

- 5002 Greenwood Ct

- 680 Silver Lake Dr

- 4933 Brittany Dr

- 1630 Highland Cir

- 1622 Highland Cir

- 1618 Highland Cir

- 1634 Highland Cir

- 1608 Highland Ct

- 1614 Highland Cir

- 1638 Highland Cir

- 1607 Highland Ct

- 1642 Highland Cir

- 1612 Highland Ct

- 1610 Highland Cir

- 1611 Highland Ct

- 1601 Highland Cir

- 1616 Highland Ct

- 1606 Highland Cir

- 1646 Highland Cir

- 1663 Highland Cir

- 1615 Highland Ct

- 1605 Highland Cir

- 1667 Highland Cir