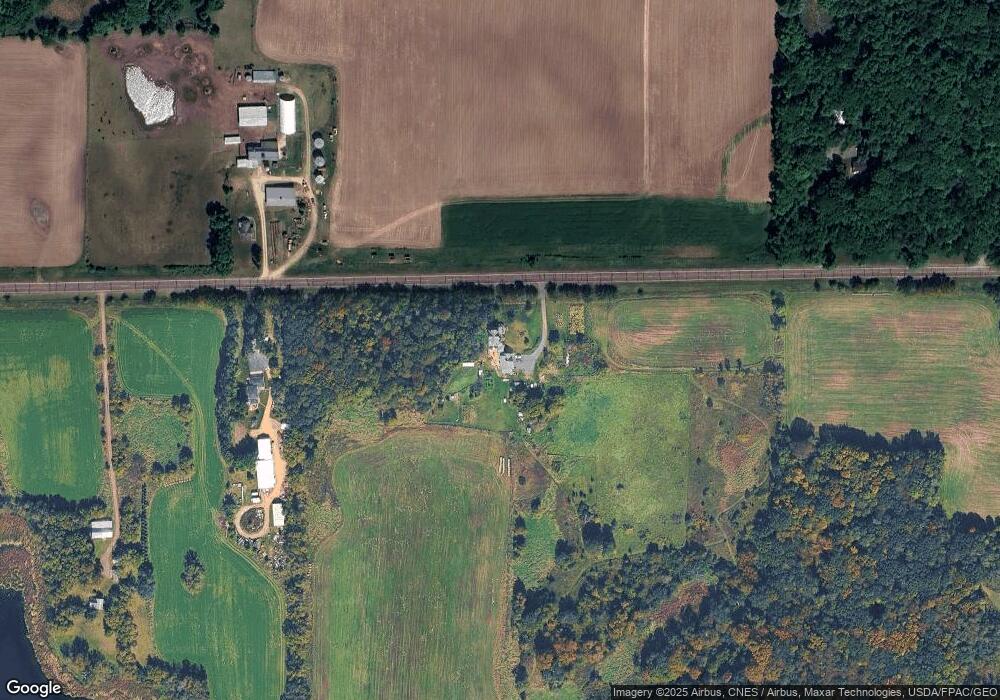

16655 Wild Mountain Rd Taylors Falls, MN 55084

Estimated Value: $611,000 - $815,000

3

Beds

1

Bath

3,756

Sq Ft

$194/Sq Ft

Est. Value

About This Home

This home is located at 16655 Wild Mountain Rd, Taylors Falls, MN 55084 and is currently estimated at $728,291, approximately $193 per square foot. 16655 Wild Mountain Rd is a home located in Chisago County with nearby schools including Taylors Falls Elementary School, Chisago Lakes Middle School, and Chisago Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2021

Sold by

Olsen Russell G and Olsen Therese C

Bought by

Grice Andrew R

Current Estimated Value

Purchase Details

Closed on

Aug 27, 2012

Sold by

Herberg Duane

Bought by

Olson Dassel G and Olson Therese C

Purchase Details

Closed on

Aug 6, 2008

Sold by

Herberg Verdy L

Bought by

Olsen Russell G and Olsen Therese C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,000

Interest Rate

6.8%

Mortgage Type

Land Contract Argmt. Of Sale

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grice Andrew R | $592,400 | -- | |

| Olson Dassel G | $280,000 | -- | |

| Olsen Russell G | $280,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Olsen Russell G | $265,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,212 | $639,300 | $0 | $0 |

| 2023 | $6,212 | $712,500 | $171,000 | $541,500 |

| 2022 | $6,200 | $650,500 | $151,800 | $498,700 |

| 2021 | $5,876 | $520,400 | $0 | $0 |

| 2020 | $5,608 | $434,100 | $66,200 | $367,900 |

| 2019 | $5,876 | $0 | $0 | $0 |

| 2018 | $5,956 | $0 | $0 | $0 |

| 2017 | $4,792 | $0 | $0 | $0 |

| 2016 | $4,402 | $0 | $0 | $0 |

| 2015 | $3,832 | $0 | $0 | $0 |

| 2014 | -- | $133,100 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 15260 360th St

- 35713 Patriot Ave

- 149xx 360th St

- 35647 Oxford Ave

- XX153 River Rd

- 34240 Park Trail

- 35420 Oasis Rd

- 196xx 346th St

- Lot 13 246th

- 2067 Wisconsin 87

- 15055 Little Lake Rd

- 12214 Sunrise Rd

- TBD 242nd St

- 33214 Nueman Ct

- Lot 4 Olson Rd

- 32372 Park Trail

- 13860 325th St

- 2265 Wisconsin 87

- 31740 Redwing Ave

- TBD Keystone Ave

- 14721 375th St

- 16535 Wild Mountain Rd

- 16536 Wild Mountain Rd

- 16822 Wild Mountain Rd

- 16xxx Wild Mountain Rd

- 16975 Wild Mountain Rd

- 16906 Wild Mountain Rd

- 16255 Wild Mountain Rd

- XXX Reed Ave

- TBD Wild Mountain Rd

- XXX Quinlan Ave

- 37600 Reed Ave

- 16125 Wild Mountain Rd

- 17145 Wild Mountain Rd

- 37760 Reed Ave

- 37493 Quinlan Ave

- XXX Quinlan Ave

- XXX Quinlan Ave

- 16464 373rd St

- 16560 373rd St