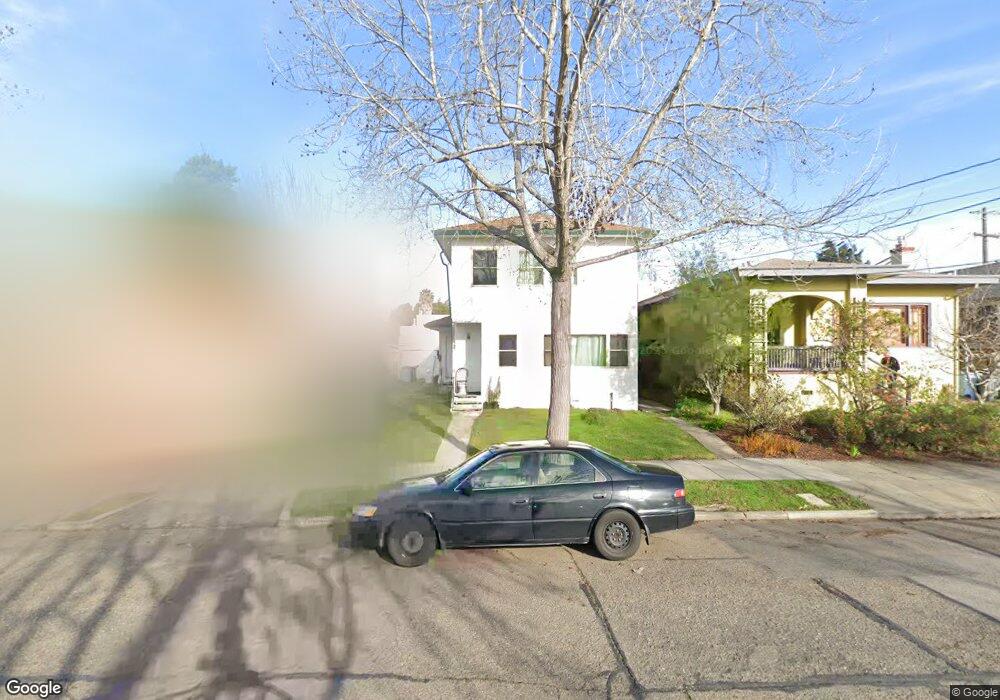

1633 Derby St Berkeley, CA 94703

South Berkeley NeighborhoodEstimated Value: $987,000 - $1,523,070

4

Beds

2

Baths

1,812

Sq Ft

$665/Sq Ft

Est. Value

About This Home

This home is located at 1633 Derby St, Berkeley, CA 94703 and is currently estimated at $1,205,768, approximately $665 per square foot. 1633 Derby St is a home located in Alameda County with nearby schools including Washington Elementary School, Malcolm X Elementary School, and Oxford Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 12, 2022

Sold by

Gerard E Du Parc Locmaria Trust

Bought by

Derby Trust and Spriggs

Current Estimated Value

Purchase Details

Closed on

Apr 4, 2005

Sold by

Locmaria Gerard Du Parc

Bought by

Locmaria Gerard E Du Parc and Gerald E Du Parc Locmaria Trus

Purchase Details

Closed on

Oct 10, 2002

Sold by

Keyes Louisa

Bought by

Locmaria Gerard Du Parc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,000

Interest Rate

6.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Derby Trust | -- | Lees Michael B | |

| Locmaria Gerard E Du Parc | -- | -- | |

| Locmaria Gerard Du Parc | $390,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Locmaria Gerard Du Parc | $312,000 | |

| Closed | Locmaria Gerard Du Parc | $58,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,314 | $582,797 | $169,439 | $420,358 |

| 2024 | $10,314 | $571,725 | $166,117 | $412,608 |

| 2023 | $10,090 | $567,871 | $162,861 | $405,010 |

| 2022 | $9,883 | $550,228 | $159,668 | $397,560 |

| 2021 | $9,576 | $514,795 | $156,538 | $365,257 |

| 2020 | $8,981 | $516,448 | $154,934 | $361,514 |

| 2019 | $8,537 | $506,324 | $151,897 | $354,427 |

| 2018 | $8,374 | $496,398 | $148,919 | $347,479 |

| 2017 | $8,063 | $486,668 | $146,000 | $340,668 |

| 2016 | $7,743 | $477,128 | $143,138 | $333,990 |

| 2015 | $7,632 | $469,964 | $140,989 | $328,975 |

| 2014 | $7,644 | $460,761 | $138,228 | $322,533 |

Source: Public Records

Map

Nearby Homes

- 1606 Derby St

- 1711 Carleton St

- 1612 Parker St

- 2701 Grant St

- 1726 Parker St Unit 2

- 1726 Parker St Unit 1

- 1540 Stuart St

- 2829 California St

- 1819 Carleton St

- 2533 Grant St

- 2750 Sacramento St

- 1524 Blake St

- 2758 Sacramento St

- 1450 Ward St

- 2774 Sacramento St

- 2782 Sacramento St

- 2790 Sacramento St

- 1516 Blake St

- 1516 Blake St Unit A

- 1901 Parker St Unit 3

- 1639 Derby St

- 1631 Derby St

- 2634 McGee Ave

- 1627 Derby St

- 1643 Derby St

- 2632 McGee Ave

- 1625 Derby St

- 1638 Carleton St

- 1634 Carleton St

- 2630 McGee Ave

- 1630 Carleton St

- 1623 Derby St

- 2641 McGee Ave

- 1701 Derby St

- 1640 Derby St

- 1628 Carleton St

- 1628 Derby St

- 1646 Carleton St

- 1624 Carleton St

- 1626 Derby St