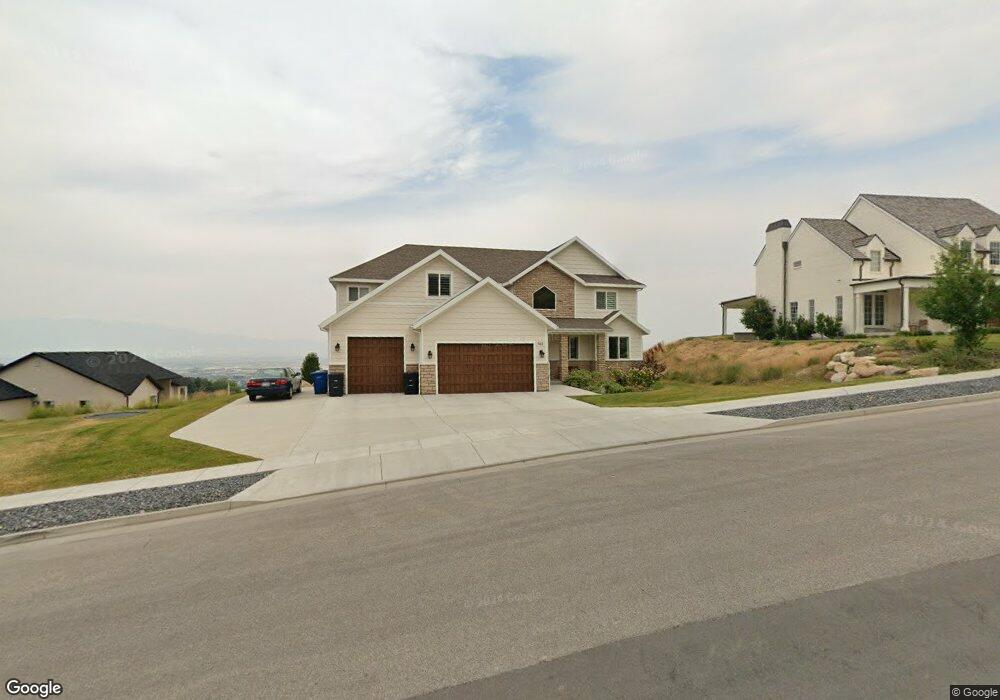

165 S 1000 E Hyde Park, UT 84318

Estimated Value: $1,074,000 - $1,168,000

6

Beds

6

Baths

6,106

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 165 S 1000 E, Hyde Park, UT 84318 and is currently estimated at $1,134,814, approximately $185 per square foot. 165 S 1000 E is a home located in Cache County with nearby schools including North Park School, Cedar Ridge School, and North Cache Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2021

Sold by

Vincent John Luke and Vincent Ashley

Bought by

Bryant Christopher and Bryant Melinda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Outstanding Balance

$381,434

Interest Rate

2.96%

Mortgage Type

New Conventional

Estimated Equity

$753,380

Purchase Details

Closed on

Nov 30, 2018

Sold by

Vincent John

Bought by

Ashley Vincent John Luke and Ashley Vincent

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 2, 2018

Sold by

Hyde Park City

Bought by

Liquid Assets H2o Llc

Purchase Details

Closed on

Mar 28, 2018

Sold by

Liquid Assets H2o Llc

Bought by

Vincent John

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bryant Christopher | -- | American Secure Ttl Tremonto | |

| Ashley Vincent John Luke | -- | Wasatch Title Insurance Agen | |

| Liquid Assets H2o Llc | -- | Pinnacle Title | |

| Vincent John | -- | Pinnacle Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bryant Christopher | $420,000 | |

| Previous Owner | Ashley Vincent John Luke | $210,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,442 | $612,500 | $0 | $0 |

| 2024 | $3,879 | $493,195 | $0 | $0 |

| 2023 | $4,066 | $491,755 | $0 | $0 |

| 2022 | $4,229 | $491,755 | $0 | $0 |

| 2021 | $3,657 | $667,930 | $106,500 | $561,430 |

| 2020 | $3,424 | $594,700 | $106,500 | $488,200 |

| 2019 | $3,607 | $594,700 | $106,500 | $488,200 |

Source: Public Records

Map

Nearby Homes

- Lincoln Plan at Lone Cedar

- Westbrook Plan at Lone Cedar

- Scottsford Plan at Lone Cedar

- Edgeworth Plan at Lone Cedar

- Brantwood Plan at Lone Cedar

- Vanbrough Plan at Lone Cedar

- Canyon Plan at Lone Cedar

- Jefferson Plan at Lone Cedar

- Chamberlain Plan at Lone Cedar

- Hamilton Plan at Lone Cedar

- Kensington Plan at Lone Cedar

- Huntington Plan at Lone Cedar

- Stanton Plan at Lone Cedar

- Ravenstone Plan at Lone Cedar

- Crimson Plan at Lone Cedar

- Cedar Ridge Plan at Lone Cedar

- Denford Plan at Lone Cedar

- Monroe Plan at Lone Cedar

- Viewside Plan at Lone Cedar

- Fairway Plan at Lone Cedar

- 147 S 1000 E

- 183 S 1000 E Unit 40

- 183 S 1000 E

- 967 E 200 S Unit 39

- 129 S 1000 E Unit 43

- 129 S 1000 E

- 118 S 950 E Unit 46

- 924 E 200 S Unit 1

- 111 S 1000 E

- 110 S 950 E Unit 45

- 127 S 950 E Unit 21

- 36 S 1000 E Unit 38139270

- 36 S 1000 E Unit 38139277

- 36 S 1000 E Unit 38139258

- 36 S 1000 E Unit 38139242

- 36 S 1000 E Unit 38139281

- 36 S 1000 E Unit 38139279

- 36 S 1000 E Unit 38139236

- 36 S 1000 E Unit 38139238

- 36 S 1000 E Unit 38139289