163 Sweetheart Rose Trail Unit 457 Clayton, GA 30525

Estimated Value: $414,105 - $565,000

3

Beds

3

Baths

2,016

Sq Ft

$245/Sq Ft

Est. Value

About This Home

This home is located at 163 Sweetheart Rose Trail Unit 457, Clayton, GA 30525 and is currently estimated at $493,776, approximately $244 per square foot. 163 Sweetheart Rose Trail Unit 457 is a home located in Rabun County with nearby schools including Rabun County Primary School, Rabun County High School, and Great Oaks Montessori .

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2017

Sold by

Collins John E

Bought by

Shaughnessy Michael John and Shaughnessy Eileen Mary

Current Estimated Value

Purchase Details

Closed on

Oct 17, 2008

Sold by

Not Provided

Bought by

Marie Collins John E and Marie Anna

Purchase Details

Closed on

Oct 1, 1999

Bought by

Anderson Anthony H

Purchase Details

Closed on

Jun 1, 1998

Purchase Details

Closed on

Jan 1, 1991

Purchase Details

Closed on

Feb 1, 1973

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shaughnessy Michael John | $210,000 | -- | |

| Shaughnessy Michael John | $210,000 | -- | |

| Marie Collins John E | $200,000 | -- | |

| Marie Collins John E | $200,000 | -- | |

| Anderson Anthony H | $160,000 | -- | |

| Anderson Anthony H | $160,000 | -- | |

| -- | $7,000 | -- | |

| -- | $7,000 | -- | |

| -- | $3,000 | -- | |

| -- | $3,000 | -- | |

| -- | $4,500 | -- | |

| -- | $4,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,817 | $118,158 | $19,200 | $98,958 |

| 2024 | $1,776 | $112,685 | $19,200 | $93,485 |

| 2023 | $1,688 | $94,249 | $14,400 | $79,849 |

| 2022 | $1,589 | $88,798 | $11,520 | $77,278 |

| 2021 | $1,485 | $81,194 | $11,520 | $69,674 |

| 2020 | $1,462 | $77,387 | $11,520 | $65,867 |

| 2019 | $1,433 | $75,349 | $11,520 | $63,829 |

| 2018 | $1,438 | $75,349 | $11,520 | $63,829 |

| 2017 | $1,241 | $66,025 | $11,520 | $54,505 |

| 2016 | $1,245 | $66,025 | $11,520 | $54,505 |

| 2015 | $1,197 | $62,157 | $9,600 | $52,557 |

| 2014 | $1,203 | $62,157 | $9,600 | $52,557 |

Source: Public Records

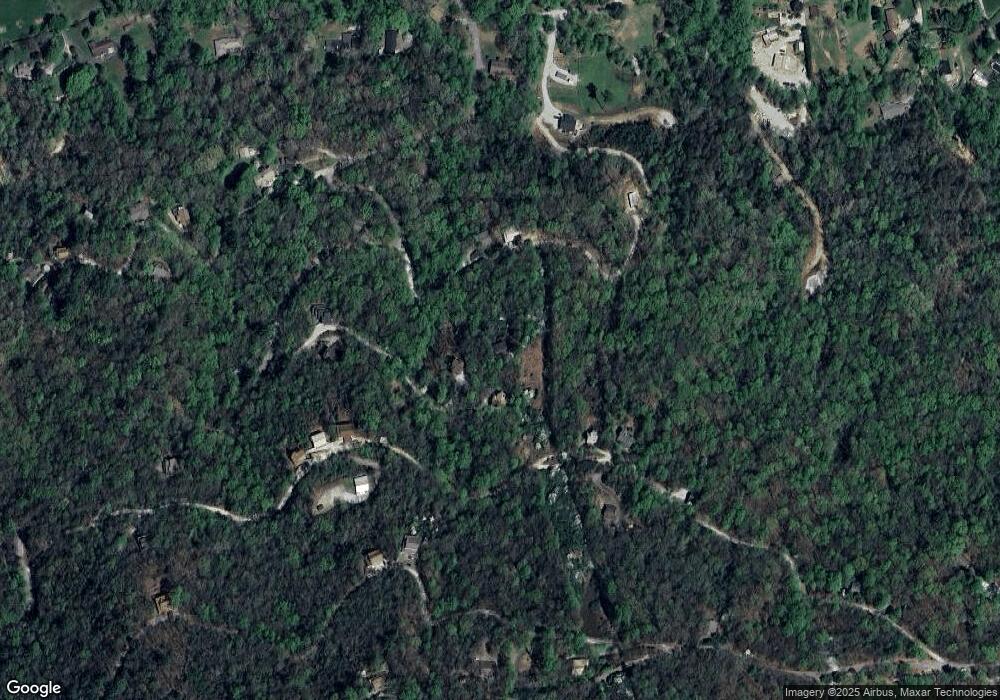

Map

Nearby Homes

- 445 Orchid Trail

- 574 Bachelors Button Dr

- 0 Orchid Trail Unit 24477815

- 672 Screamer Dr

- LT 547 Saddle Gap Dr

- 0 Confederate Dr Unit 523100

- 41 Ginger Ln

- 883 Rue Ln

- 140 Barron Rd

- 866 Yunai Cir

- 0 Wood Sorrel Ln Unit LOT 727/726

- 0 Wood Sorrel Ln Unit 7665794

- LT113 Laurel Ln

- 967 Saddle Gap Dr

- LOT 846 Larkspur Ln

- LOT 84 Larkspur Ln

- 271 Limelight Dr

- 0 Juniper Trail Unit 10437006

- 0 Juniper Trail Unit 10437005

- 0 Juniper Trail Unit 10437003

- 163 Sweetheart Rose Trail

- 144 Sweetheart Rose Trail

- #452 Mint Ln

- 87 Mint Ln

- 63 Mint Ln

- 220 Orchid Trail

- 220 Orchid Trail Unit 245

- 220 Orchid Trail Unit 245/246

- 220 Orchid Trail Unit 2

- 235 Orchid Trail

- 40 Sweetheart Rose Trail

- 41 Sweetheart Rose Trail

- 41 Sweetheart Rose Trail

- 41 Sweetheart Rose Trail

- 424 Orchid Trail

- 424 Orchid Trail Unit 313, 314, 315

- 308 Screamer Dr

- 157 Screamer Dr

- 1414 Warwoman Rd

- 233 Orchid Trail Unit 426