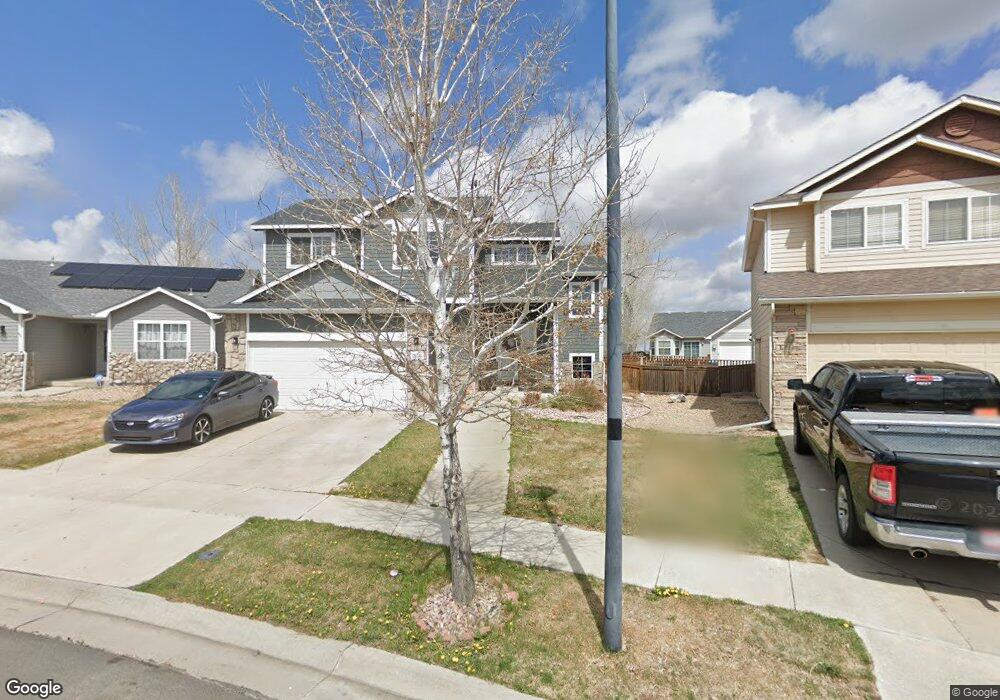

1650 Dyer Loop Brighton, CO 80603

Silver Peaks NeighborhoodEstimated Value: $472,253 - $521,000

3

Beds

3

Baths

2,646

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 1650 Dyer Loop, Brighton, CO 80603 and is currently estimated at $496,063, approximately $187 per square foot. 1650 Dyer Loop is a home located in Weld County with nearby schools including Weld Central Senior High School, Bromley East Charter School, and Foundations Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2021

Sold by

Pope Brittany Y and Pope Jason R

Bought by

Pope Brittney Y and Pope Jason R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,000

Outstanding Balance

$254,886

Interest Rate

2.88%

Mortgage Type

New Conventional

Estimated Equity

$241,177

Purchase Details

Closed on

Nov 15, 2013

Sold by

Gutierrez Dana M and Gallegos Loretta A

Bought by

Zapien Brittney Y and Pope Jason R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,285

Interest Rate

4.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 10, 2011

Sold by

Feeney Dana M

Bought by

Gutierrez Dana M and Gallegos Loretta A

Purchase Details

Closed on

Apr 18, 2011

Sold by

Feeney Dana M and Feeney Robert J

Bought by

Feeney Dana M

Purchase Details

Closed on

May 25, 2006

Sold by

Journey Homes Llc

Bought by

Feeney Dana M and Feeney Robert J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,380

Interest Rate

6.5%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pope Brittney Y | -- | Accommodation | |

| Zapien Brittney Y | $210,000 | None Available | |

| Gutierrez Dana M | -- | None Available | |

| Feeney Dana M | -- | None Available | |

| Feeney Dana M | $200,475 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pope Brittney Y | $281,000 | |

| Closed | Zapien Brittney Y | $214,285 | |

| Previous Owner | Feeney Dana M | $160,380 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,404 | $28,950 | $7,810 | $21,140 |

| 2024 | $4,404 | $28,950 | $7,810 | $21,140 |

| 2023 | $4,286 | $34,210 | $8,120 | $26,090 |

| 2022 | $3,370 | $25,210 | $4,520 | $20,690 |

| 2021 | $3,534 | $25,940 | $4,650 | $21,290 |

| 2020 | $3,130 | $23,730 | $3,220 | $20,510 |

| 2019 | $3,274 | $23,730 | $3,220 | $20,510 |

| 2018 | $2,966 | $20,650 | $3,240 | $17,410 |

| 2017 | $2,998 | $20,650 | $3,240 | $17,410 |

| 2016 | $2,300 | $17,280 | $2,550 | $14,730 |

| 2015 | $2,216 | $17,280 | $2,550 | $14,730 |

| 2014 | $1,696 | $12,810 | $2,790 | $10,020 |

Source: Public Records

Map

Nearby Homes

- 301 Jewel St

- 277 Jewel St

- 269 Jewel St

- 424 Iron St

- 164 Hermosa St

- ELDER II Plan at Silver Peaks

- Hennessy Plan at Silver Peaks

- HENLEY Plan at Silver Peaks

- Chatham Plan at Silver Peaks

- BELLAMY Plan at Silver Peaks

- Edmon Plan at Silver Peaks

- Adair Plan at Silver Peaks

- 4582 Dewey Ln

- 713 Indigo St

- 804 Mulberry Ct

- 942 Tallus St

- 1073 Brink St

- 1758 Opal Ave

- 1061 Brink St

- 1049 Brink St