165 Eastman Meadows Petaluma, CA 94952

Estimated Value: $990,817 - $1,265,000

3

Beds

2

Baths

1,148

Sq Ft

$1,012/Sq Ft

Est. Value

About This Home

This home is located at 165 Eastman Meadows, Petaluma, CA 94952 and is currently estimated at $1,161,204, approximately $1,011 per square foot. 165 Eastman Meadows is a home located in Sonoma County with nearby schools including Wilson Elementary School, Petaluma Junior High School, and Petaluma High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2020

Sold by

Ghazalgou Shahnaz and Esfahani Hossein Vafadar

Bought by

Esfahani Hossein Vafadar and Shahnaz Ghazalgou

Current Estimated Value

Purchase Details

Closed on

Apr 15, 2020

Sold by

Ingram Lori

Bought by

Ghazalgou Shahnaz

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$176,499

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$984,705

Purchase Details

Closed on

Aug 3, 2017

Sold by

Loew Hermann

Bought by

Loew Hermann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,163

Interest Rate

3.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 20, 2007

Sold by

Loew Hermann

Bought by

Loew Hermann

Purchase Details

Closed on

May 27, 2004

Sold by

Loew Jeanette V and Loew Hermann

Bought by

Loew Hermann and Loew Jeanette V

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Esfahani Hossein Vafadar | -- | None Available | |

| Ghazalgou Shahnaz | $257,258 | First American Title Company | |

| Loew Hermann | -- | None Available | |

| Loew Hermann | -- | None Available | |

| Loew Hermann | -- | None Available | |

| Loew Hermann | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ghazalgou Shahnaz | $200,000 | |

| Previous Owner | Loew Hermann | $90,163 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,748 | $792,889 | $393,710 | $399,179 |

| 2024 | $8,748 | $777,343 | $385,991 | $391,352 |

| 2023 | $8,748 | $762,102 | $378,423 | $383,679 |

| 2022 | $8,346 | $747,159 | $371,003 | $376,156 |

| 2021 | $8,160 | $732,510 | $363,729 | $368,781 |

| 2020 | $5,948 | $520,259 | $252,812 | $267,447 |

| 2019 | $5,855 | $510,058 | $247,855 | $262,203 |

| 2018 | $2,811 | $245,115 | $145,991 | $99,124 |

| 2017 | $0 | $240,310 | $143,129 | $97,181 |

| 2016 | $2,671 | $235,599 | $140,323 | $95,276 |

| 2015 | -- | $232,061 | $138,216 | $93,845 |

| 2014 | -- | $227,516 | $135,509 | $92,007 |

Source: Public Records

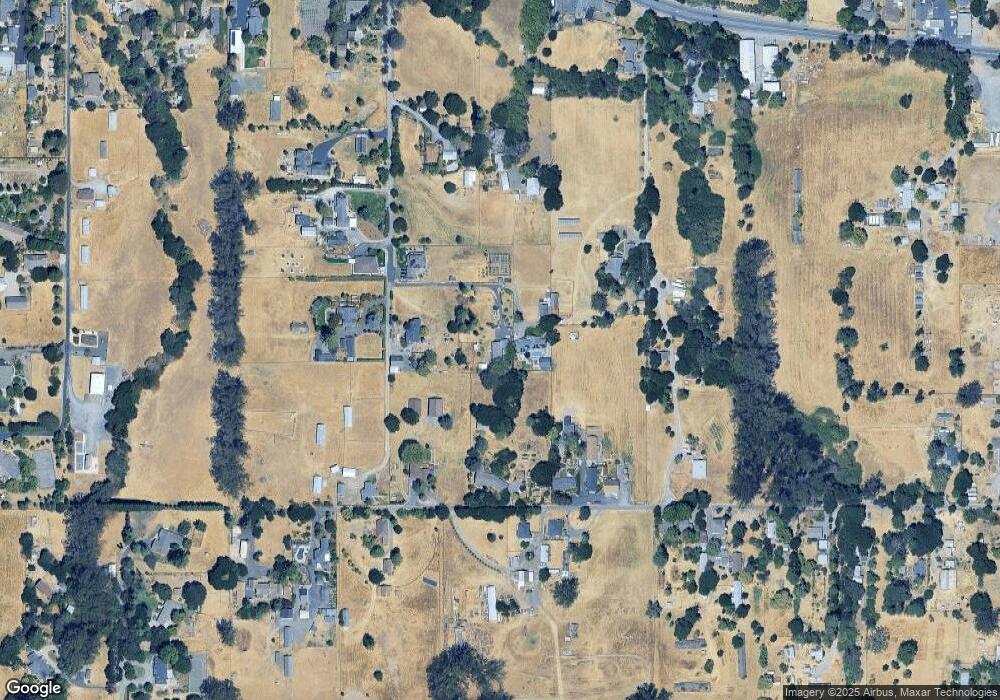

Map

Nearby Homes

- 599 Cleveland Ave

- 13 Dorenfeld Ct

- 12 Dorenfeld Ct

- 509 Larch Dr

- 2183 Live Oak Farm Ln

- 513 Larch Dr

- 716 Elm Dr

- 1375 Gossage Ave

- 874 Cherry St

- 12 Haven Dr

- 100 Orchard Ln

- 136 Court St

- 65 Freedom Ln N

- 131 Liberty St

- 716 Keller Ct

- 142 Cherry St

- 12 Rain Tree Ct

- 512 Kentucky St

- 11 10th St

- 146 Shelina Vista Ln

- 155 Eastman Meadows

- 532 Eastman Ranch Rd

- 170 Eastman Meadows

- 816 Cleveland Ave

- 200 Knudtsen Ln

- 200 Knudtsen Ln

- 820 Cleveland Ave

- 550 Cleveland Ave

- 617 Eastman Ranch Rd

- 595 Eastman Ranch Rd

- 271 Cleveland Ave

- 460 Cleveland Ave

- 621 Cleveland Ave

- 411 Eastman Ranch Rd

- 599 Cleveland Ave

- 685 Eastman Ranch Rd

- 820 Eastman Ranch Rd

- 47 Eastman Ln

- 825 Cleveland Ave

- 827 Cleveland Ave

Your Personal Tour Guide

Ask me questions while you tour the home.