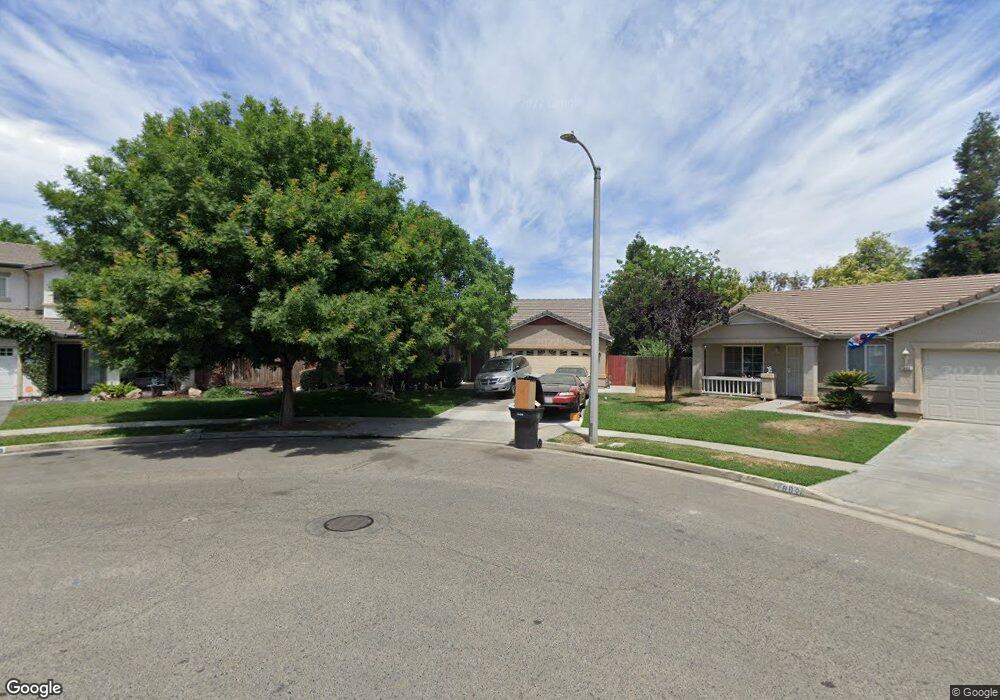

1650 Mt Whitney St Tulare, CA 93274

Tulare Southeast NeighborhoodEstimated Value: $385,000 - $432,000

4

Beds

2

Baths

1,995

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 1650 Mt Whitney St, Tulare, CA 93274 and is currently estimated at $403,345, approximately $202 per square foot. 1650 Mt Whitney St is a home located in Tulare County with nearby schools including Cypress Elementary School, Alpine Vista School, and Mission Oak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2019

Sold by

Bravo Franklin

Bought by

Sanchez Asugey A

Current Estimated Value

Purchase Details

Closed on

Aug 5, 2019

Sold by

Sanchez Asugey A

Bought by

Correia Marvin and Correia Mary

Purchase Details

Closed on

Feb 10, 2010

Sold by

Eubank Guy

Bought by

Sanchez Asugey A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,920

Interest Rate

5.37%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 17, 2006

Sold by

Potter Rachel Evelyn

Bought by

Eubank Guy and Eubank Jami

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,405

Interest Rate

6.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 19, 2002

Sold by

Centex Homes

Bought by

Potter Rachel Evelyn and The Rachel Evelyn Potter Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanchez Asugey A | -- | First American Title | |

| Correia Marvin | -- | First American | |

| Sanchez Asugey A | $170,000 | Chicago Title Company | |

| Eubank Guy | $270,000 | Chicago Title Co | |

| Potter Rachel Evelyn | $154,000 | Commerce Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sanchez Asugey A | $166,920 | |

| Previous Owner | Eubank Guy | $256,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,202 | $289,813 | $65,617 | $224,196 |

| 2024 | $3,202 | $284,131 | $64,331 | $219,800 |

| 2023 | $3,124 | $278,561 | $63,070 | $215,491 |

| 2022 | $3,034 | $273,100 | $61,834 | $211,266 |

| 2021 | $2,973 | $267,746 | $60,622 | $207,124 |

| 2020 | $3,020 | $265,000 | $60,000 | $205,000 |

| 2019 | $2,349 | $196,717 | $46,286 | $150,431 |

| 2018 | $2,306 | $192,859 | $45,378 | $147,481 |

| 2017 | $2,285 | $189,077 | $44,488 | $144,589 |

| 2016 | $2,185 | $185,370 | $43,616 | $141,754 |

| 2015 | -- | $182,586 | $42,961 | $139,625 |

| 2014 | -- | $179,009 | $42,119 | $136,890 |

Source: Public Records

Map

Nearby Homes

- 1572 Jasmine Ct

- 1533 Etna Dr

- 1730 E Evergreen Ave

- 1625 S Lydia Dr

- 980 S Spruce St

- 931 S Amber St

- 900 S Ann St

- 860 S Kazarian St

- 2005 Mount Stewart Ave

- 716 S Kazarian St

- 1803 Durango Ct

- 1065 E Cedar Ave

- 752 S T St

- 1686 E Foster Dr

- 501 S Magnolia St

- 2570 Trapper Springs Ave

- 2671 Lakeridge Ave

- 2727 Eshom Creek Ct

- 434 Fallbrook Ct

- 2796 Azalea Ave

- 1650 Mount Whitney Ave

- 1692 Mount Whitney Ave

- 1203 Dalton St

- 1702 Mount Whitney Ave

- 1227 Dalton St

- 1718 Mount Whitney Ave

- 1151 S Laspina St

- 1220 Dalton St

- 1243 Dalton St

- 1145 -1149 Laspina

- 1149 Laspina

- 1732 Mount Whitney Ave

- 1145 S Laspina St

- 1248 Dalton St

- 1126 Cabrillo Dr

- 1101 Cabrillo Dr

- 1265 Dalton St

- 1729 Mount Whitney Ave

- 1744 Mount Whitney Ave

- 1233 S Laspina St