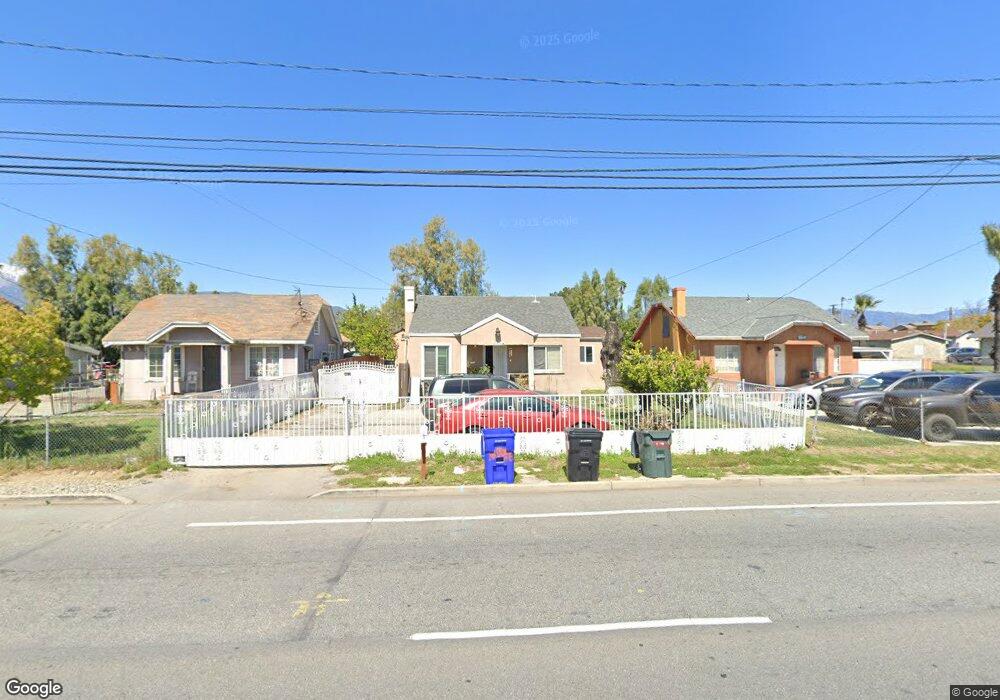

16536 Foothill Blvd Fontana, CA 92335

Estimated Value: $392,163 - $468,000

2

Beds

1

Bath

812

Sq Ft

$530/Sq Ft

Est. Value

About This Home

This home is located at 16536 Foothill Blvd, Fontana, CA 92335 and is currently estimated at $430,082, approximately $529 per square foot. 16536 Foothill Blvd is a home located in San Bernardino County with nearby schools including Juniper Elementary School, Almeria Middle School, and Fontana A. B. Miller High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2003

Sold by

Morgan Susana

Bought by

Morgan Primitivo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,250

Interest Rate

6.17%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 7, 2003

Sold by

Comer Patrick and Comer Cindy

Bought by

Morgan Primitivo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,250

Interest Rate

6.17%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 22, 1998

Sold by

Green Renee L

Bought by

Comer Patrick and Comer Cindy

Purchase Details

Closed on

Jul 21, 1998

Sold by

Green Renee L and Green Rusty

Bought by

Green Renee Lynn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morgan Primitivo | -- | First American | |

| Morgan Primitivo | $135,000 | First American | |

| Comer Patrick | $65,500 | Fidelity National Title Ins | |

| Green Renee Lynn | -- | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Morgan Primitivo | $128,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,434 | $191,943 | $85,306 | $106,637 |

| 2024 | $2,434 | $188,179 | $83,633 | $104,546 |

| 2023 | $1,948 | $184,489 | $81,993 | $102,496 |

| 2022 | $1,941 | $180,871 | $80,385 | $100,486 |

| 2021 | $1,916 | $177,325 | $78,809 | $98,516 |

| 2020 | $1,912 | $175,507 | $78,001 | $97,506 |

| 2019 | $1,854 | $172,066 | $76,472 | $95,594 |

| 2018 | $1,882 | $168,693 | $74,973 | $93,720 |

| 2017 | $1,871 | $165,385 | $73,503 | $91,882 |

| 2016 | $1,840 | $162,142 | $72,062 | $90,080 |

| 2015 | $1,817 | $159,707 | $70,980 | $88,727 |

| 2014 | $1,818 | $156,579 | $69,590 | $86,989 |

Source: Public Records

Map

Nearby Homes

- 8147 Cypress Ave

- 16436 Foothill Blvd

- 8164 Cypress Ave

- 7938 Chantry Ave

- 8238 Pepper Ave

- 16554 Reed St

- 16304 Foothill Blvd

- 16590 Terrace Ln Unit G

- 16250 Upland Ave

- 16203 Foothill Blvd

- 0 Sierra Ave Unit EV22072866

- 7801 Pinyon Ave

- 16733 Miller Ave

- 7625 Cypress Ave

- 16843 Miller Ave

- 8566 Cypress Ave

- 8621 Cypress Ave

- 8636 Cypress Ave

- 7702 Newport Ct

- 7908 Tokay Ave Unit 108

- 16544 Foothill Blvd

- 16530 Foothill Blvd

- 16522 Foothill Blvd

- 16520 Foothill Blvd

- 16481 Paine St

- 16542 Paine St

- 8051 Cypress Ave

- 8047 Cypress Ave

- 16575 Paine St Unit B

- 16575 Paine St

- 8145 Cypress Ave Unit A-D

- 8145 Cypress Ave Unit I-2

- 8145 Cypress Ave Unit N

- 8068 Cypress Ave

- 16585 Paine St Unit 1

- 16585 Paine St

- 8058 Cypress Ave

- 16593 Paine St

- 8027 Cypress Ave

- 8044 Cypress Ave